Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jim's Brims, Inc., has sales of $565,000, operating costs of $240,000, depreciation expenses of $74,000, interest expense of $41,000, a tax rate of 35

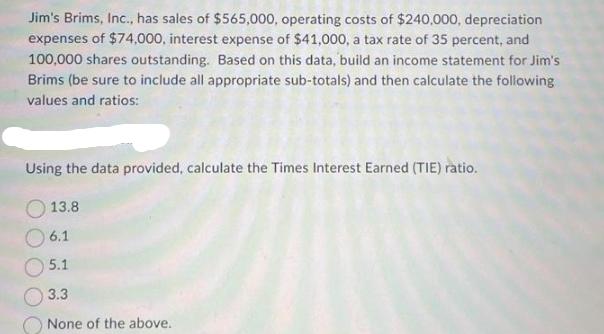

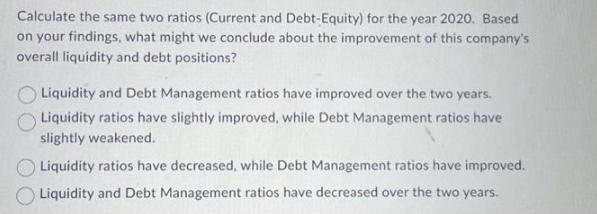

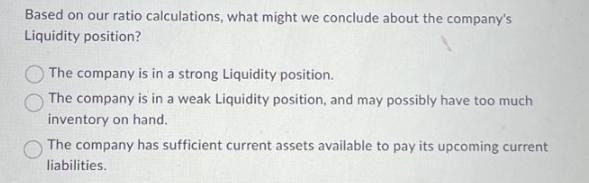

Jim's Brims, Inc., has sales of $565,000, operating costs of $240,000, depreciation expenses of $74,000, interest expense of $41,000, a tax rate of 35 percent, and 100,000 shares outstanding. Based on this data, build an income statement for Jim's Brims (be sure to include all appropriate sub-totals) and then calculate the following values and ratios: Using the data provided, calculate the Times Interest Earned (TIE) ratio. 13.8 6.1 5.1 3.3 None of the above. Calculate the same two ratios (Current and Debt-Equity) for the year 2020. Based on your findings, what might we conclude about the improvement of this company's overall liquidity and debt positions? Liquidity and Debt Management ratios have improved over the two years. Liquidity ratios have slightly improved, while Debt Management ratios have slightly weakened. Liquidity ratios have decreased, while Debt Management ratios have improved. Liquidity and Debt Management ratios have decreased over the two years. Based on our ratio calculations, what might we conclude about the company's Liquidity position? The company is in a strong Liquidity position. The company is in a weak Liquidity position, and may possibly have too much inventory on hand. The company has sufficient current assets available to pay its upcoming current liabilities. Jim's Brims, Inc., has sales of $565,000, operating costs of $240,000, depreciation expenses of $74,000, interest expense of $41,000, a tax rate of 35 percent, and 100,000 shares outstanding. Based on this data, build an income statement for Jim's Brims (be sure to include all appropriate sub-totals) and then calculate the following values and ratios: Using the data provided, calculate the Times Interest Earned (TIE) ratio. 13.8 6.1 5.1 3.3 None of the above. Calculate the same two ratios (Current and Debt-Equity) for the year 2020. Based on your findings, what might we conclude about the improvement of this company's overall liquidity and debt positions? Liquidity and Debt Management ratios have improved over the two years. Liquidity ratios have slightly improved, while Debt Management ratios have slightly weakened. Liquidity ratios have decreased, while Debt Management ratios have improved. Liquidity and Debt Management ratios have decreased over the two years. Based on our ratio calculations, what might we conclude about the company's Liquidity position? The company is in a strong Liquidity position. The company is in a weak Liquidity position, and may possibly have too much inventory on hand. The company has sufficient current assets available to pay its upcoming current liabilities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Part A Income Statement for Jims Brims ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started