Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jeff, age 70 was unable to access the second floor of his home due to hip issues. His doctor recommended that he build a bedroom

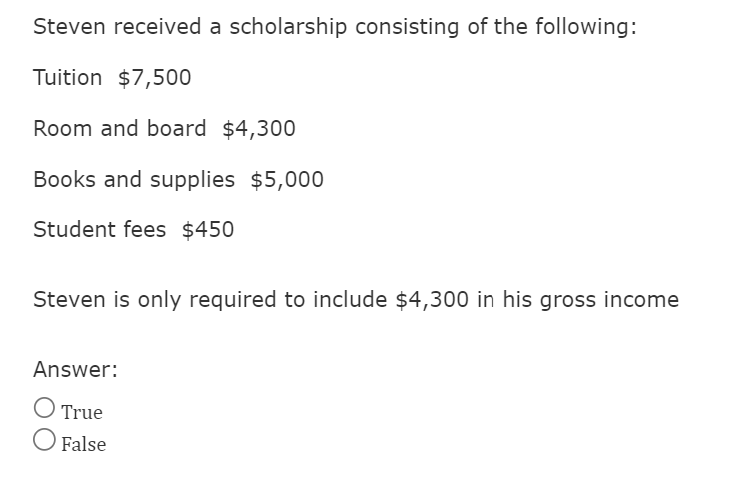

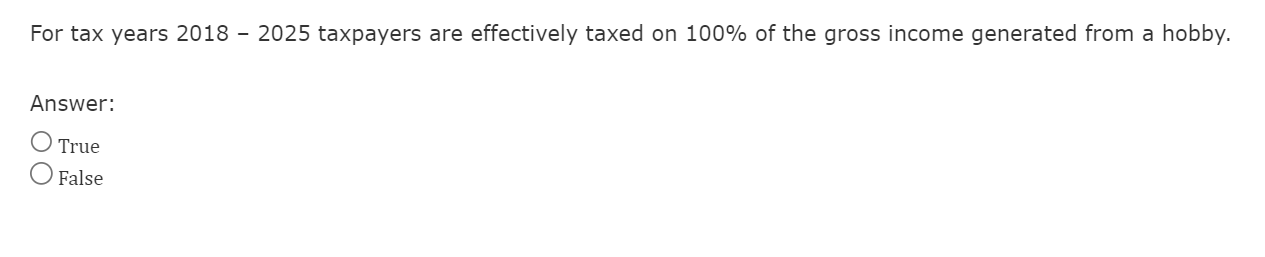

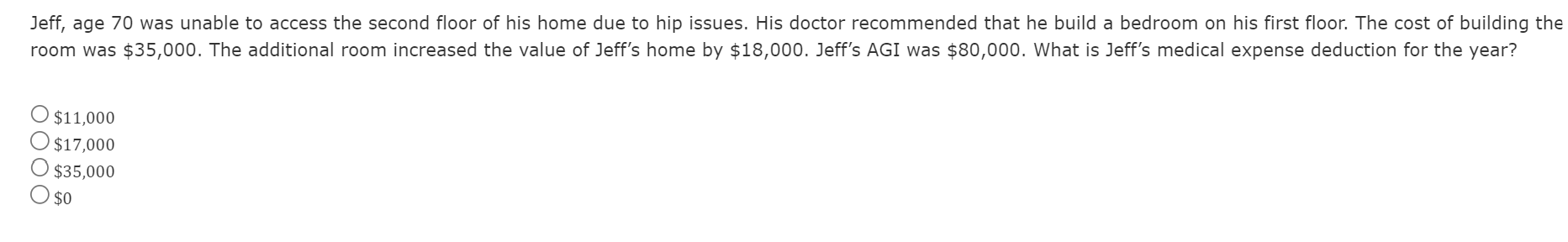

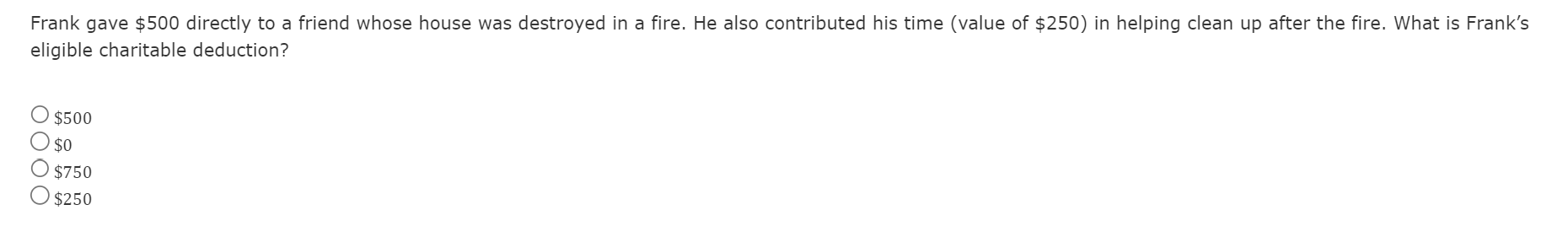

Jeff, age 70 was unable to access the second floor of his home due to hip issues. His doctor recommended that he build a bedroom on his first floor. The cost of building the room was \\( \\$ 35,000 \\). The additional room increased the value of Jeff's home by \\( \\$ 18,000 \\). Jeff's AGI was \\( \\$ 80,000 \\). What is Jeff's medical expense deduction for the year? \\[ \\begin{array}{l} \\$ 11,000 \\\\ \\$ 17,000 \\\\ \\$ 35,000 \\\\ \\$ 0 \\end{array} \\] Frank gave \\( \\$ 500 \\) directly to a friend whose house was destroyed in a fire. He also contributed his time (value of \\( \\$ 250 \\) ) in helping clean up after the fire. What is Frank's eligible charitable deduction? \\[ \\begin{array}{l} \\$ 500 \\\\ \\$ 0 \\\\ \\$ 750 \\\\ \\$ 250 \\end{array} \\] For tax years 2018 - 2025 taxpayers are effectively taxed on \100 of the gross income generated from a hobby. Answer: True False Steven received a scholarship consisting of the following: Tuition \\( \\$ 7,500 \\) Room and board \\( \\$ 4,300 \\) Books and supplies \\( \\$ 5,000 \\) Student fees \\( \\$ 450 \\) Steven is only required to include \\( \\$ 4,300 \\) in his gross income Answer: True False

Jeff, age 70 was unable to access the second floor of his home due to hip issues. His doctor recommended that he build a bedroom on his first floor. The cost of building the room was \\( \\$ 35,000 \\). The additional room increased the value of Jeff's home by \\( \\$ 18,000 \\). Jeff's AGI was \\( \\$ 80,000 \\). What is Jeff's medical expense deduction for the year? \\[ \\begin{array}{l} \\$ 11,000 \\\\ \\$ 17,000 \\\\ \\$ 35,000 \\\\ \\$ 0 \\end{array} \\] Frank gave \\( \\$ 500 \\) directly to a friend whose house was destroyed in a fire. He also contributed his time (value of \\( \\$ 250 \\) ) in helping clean up after the fire. What is Frank's eligible charitable deduction? \\[ \\begin{array}{l} \\$ 500 \\\\ \\$ 0 \\\\ \\$ 750 \\\\ \\$ 250 \\end{array} \\] For tax years 2018 - 2025 taxpayers are effectively taxed on \100 of the gross income generated from a hobby. Answer: True False Steven received a scholarship consisting of the following: Tuition \\( \\$ 7,500 \\) Room and board \\( \\$ 4,300 \\) Books and supplies \\( \\$ 5,000 \\) Student fees \\( \\$ 450 \\) Steven is only required to include \\( \\$ 4,300 \\) in his gross income Answer: True False Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started