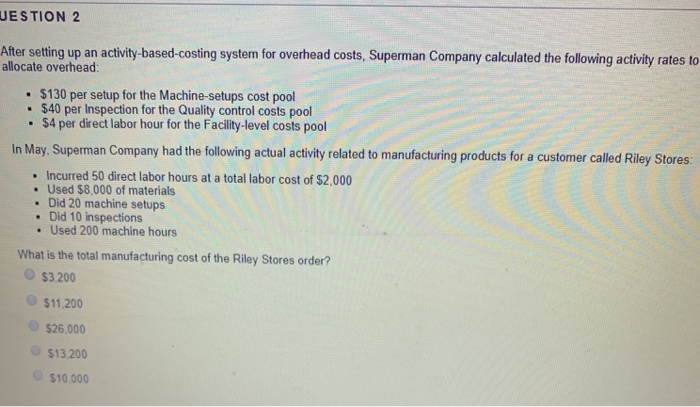

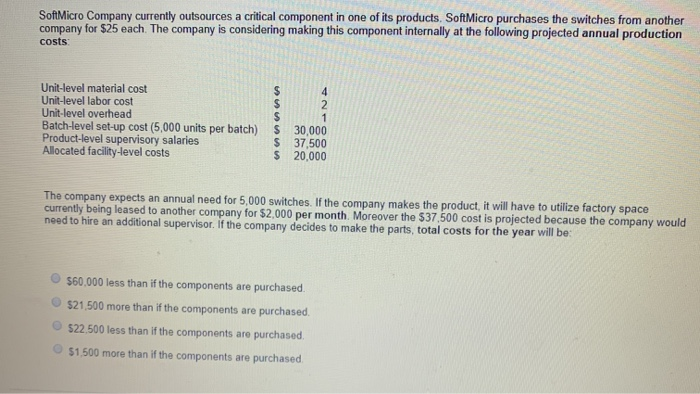

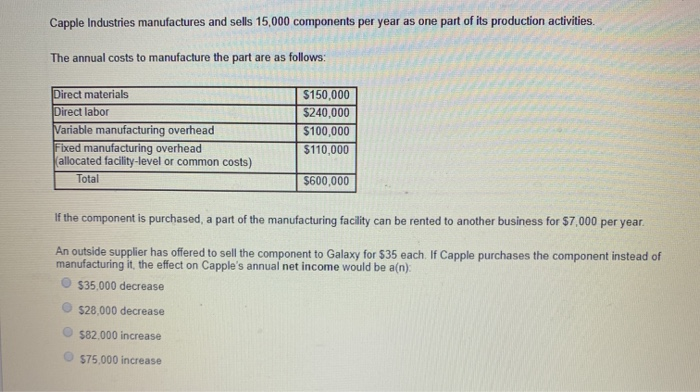

JESTION 2 After setting up an activity-based costing system for overhead costs, Superman Company calculated the following activity rates to allocate overhead: $130 per setup for the Machine-setups cost pool $40 per Inspection for the Quality control costs pool $4 per direct labor hour for the Facility-level costs pool In May, Superman Company had the following actual activity related to manufacturing products for a customer called Riley Stores: Incurred 50 direct labor hours at a total labor cost of $2,000 Used $8,000 of materials Did 20 machine setups Did 10 inspections Used 200 machine hours What is the total manufacturing cost of the Riley Stores order? $3.200 $11.200 526,000 513,200 $10.000 SoftMicro Company currently outsources a critical component in one of its products. Soft Micro purchases the switches from another company for $25 each. The company is considering making this component internally at the following projected annual production costs Unit-level material cost Unit-level labor cost Unit-level overhead Batch-level set-up cost (5,000 units per batch) Product-level supervisory salaries Allocated facility-level costs $ $ $ 30,000 37,500 20,000 The company expects an annual need for 5,000 switches. If the company makes the product, it will have to utilize factory space currently being leased to another company for $2.000 per month. Moreover the $37.500 cost is projected because the company would need to hire an additional supervisor. If the company decides to make the parts, total costs for the year will be: $60.000 less than if the components are purchased. $21.500 more than if the components are purchased $22.500 less than if the components are purchased $1.500 more than if the components are purchased Capple Industries manufactures and sells 15,000 components per year as one part of its production activities. The annual costs to manufacture the part are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead (allocated facility-level or common costs) Total $150,000 $240,000 $100,000 $110,000 $600,000 If the component is purchased, a part of the manufacturing facility can be rented to another business for $7,000 per year. An outside supplier has offered to sell the component to Galaxy for $35 each. If Capple purchases the component instead of manufacturing it, the effect on Capple's annual net income would be a(n): $35.000 decrease $28.000 decrease $82,000 increase $75,000 increase