Answered step by step

Verified Expert Solution

Question

1 Approved Answer

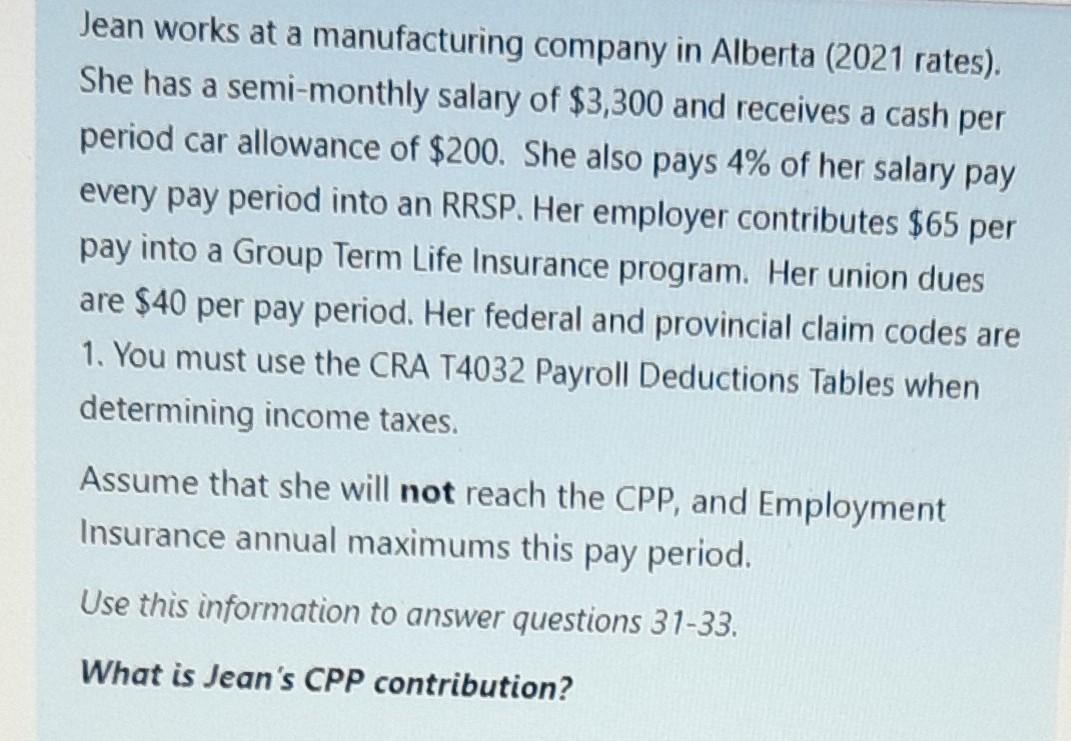

Jean works at a manufacturing company in Alberta (2021 rates). She has a semi-monthly salary of $3,300 and receives a cash per period car allowance

Jean works at a manufacturing company in Alberta (2021 rates). She has a semi-monthly salary of $3,300 and receives a cash per period car allowance of $200. She also pays 4% of her salary pay every pay period into an RRSP. Her employer contributes $65 per pay into a Group Term Life Insurance program. Her union dues are $40 per pay period. Her federal and provincial claim codes are 1. You must use the CRA T4032 Payroll Deductions Tables when determining income taxes. Assume that she will not reach the CPP, and Employment Insurance annual maximums this pay period. Use this information to answer questions 31-33. What is Jean's CPP contribution? What is her El premium? Answer: What is her net pay? Hint: Make sure to use the tax tables to help you determine federal and provincial taxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started