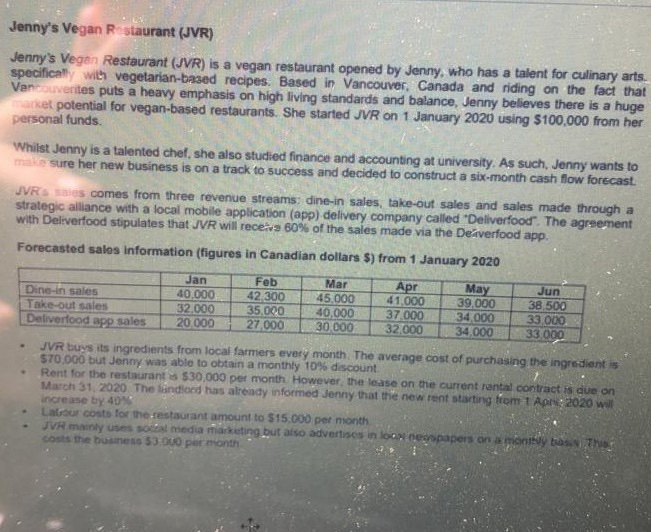

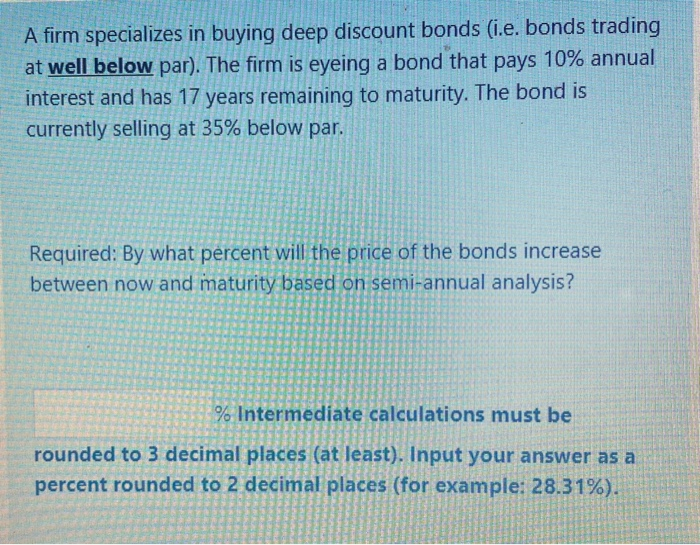

Jenny's Vegan R staurant (JVR) Jenny's Vegan Restaurant (JVR) is a vegan restaurant opened by Jenny, who has a talent for culinary arts. specifically with vegetarian-based recipes. Based in Vancouver, Canada and riding on the fact that Vanuverites puts a heavy emphasis on high living standards and balance, Jenny believes there is a huge arket potential for vegan-based restaurants. She started JVR on 1 January 2020 using $100,000 from her personal funds. Whilst Jenny is a talented chef, she also studied finance and accounting at university. As such, Jenny wants to make sure her new business is on a track to success and decided to construct a six-month cash flow forecast JVR sus comes from three revenue streams: dine-in sales, take-out sales and sales made through a strategic alliance with a local mobile application (app) delivery company called "Deliverfood. The agreement with Deliverfood stipulates that JVR will recera 60% of the sales made via the Deaverfood app. Forecasted sales information (figures in Canadian dollars $) from 1 January 2020 Jan Feb Mar Apr May Jun Dine-in sales 40.000 42 300 45,000 41.000 39,000 38.500 Take-out sales 32.000 35.000 40,000 37 000 34.000 33.000 Deliverfood app sales 20.000 27.000 30.000 32.000 34.000 33 000 JVR buy its ingredients from local farmers every month. The average cost of purchasing the ingredient is $70.000 but Jenny was able to obtain a monthly 10% discount Rent for the restaurants $30,000 per month. However the lease on the current rental contract is que on March 31, 2020. The landlord has already informed Jenny that the new rent starting from 1 Apr 2020 will increase by 404 Labour costs for the restaurant amount to $15.000 per month JVR mainly uses social media marketing but also advertises in loc de papers on a monthly basis. costs the business 53.000 per month - A firm specializes in buying deep discount bonds (i.e. bonds trading at well below par). The firm is eyeing a bond that pays 10% annual interest and has 17 years remaining to maturity. The bond is currently selling at 35% below par. Required: By what percent will the price of the bonds increase between now and maturity based on semi-annual analysis? % Intermediate calculations must be rounded to 3 decimal places (at least). Input your answer as a percent rounded to 2 decimal places (for example: 28.31%). Jenny's Vegan R staurant (JVR) Jenny's Vegan Restaurant (JVR) is a vegan restaurant opened by Jenny, who has a talent for culinary arts. specifically with vegetarian-based recipes. Based in Vancouver, Canada and riding on the fact that Vanuverites puts a heavy emphasis on high living standards and balance, Jenny believes there is a huge arket potential for vegan-based restaurants. She started JVR on 1 January 2020 using $100,000 from her personal funds. Whilst Jenny is a talented chef, she also studied finance and accounting at university. As such, Jenny wants to make sure her new business is on a track to success and decided to construct a six-month cash flow forecast JVR sus comes from three revenue streams: dine-in sales, take-out sales and sales made through a strategic alliance with a local mobile application (app) delivery company called "Deliverfood. The agreement with Deliverfood stipulates that JVR will recera 60% of the sales made via the Deaverfood app. Forecasted sales information (figures in Canadian dollars $) from 1 January 2020 Jan Feb Mar Apr May Jun Dine-in sales 40.000 42 300 45,000 41.000 39,000 38.500 Take-out sales 32.000 35.000 40,000 37 000 34.000 33.000 Deliverfood app sales 20.000 27.000 30.000 32.000 34.000 33 000 JVR buy its ingredients from local farmers every month. The average cost of purchasing the ingredient is $70.000 but Jenny was able to obtain a monthly 10% discount Rent for the restaurants $30,000 per month. However the lease on the current rental contract is que on March 31, 2020. The landlord has already informed Jenny that the new rent starting from 1 Apr 2020 will increase by 404 Labour costs for the restaurant amount to $15.000 per month JVR mainly uses social media marketing but also advertises in loc de papers on a monthly basis. costs the business 53.000 per month - A firm specializes in buying deep discount bonds (i.e. bonds trading at well below par). The firm is eyeing a bond that pays 10% annual interest and has 17 years remaining to maturity. The bond is currently selling at 35% below par. Required: By what percent will the price of the bonds increase between now and maturity based on semi-annual analysis? % Intermediate calculations must be rounded to 3 decimal places (at least). Input your answer as a percent rounded to 2 decimal places (for example: 28.31%)