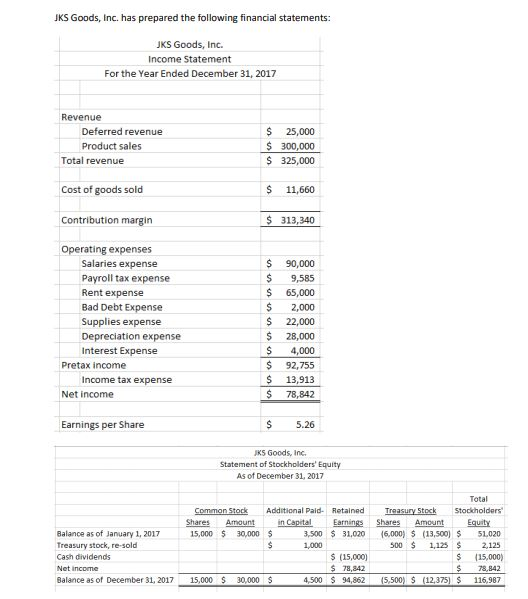

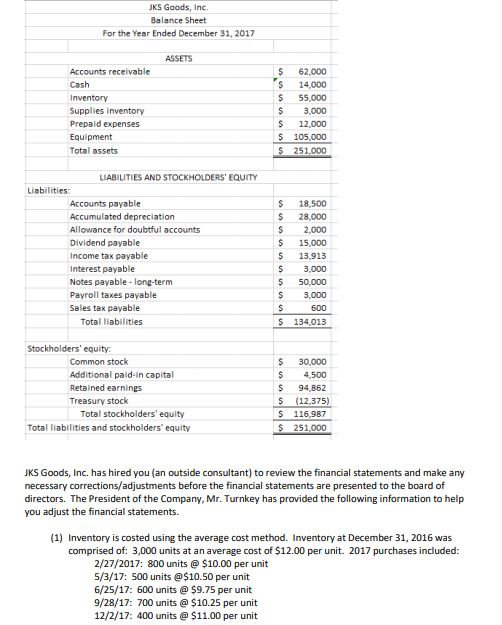

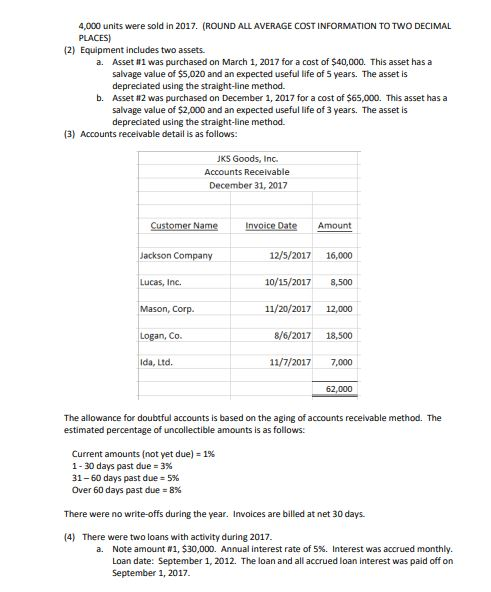

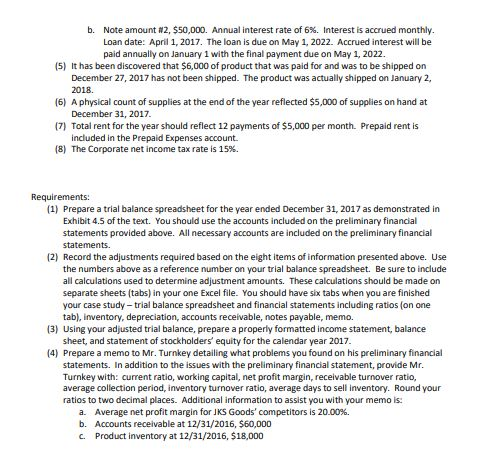

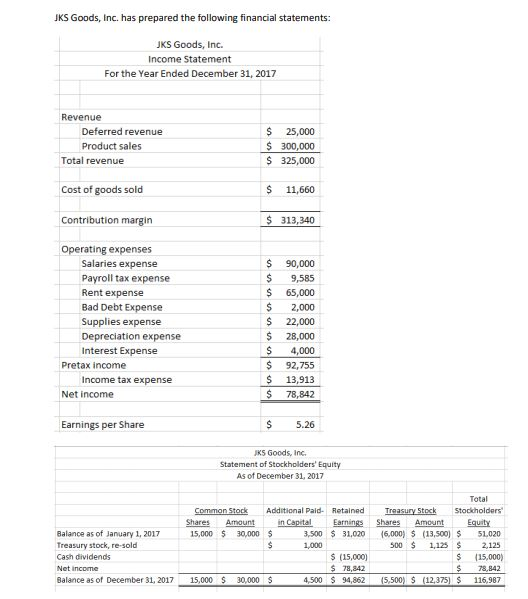

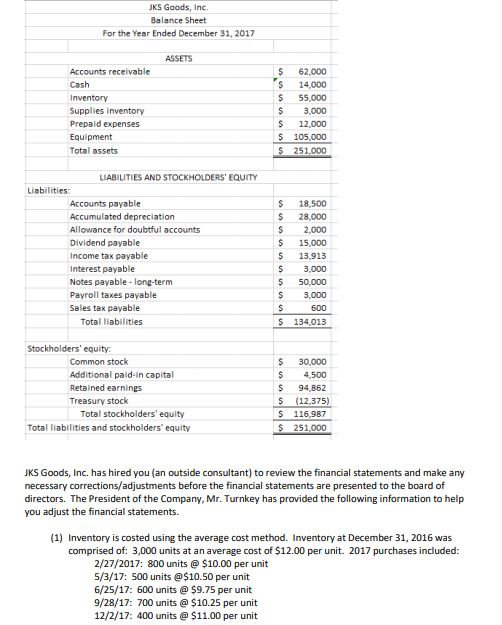

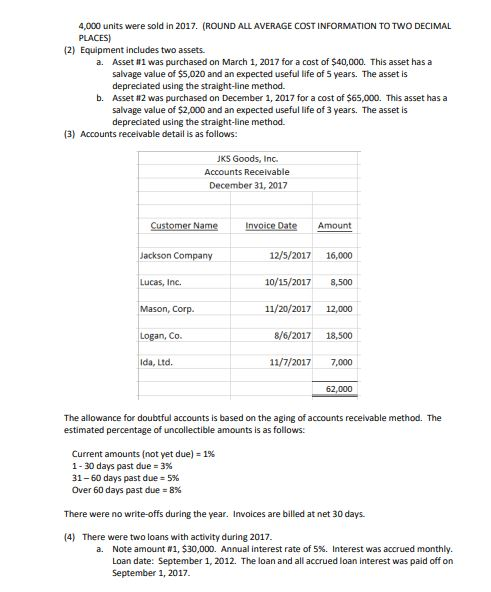

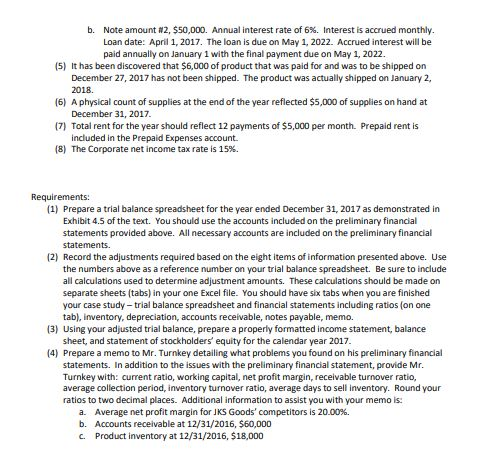

JKS Goods, Inc. has prepared the following financial statements: JKS Goods, Inc. Income Statement For the Year Ended December 31, 2017 Revenue 25,000 $ 300,000 325,000 Deferred revenue Product sales Total revenue Cost of goods sold Contribution margin Operating expenses $ 11,660 313,340 $ 90,000 $9,585 $ 65,000 $2,000 $ 22,000 $ 28,000 4,000 $92,755 13,913 $ 78,842 Salaries expense Payroll tax expense Rent expense Bad Debt Expense Supplies expense Depreciation expense Interest Expense Pretax income Income tax expense Net income Earnings per Share 5.26 KS Goods, Inc Statement of Stockholders' Equity As of December 31, 2017 Total Common Stock Additional Paid Retained Teasury Stock Stoccholders Shares Amount in Copital Earnings Shares Amount Equity Balance as of January 1, 2017 Treasury stock, re-sold Cash dividends 3,500 31,020 (6,000 (13,500) 51,020 500 1,125 2,125 $15,000) 78,842 Balance as of December 31,2017 15,000 $ 30,000 $4,500 $ 94,862 (5.500) 12,375) 116.987 15,000 $ 30,000 $ 1,000 (15,000) 78,842 KS Goods, Inc. Balance Sheet For the Year Ended December 31, 2017 ASSETS 62,000 S 14,000 55,000 S 3,000 S 12,000 S 105,000 251,000 Supplies inventory Prepaid expenses Equipment Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities: Accounts payable Accumulated depreciation Allowance for doubtful accounts Dividend payable Income tax payable Interest payable Notes payable- long-term Payroll taxes payable Sales tax payable S 18,500 5 28,000 S 2,000 5 15,000 5 13,913 5 3,000 5 50,000 3,000 600 5 134,013 Total liabilities Stockholders' equity Common stock Additional pald-in capital Retained earnings Treasury stock 5 30,000 4,500 5 94,862 (12,375) 5 116,987 Total stockholders' equity Total liabilities and stockholders' equity 251 JKS Goods, Inc. has hired you (an outside consultant) to review the financial statements and make any necessary corrections/adjustments before the financial statements are presented to the board of directors. The President of the Company, Mr. Turnkey has provided the following information to help you adjust the financial statements. (1) Inventory is costed using the average cost method. Inventory at December 31, 2016 was comprised of: 3,000 units at an average cost of $12.00 per unit. 2017 purchases included: 2/27/2017: 800 units@$10.00 per unit S/3/17: 500 units@$10.50 per unit 6/25/17: 600 units@$9.75 per unit 9/28/17: 700 units@ $10.25 per unit 12/2/17: 400 units@$11.00 per unit 4,000 units were sold in 2017. (ROUND ALL AVERAGE COST INFORMATION TO TWO DECIMAL PLACES) (2) Equipment includes two assets. Asset #1 was purchased on March 1, 2017 for a cost of $40,000. This asset has a salvage value of $5,020 and an expected useful life of 5 years. The asset is depreciated using the straight-line method. Asset #2 was purchased on December 1, 2017 for a cost of $65,000. This asset has a salvage value of $2,000 and an expected useful life of 3 years. The asset is depreciated using the straight-line method. a. b. (3) Accounts receivable detail is as follows: JKS Goods, Inc December 31, 2017 12/5/2017 16,000 10/15/2017 8,500 11/20/2017 12,000 8/6/2017 18,500 1/7/2017 7,000 Jackson Company Lucas, Inc Mason, Corp. Logan, Co. Ida, Ltd 62,000 The allowance for doubtful accounts is based on the aging of accounts receivable method. The estimated percentage of uncollectible amounts is as follows: Current amounts {not yet due)-196 1-30 days past due 3% 31-60 days past due 596 Over 60 days past due 8% There were no write-offs during the year. Invoices are billed at net 30 days (4) There were two loans with activity during 2017 Note amount #1, $30,000. Annual interest rate of 5%. Interest was accrued monthly. Loan date: September 1, 2012. The loan and all accrued loan interest was paid off on September 1, 2017 a. b. Note amount #2, $50,000. Annual interest rate of 6%. Interest is accrued monthly. Loan date: April 1, 2017. The loan is due on May 1, 2022. Accrued interest will be paid annually on January 1 with the final payment due on May 1, 2022. (5) It has been discovered that $6,000 of product that was paid for and was to be shipped on December 27, 2017 has not been shipped. The product was actually shipped on January 2, 2018 (6) A physical count of supplies at the end of the year reflected $5,000 of supplies on hand at (7) Total rent for the year should reflect 12 payments of $5,000 per month. Prepaid rent is (8) The Corporate net income tax rate is 15%. December 31, 2017 included in the Prepaid Expenses account. Requirements: (1) Prepare a trial balance spreadsheet for the year ended December 31, 2017 as demonstrated in Exhibit 4.5 of the text. You should use the accounts included on the preliminary financial statements provided above. All necessary accounts are included on the preliminary financial statements. (2) Record the adjustments required based on the eight items of information presented above. Use the numbers above as a reference number on your trial balance spreadsheet. Be sure to include all calculations used to determine adjustment amounts. These calculations should be made on separate sheets (tabs) in your one Excel file. You should have six tabs when you are finished your case study trial balance spreadsheet and financial statements including ratios (on one tab), inventory, depreciation, accounts receivable, notes payable, memo. (3) Using your adjusted trial balance, prepare a properly formatted income statement, balance sheet, and statement of stockholders equity for the calendar year 2017 (4) Prepare a memo to Mr. Turnkey detailing what problems you found on his preliminary financial statements. In addition to the issues with the preliminary financial statement, provide Mr. Turnkey with: current ratio, working capital, net profit margin, receivable turnover ratio, average collection period, inventory turnover ratio, average days to sell inventory. Round your ratios to two decimal places. Additional information to assist you with your memo is: Average net profit margin for KS Goods' competitors is 20.00%. Accounts receivable at 12/31/2016, $60,000 Product inventory at 12/31/2016, $18,000 a. b. c. JKS Goods, Inc. has prepared the following financial statements: JKS Goods, Inc. Income Statement For the Year Ended December 31, 2017 Revenue 25,000 $ 300,000 325,000 Deferred revenue Product sales Total revenue Cost of goods sold Contribution margin Operating expenses $ 11,660 313,340 $ 90,000 $9,585 $ 65,000 $2,000 $ 22,000 $ 28,000 4,000 $92,755 13,913 $ 78,842 Salaries expense Payroll tax expense Rent expense Bad Debt Expense Supplies expense Depreciation expense Interest Expense Pretax income Income tax expense Net income Earnings per Share 5.26 KS Goods, Inc Statement of Stockholders' Equity As of December 31, 2017 Total Common Stock Additional Paid Retained Teasury Stock Stoccholders Shares Amount in Copital Earnings Shares Amount Equity Balance as of January 1, 2017 Treasury stock, re-sold Cash dividends 3,500 31,020 (6,000 (13,500) 51,020 500 1,125 2,125 $15,000) 78,842 Balance as of December 31,2017 15,000 $ 30,000 $4,500 $ 94,862 (5.500) 12,375) 116.987 15,000 $ 30,000 $ 1,000 (15,000) 78,842 KS Goods, Inc. Balance Sheet For the Year Ended December 31, 2017 ASSETS 62,000 S 14,000 55,000 S 3,000 S 12,000 S 105,000 251,000 Supplies inventory Prepaid expenses Equipment Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities: Accounts payable Accumulated depreciation Allowance for doubtful accounts Dividend payable Income tax payable Interest payable Notes payable- long-term Payroll taxes payable Sales tax payable S 18,500 5 28,000 S 2,000 5 15,000 5 13,913 5 3,000 5 50,000 3,000 600 5 134,013 Total liabilities Stockholders' equity Common stock Additional pald-in capital Retained earnings Treasury stock 5 30,000 4,500 5 94,862 (12,375) 5 116,987 Total stockholders' equity Total liabilities and stockholders' equity 251 JKS Goods, Inc. has hired you (an outside consultant) to review the financial statements and make any necessary corrections/adjustments before the financial statements are presented to the board of directors. The President of the Company, Mr. Turnkey has provided the following information to help you adjust the financial statements. (1) Inventory is costed using the average cost method. Inventory at December 31, 2016 was comprised of: 3,000 units at an average cost of $12.00 per unit. 2017 purchases included: 2/27/2017: 800 units@$10.00 per unit S/3/17: 500 units@$10.50 per unit 6/25/17: 600 units@$9.75 per unit 9/28/17: 700 units@ $10.25 per unit 12/2/17: 400 units@$11.00 per unit 4,000 units were sold in 2017. (ROUND ALL AVERAGE COST INFORMATION TO TWO DECIMAL PLACES) (2) Equipment includes two assets. Asset #1 was purchased on March 1, 2017 for a cost of $40,000. This asset has a salvage value of $5,020 and an expected useful life of 5 years. The asset is depreciated using the straight-line method. Asset #2 was purchased on December 1, 2017 for a cost of $65,000. This asset has a salvage value of $2,000 and an expected useful life of 3 years. The asset is depreciated using the straight-line method. a. b. (3) Accounts receivable detail is as follows: JKS Goods, Inc December 31, 2017 12/5/2017 16,000 10/15/2017 8,500 11/20/2017 12,000 8/6/2017 18,500 1/7/2017 7,000 Jackson Company Lucas, Inc Mason, Corp. Logan, Co. Ida, Ltd 62,000 The allowance for doubtful accounts is based on the aging of accounts receivable method. The estimated percentage of uncollectible amounts is as follows: Current amounts {not yet due)-196 1-30 days past due 3% 31-60 days past due 596 Over 60 days past due 8% There were no write-offs during the year. Invoices are billed at net 30 days (4) There were two loans with activity during 2017 Note amount #1, $30,000. Annual interest rate of 5%. Interest was accrued monthly. Loan date: September 1, 2012. The loan and all accrued loan interest was paid off on September 1, 2017 a. b. Note amount #2, $50,000. Annual interest rate of 6%. Interest is accrued monthly. Loan date: April 1, 2017. The loan is due on May 1, 2022. Accrued interest will be paid annually on January 1 with the final payment due on May 1, 2022. (5) It has been discovered that $6,000 of product that was paid for and was to be shipped on December 27, 2017 has not been shipped. The product was actually shipped on January 2, 2018 (6) A physical count of supplies at the end of the year reflected $5,000 of supplies on hand at (7) Total rent for the year should reflect 12 payments of $5,000 per month. Prepaid rent is (8) The Corporate net income tax rate is 15%. December 31, 2017 included in the Prepaid Expenses account. Requirements: (1) Prepare a trial balance spreadsheet for the year ended December 31, 2017 as demonstrated in Exhibit 4.5 of the text. You should use the accounts included on the preliminary financial statements provided above. All necessary accounts are included on the preliminary financial statements. (2) Record the adjustments required based on the eight items of information presented above. Use the numbers above as a reference number on your trial balance spreadsheet. Be sure to include all calculations used to determine adjustment amounts. These calculations should be made on separate sheets (tabs) in your one Excel file. You should have six tabs when you are finished your case study trial balance spreadsheet and financial statements including ratios (on one tab), inventory, depreciation, accounts receivable, notes payable, memo. (3) Using your adjusted trial balance, prepare a properly formatted income statement, balance sheet, and statement of stockholders equity for the calendar year 2017 (4) Prepare a memo to Mr. Turnkey detailing what problems you found on his preliminary financial statements. In addition to the issues with the preliminary financial statement, provide Mr. Turnkey with: current ratio, working capital, net profit margin, receivable turnover ratio, average collection period, inventory turnover ratio, average days to sell inventory. Round your ratios to two decimal places. Additional information to assist you with your memo is: Average net profit margin for KS Goods' competitors is 20.00%. Accounts receivable at 12/31/2016, $60,000 Product inventory at 12/31/2016, $18,000 a. b. c