Question

Jenn Wadden, owner of Wadden Home Decorating Service, has requested that you prepare from the following balances (a) an income statement for September 201X,

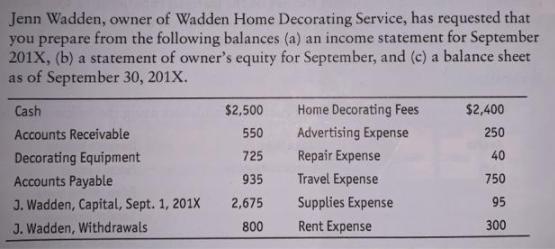

Jenn Wadden, owner of Wadden Home Decorating Service, has requested that you prepare from the following balances (a) an income statement for September 201X, (b) a statement of owner's equity for September, and (c) a balance sheet as of September 30, 201X. Cash $2,500 Home Decorating Fees $2,400 Accounts Receivable 550 Advertising Expense 250 Decorating Equipment 725 Repair Expense 40 Accounts Payable 935 Travel Expense 750 J. Wadden, Capital, Sept. 1, 201X 2,675 Supplies Expense 95 J. Wadden, Withdrawals 800 Rent Expense 300

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Jenn Home Decorating Service Income Statement For the month ended September 30...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting A Practical Approach Chapters 1-25

Authors: Jeffrey Slater

13th Edition

0133791009, 978-0133791006

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App