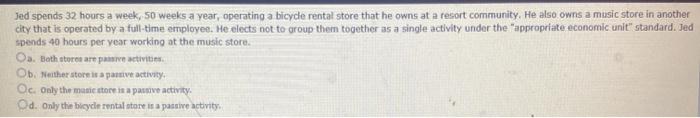

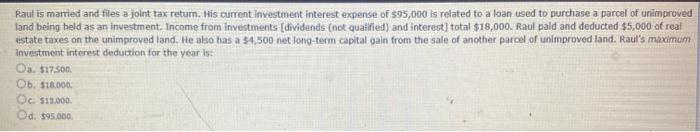

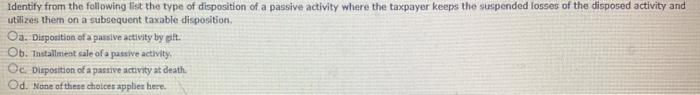

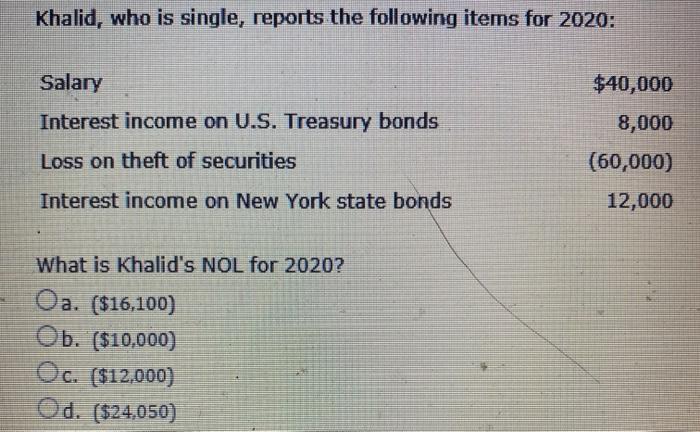

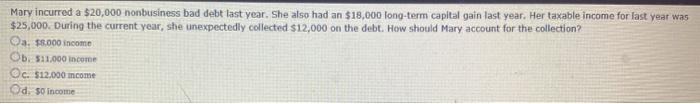

Jed spends 32 hours a week, 50 weeks a year, operating a bicycle rental store that he owns at a resort community. He also owns a music store in another city that is operated by a full-time employes. He elects not to group them together as a single activity under the appropriate economic unit" standard. Jed spends 10 hours per year working at the music store. Oa. Both stora are passive activiti Ob. Neither store is a partive activity, Oc. Only the music store is a passive activity Od. Only the beyde rental store is a passive activity Raut is married and files a joint tax return. His current investment interest expense of $95,000 is related to a loan used to purchase a parcel of unimproved land being held as an investment. Income from investments [dividends (not qualified) and interest] total $18,000. Raut paid and deducted $5,000 of real estate taxes on the unimproved land. He also has a $4,500 net long-term capital gain from the sale of another parcel of unimproved land. Raul's maximum investment interest deduction for the year is: Os $17.500 Ob 518,000 Oc $13.000 Od. $95.000 identity from the following list the type of disposition of a passive activity where the taxpayer keeps the suspended losses of the disposed activity and utilizes them on a subsequent taxable disposition Oa. Disposition of a passive activity by t. Ob. Installmeat sale of a passive activity Oc. Disposition of a partive activity at death Od. None of the choices applies here. Khalid, who is single, reports the following items for 2020: Salary $40,000 8,000 Interest income on U.S. Treasury bonds Loss on theft of securities (60,000) Interest income on New York state bonds 12,000 What is Khalid's NOL for 2020? Oa. ($16,100) Ob. ($10,000) Oc. ($12,000) Od. ($24,050) Mary incurred a $20,000 nonbusiness bad debt last year. She also had an $18,000 long-term capital gain last year. Her taxable income for last year was $25,000. During the current year, she unexpectedly collected $12,000 on the debt. How should Mary account for the collection? Oa. $8.000 income Ob 511.000 Income Oc. $12.000 mcome Od 50 Income