Answered step by step

Verified Expert Solution

Question

1 Approved Answer

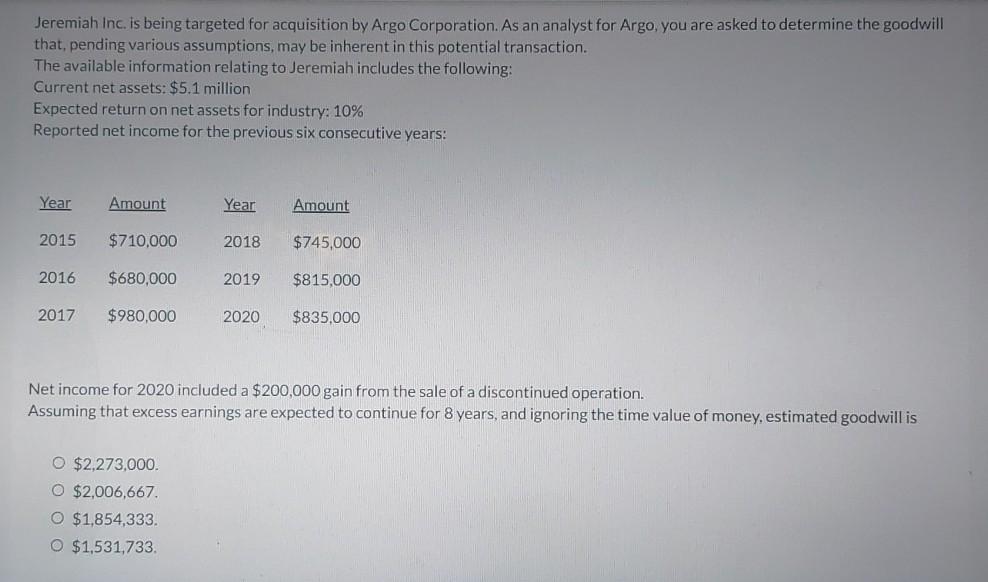

Jeremiah Inc. is being targeted for acquisition by Argo Corporation. As an analyst for Argo, you are asked to determine the goodwill that, pending various

Jeremiah Inc. is being targeted for acquisition by Argo Corporation. As an analyst for Argo, you are asked to determine the goodwill that, pending various assumptions may be inherent in this potential transaction. The available information relating to Jeremiah includes the following: Current net assets: $5.1 million Expected return on net assets for industry: 10% Reported net income for the previous six consecutive years: Year Amount Year Amount 2015 $710,000 2018 $745,000 2016 $680,000 2019 $815,000 2017 $980,000 2020 $835,000 Net income for 2020 included a $200,000 gain from the sale of a discontinued operation. Assuming that excess earnings are expected to continue for 8 years, and ignoring the time value of money. estimated goodwill is O $2,273,000. O $2,006,667 O $1,854,333 O $1,531,733

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started