Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jessica purchased a home on January 1,2020 , for $730,000 by making a do $440,000 with a loan, secured by the residence, at 6 percent.

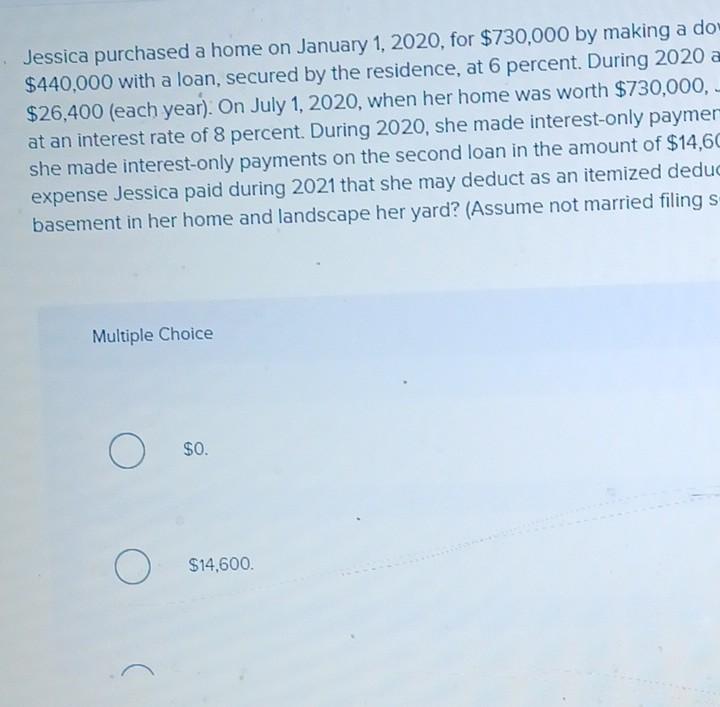

Jessica purchased a home on January 1,2020 , for $730,000 by making a do $440,000 with a loan, secured by the residence, at 6 percent. During 2020 $26,400 (each year). On July 1,2020 , when her home was worth $730,000, at an interest rate of 8 percent. During 2020, she made interest-only paymer she made interest-only payments on the second loan in the amount of $14,6 expense Jessica paid during 2021 that she may deduct as an itemized dedu basement in her home and landscape her yard? (Assume not married filing s Multiple Choice \$0. $14,600. yment of $290,000 and financing the remaining 21, Jessica made interest-only payments on this loan of a borrowed an additional $182,500 secured by the home the second loan in the amount of $7,300. During 2021 , lat is the maximum amount of the $41,000 interest she used the proceeds of the second loan to finish the ely.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started