Question

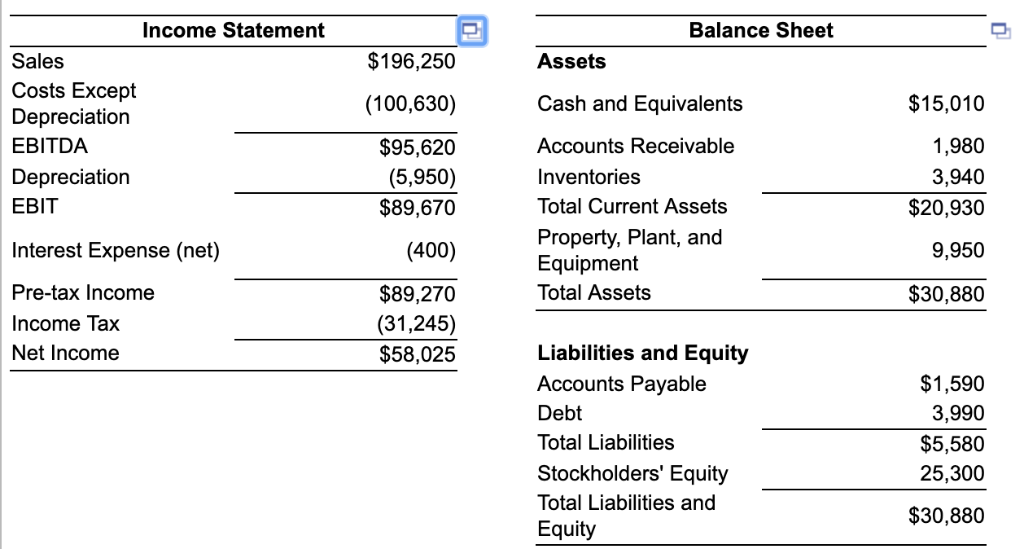

Jim's Espresso expects sales to grow by 10.4% next year. Using the following statements and the percent of sales method, forecast: a. Costs b. Depreciation

Jim's Espresso expects sales to grow by 10.4% next year. Using the following statements and the percent of sales method, forecast:

a. Costs

b. Depreciation

c. Net Income

d. Cash

e. Accounts receivable

f. Inventory

g. Property, plant, and equipment

(Note: Make sure to round all intermediate calculations to at least five decimal places.)

The Tax Cuts and Jobs Act of 2017 temporarily allow 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career.

a. Costs

The forecasted costs will be

$111095.52.

(Round to the nearest dollar and enter all numbers as positive.)

b. Depreciation

The forecasted depreciation will be

$____________.

(Round to the nearest dollar and enter all numbers as positive.)

Income Statement Balance Sheet $196,250 Sales Costs Except Depreciation EBITDA Depreciation EBIT Assets (100,630) $95,620 (5,950) $89,670 (400) $89,270 (31,245) $58,025 $15,010 Cash and Equivalents 1,980 3,940 $20,930 9,950 Accounts Receivable Inventories Total Current Assets Property, Plant, and Equipment Total Assets Interest Expense (net) Pre-tax Income Income Tax Net Income $30,880 Liabilities and Equity Accounts Payable Debt Total Liabilities Stockholders' Equity Total Liabilities and Equity $1,590 3,990 $5,580 25,300 $30,880 Income Statement Balance Sheet $196,250 Sales Costs Except Depreciation EBITDA Depreciation EBIT Assets (100,630) $95,620 (5,950) $89,670 (400) $89,270 (31,245) $58,025 $15,010 Cash and Equivalents 1,980 3,940 $20,930 9,950 Accounts Receivable Inventories Total Current Assets Property, Plant, and Equipment Total Assets Interest Expense (net) Pre-tax Income Income Tax Net Income $30,880 Liabilities and Equity Accounts Payable Debt Total Liabilities Stockholders' Equity Total Liabilities and Equity $1,590 3,990 $5,580 25,300 $30,880Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started