Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jim Jones currently has income in period 0 of 40 and in period 1 of 44. Given the interest rate at which Jim can

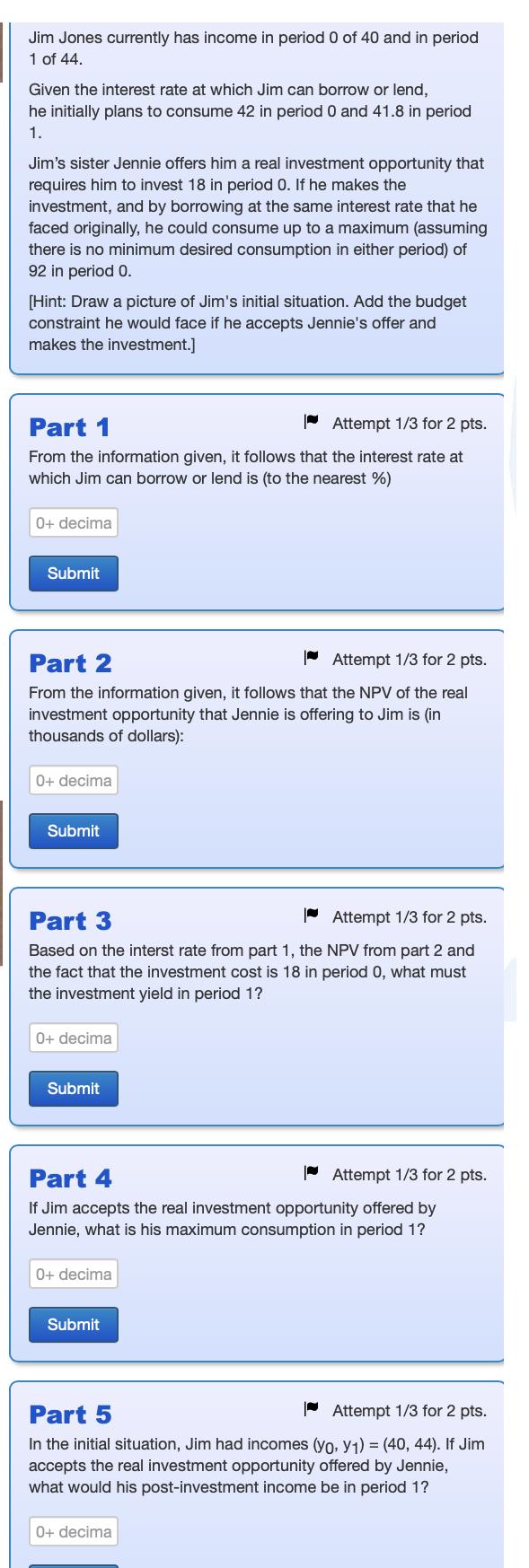

Jim Jones currently has income in period 0 of 40 and in period 1 of 44. Given the interest rate at which Jim can borrow or lend, he initially plans to consume 42 in period 0 and 41.8 in period 1. Jim's sister Jennie offers him a real investment opportunity that requires him to invest 18 in period 0. If he makes the investment, and by borrowing at the same interest rate that he faced originally, he could consume up to a maximum (assuming there is no minimum desired consumption in either period) of 92 in period 0. [Hint: Draw a picture of Jim's initial situation. Add the budget constraint he would face if he accepts Jennie's offer and makes the investment.] Part 1 Attempt 1/3 for 2 pts. From the information given, it follows that the interest rate at which Jim can borrow or lend is (to the nearest %) 0+ decima Submit Part 2 Attempt 1/3 for 2 pts. From the information given, it follows that the NPV of the real investment opportunity that Jennie is offering to Jim is (in thousands of dollars): 0+ decima Submit Part 3 Attempt 1/3 for 2 pts. Based on the interst rate from part 1, the NPV from part 2 and the fact that the investment cost is 18 in period 0, what must the investment yield in period 1? 0+ decima Submit Part 4 If Jim accepts the real investment opportunity offered by Jennie, what is his maximum consumption in period 1? 0+ decima Submit Attempt 1/3 for 2 pts. Part 5 Attempt 1/3 for 2 pts. In the initial situation, Jim had incomes (yo, y) = (40, 44). If Jim accepts the real investment opportunity offered by Jennie, what would his post-investment income be in period 1? 0+ decima

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 To find the interest rate at which Jim can borrow or lend we can use the formula for the interest rate Interest rate Future Value Present Value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started