Answered step by step

Verified Expert Solution

Question

1 Approved Answer

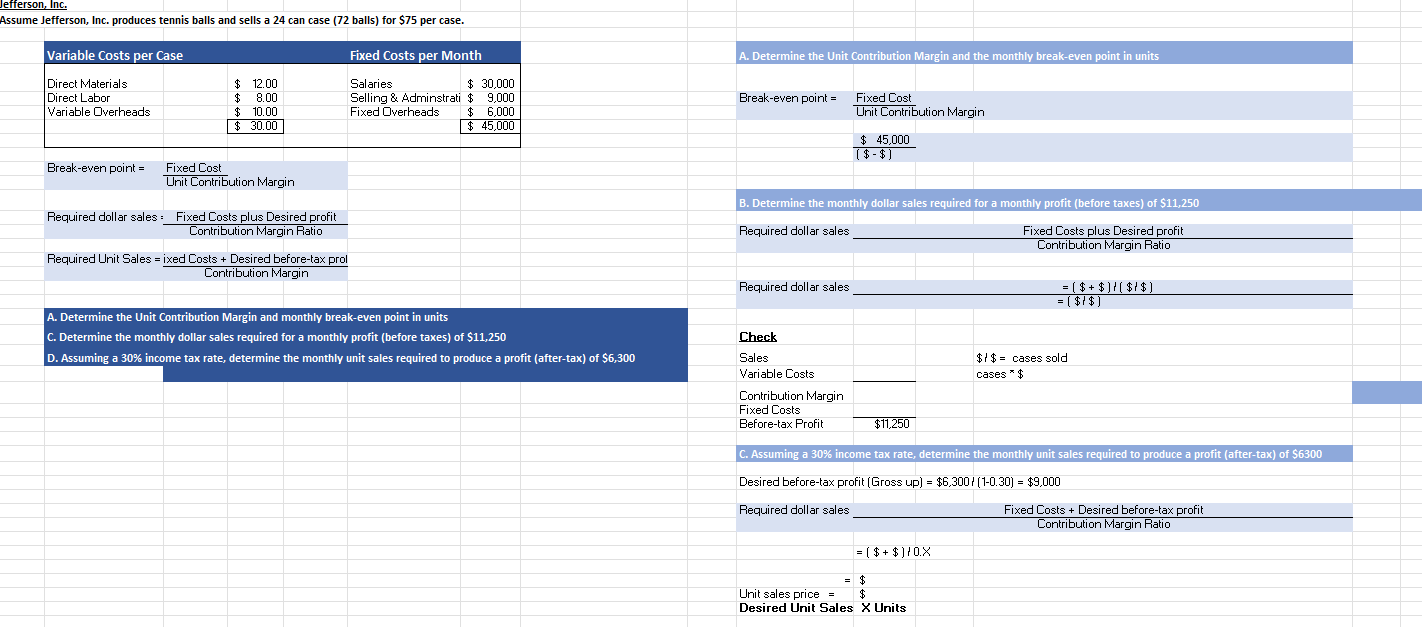

Jefferson, Ic. Assume Jefferson, Inc. produces tennis balls and sells a 24 can case (72 balls) for $75 per case. Variable Costs per Case

Jefferson, Ic. Assume Jefferson, Inc. produces tennis balls and sells a 24 can case (72 balls) for $75 per case. Variable Costs per Case Fixed Costs per Month A. Determine the Unit Contribution Margin and the monthly break-even point in units Direct Materials Direct Labor Variable Overheads $ 30,000 Selling & Adminstrati $ 9,000 $ 6,000 $ 45,000 $ 12.00 8.00 Salaries Break-even point = Fixed Cost $ $ 10.00 $ 30.00 Fixed Overheads Unit Contribution Margin $ 45,000 [$ - $) Break-even point = Fixed Cost Unit Contribution Margin B. Determine the monthly dollar sales required for a monthly profit (before taxes) of $11,250 Required dollar sales : Fixed Costs plus Desired profit Contribution Margin Ratio Fixed Costs plus Desired profit Contribution Margin Ratio Required dollar sales Required Unit Sales = ixed Costs + Desired before-tax prol Contribution Margin Required dollar sales = ( $ + $)!( $/$) ($ } $ ] = A. Determine the Unit Contribution Margin and monthly break-even point in units C. Determine the monthly dollar sales required for a monthly profit (before taxes) of $11,250 D. Assuming a 30% income tax rate, determine the monthly unit sales required to produce a profit (after-tax) of $6,300 Check Sales $I$ = cases sold Variable Costs cases *$ Contribution Margin Fixed Costs Before-tax Profit $11,250 C. Assuming a 30% income tax rate, determine the monthly unit sales required to produce a profit (after-tax) of $6300 Desired before-tax profit (Gross up) = $6,300/ (1-0.30) = $9,000 Required dollar sales Fixed Costs + Desired before-tax profit Contribution Margin Ratio |= ( $ + $ ] } 0.X = $ Unit sales price = Desired Unit Sales X Units $4

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

calculations E F 3 1 Unit contribution margin 4 5 6 sale...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started