Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jennerous Ltd pays dividends at the end of each quarter that are constantly growing by 4% p.a. compounded monthly. If the dividend paid exactly

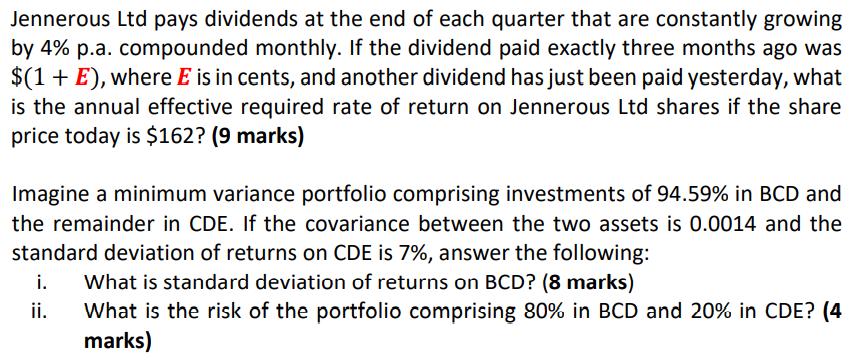

Jennerous Ltd pays dividends at the end of each quarter that are constantly growing by 4% p.a. compounded monthly. If the dividend paid exactly three months ago was $(1 + E), where E is in cents, and another dividend has just been paid yesterday, what is the annual effective required rate of return on Jennerous Ltd shares if the share price today is $162? (9 marks) Imagine a minimum variance portfolio comprising investments of 94.59% in BCD and the remainder in CDE. If the covariance between the two assets is 0.0014 and the standard deviation of returns on CDE is 7%, answer the following: i. What is standard deviation of returns on BCD? (8 marks) ii. What is the risk of the portfolio comprising 80% in BCD and 20% in CDE? (4 marks)

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 Let D be the dividend paid yesterday then the dividend paid three months ago is D1043 The cur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started