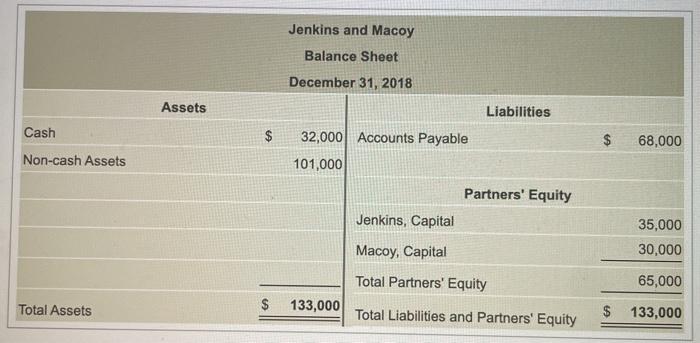

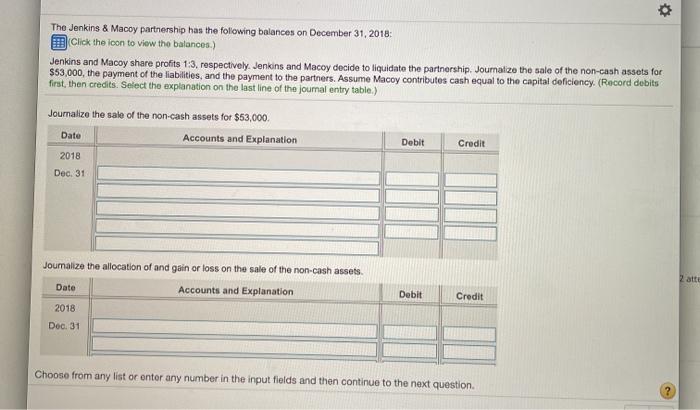

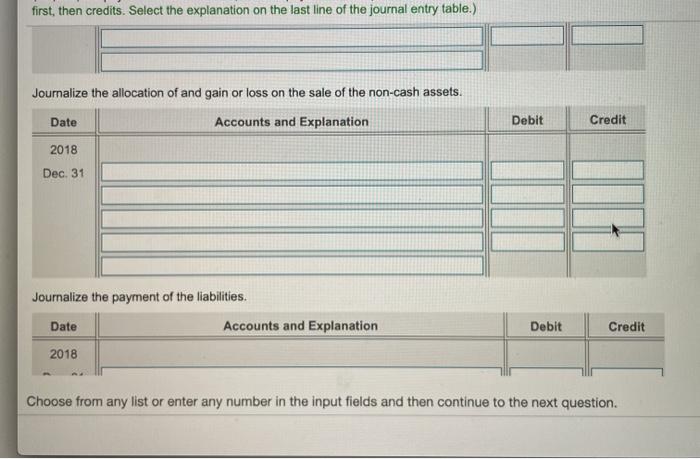

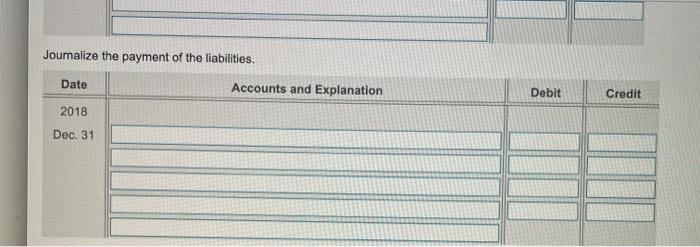

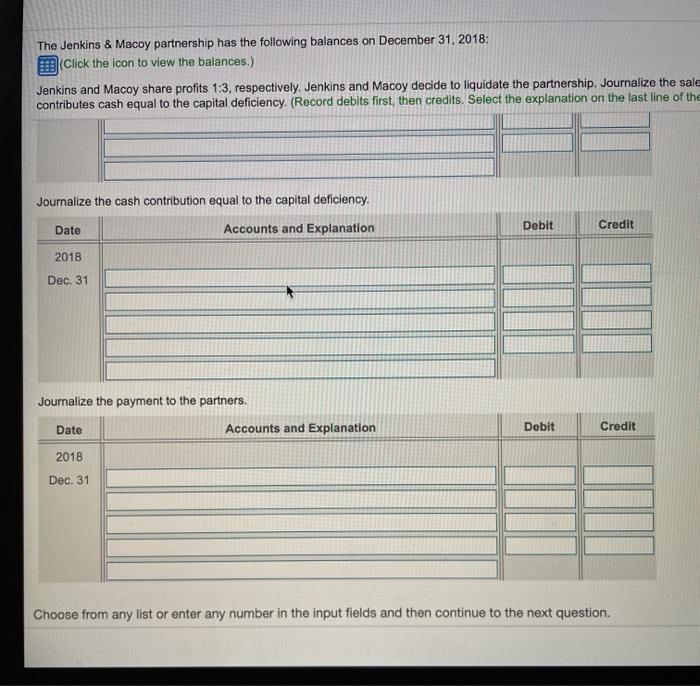

Jenkins and Macoy Balance Sheet December 31, 2018 Assets Liabilities $ Cash Non-cash Assets 68,000 32,000 Accounts Payable 101,000 Partners' Equity Jenkins, Capital 35,000 30,000 Macoy, Capital Total Partners' Equity 65,000 Total Assets $ 133,000 Total Liabilities and Partners' Equity $ 133,000 The Jenkins & Macoy partnership has the following balances on December 31, 2018 Click the icon to view the balances) Jenkins and Macoy share profits 1:3, respectively. Jenkins and Macoy decide to liquidate the partnership. Journalize the sale of the non-cash assets for $53,000, the payment of the liabilities, and the payment to the partners. Assume Macoy contributes cash equal to the capital deficiency. (Record debits first, then credits. Select the explanation on the last line of the joumal entry table) Journalize the sale of the non-cash assets for $53,000 Date Accounts and Explanation 2018 Dec 31 Debit Credit Joumalize the allocation of and gain or loss on the sale of the non-cash assets 2 att Date Accounts and Explanation Debit Credit 2018 Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next question first, then credits. Select the explanation on the last line of the journal entry table.) Journalize the allocation of and gain or loss on the sale of the non-cash assets. Date Accounts and Explanation Debit Credit 2018 Dec. 31 Journalize the payment of the liabilities. Date Accounts and Explanation 2018 Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question. Journalize the payment of the liabilities. Date Accounts and Explanation Debit Credit 2018 Dec. 31 The Jenkins & Macoy partnership has the following balances on December 31, 2018: (Click the icon to view the balances.) Jenkins and Macoy share profits 1:3, respectively. Jenkins and Macoy decide to liquidate the partnership. Journalize the sale contributes cash equal to the capital deficiency. (Record debits first, then credits. Select the explanation on the last line of the Journalize the cash contribution equal to the capital deficiency. Debit Accounts and Explanation Date Credit 2018 Dec. 31 Journalize the payment to the partners. Date Accounts and Explanation Debit Credit 2018 Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next question. Jenkins and Macoy Balance Sheet December 31, 2018 Assets Liabilities $ Cash Non-cash Assets 68,000 32,000 Accounts Payable 101,000 Partners' Equity Jenkins, Capital 35,000 30,000 Macoy, Capital Total Partners' Equity 65,000 Total Assets $ 133,000 Total Liabilities and Partners' Equity $ 133,000 The Jenkins & Macoy partnership has the following balances on December 31, 2018 Click the icon to view the balances) Jenkins and Macoy share profits 1:3, respectively. Jenkins and Macoy decide to liquidate the partnership. Journalize the sale of the non-cash assets for $53,000, the payment of the liabilities, and the payment to the partners. Assume Macoy contributes cash equal to the capital deficiency. (Record debits first, then credits. Select the explanation on the last line of the joumal entry table) Journalize the sale of the non-cash assets for $53,000 Date Accounts and Explanation 2018 Dec 31 Debit Credit Joumalize the allocation of and gain or loss on the sale of the non-cash assets 2 att Date Accounts and Explanation Debit Credit 2018 Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next question first, then credits. Select the explanation on the last line of the journal entry table.) Journalize the allocation of and gain or loss on the sale of the non-cash assets. Date Accounts and Explanation Debit Credit 2018 Dec. 31 Journalize the payment of the liabilities. Date Accounts and Explanation 2018 Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question. Journalize the payment of the liabilities. Date Accounts and Explanation Debit Credit 2018 Dec. 31 The Jenkins & Macoy partnership has the following balances on December 31, 2018: (Click the icon to view the balances.) Jenkins and Macoy share profits 1:3, respectively. Jenkins and Macoy decide to liquidate the partnership. Journalize the sale contributes cash equal to the capital deficiency. (Record debits first, then credits. Select the explanation on the last line of the Journalize the cash contribution equal to the capital deficiency. Debit Accounts and Explanation Date Credit 2018 Dec. 31 Journalize the payment to the partners. Date Accounts and Explanation Debit Credit 2018 Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next