Answered step by step

Verified Expert Solution

Question

1 Approved Answer

JLC company is a manufacturer of shoes and aims to be competent in their production of quality local shoes. The costs involved in producing

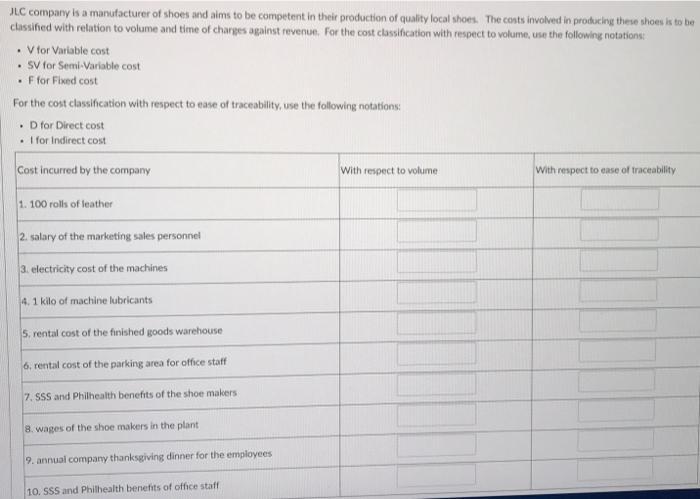

JLC company is a manufacturer of shoes and aims to be competent in their production of quality local shoes. The costs involved in producing these shoes is to be classified with relation to volume and time of charges against revenue. For the cost classification with respect to volume, use the following notations: V tor Variable cost SV for Semi-Variable cost F for Fixed cost For the cost classification with respect to ease of traceability, use the following notations: D for Direct cost I for Indirect cost Cost incurred by the company With respect to volume With respect to ease of traceability 1. 100 rolls of leather 2. salary of the marketing sales personnel 3. electricity cost of the machines 4. 1 kilo of machine lubricants 5. rental cost of the finished goods warehouse 6, rental cost of the parking area for office staff 7. SSS and Philhealth benefits of the shoe makers 8. wages of the shoe makers in the plant 9. annual company thanksgiving dinner for the employees 10. SSS and Philhealth benefits of office staff

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The cost incurred by the company with respect to volume with respect to ease of traceability 100 rol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started