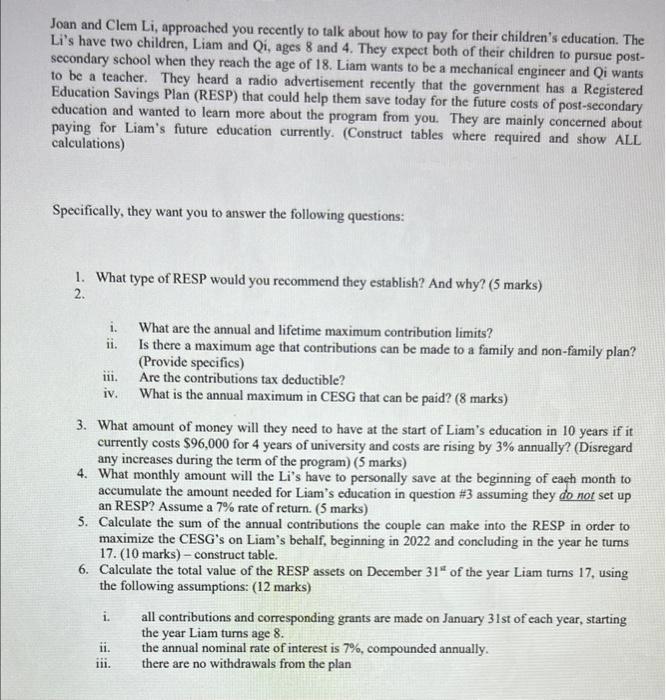

Joan and Clem Li, approached you recently to talk about how to pay for their children's education. The Li's have two children, Liam and Qi, ages 8 and 4. They expect both of their children to pursue post- secondary school when they reach the age of 18. Liam wants to be a mechanical engineer and Qi wants to be a teacher. They heard a radio advertisement recently that the government has a Registered Education Savings Plan (RESP) that could help them save today for the future costs of post-secondary education and wanted to learn more about the program from you. They are mainly concerned about paying for Liam's future education currently. (Construct tables where required and show ALL calculations) Specifically, they want you to answer the following questions: 1. What type of RESP would you recommend they establish? And why? (5 marks) 2. ii. 111. iv. What are the annual and lifetime maximum contribution limits? Is there a maximum age that contributions can be made to a family and non-family plan? (Provide specifics) 3. What amount of money will they need to have at the start of Liam's education in 10 years if it currently costs $96,000 for 4 years of university and costs are rising by 3% annually? (Disregard any increases during the term of the program) (5 marks) 4. What monthly amount will the Li's have to personally save at the beginning of each month to accumulate the amount needed for Liam's education in question #3 assuming they do not set up an RESP? Assume a 7% rate of return. (5 marks) i. Are the contributions tax deductible? What is the annual maximum in CESG that can be paid? (8 marks) 5. Calculate the sum of the annual contributions the couple can make into the RESP in order to maximize the CESG's on Liam's behalf, beginning in 2022 and concluding in the year he turns 17. (10 marks) - construct table. 6. Calculate the total value of the RESP assets on December 31" of the year Liam turns 17, using the following assumptions: (12 marks) ii. 111. all contributions and corresponding grants are made on January 31st of each year, starting the year Liam turns age 8. the annual nominal rate of interest is 7%, compounded annually. there are no withdrawals from the plan Joan and Clem Li, approached you recently to talk about how to pay for their children's education. The Li's have two children, Liam and Qi, ages 8 and 4. They expect both of their children to pursue post- secondary school when they reach the age of 18. Liam wants to be a mechanical engineer and Qi wants to be a teacher. They heard a radio advertisement recently that the government has a Registered Education Savings Plan (RESP) that could help them save today for the future costs of post-secondary education and wanted to learn more about the program from you. They are mainly concerned about paying for Liam's future education currently. (Construct tables where required and show ALL calculations) Specifically, they want you to answer the following questions: 1. What type of RESP would you recommend they establish? And why? (5 marks) 2. ii. 111. iv. What are the annual and lifetime maximum contribution limits? Is there a maximum age that contributions can be made to a family and non-family plan? (Provide specifics) 3. What amount of money will they need to have at the start of Liam's education in 10 years if it currently costs $96,000 for 4 years of university and costs are rising by 3% annually? (Disregard any increases during the term of the program) (5 marks) 4. What monthly amount will the Li's have to personally save at the beginning of each month to accumulate the amount needed for Liam's education in question #3 assuming they do not set up an RESP? Assume a 7% rate of return. (5 marks) i. Are the contributions tax deductible? What is the annual maximum in CESG that can be paid? (8 marks) 5. Calculate the sum of the annual contributions the couple can make into the RESP in order to maximize the CESG's on Liam's behalf, beginning in 2022 and concluding in the year he turns 17. (10 marks) - construct table. 6. Calculate the total value of the RESP assets on December 31" of the year Liam turns 17, using the following assumptions: (12 marks) ii. 111. all contributions and corresponding grants are made on January 31st of each year, starting the year Liam turns age 8. the annual nominal rate of interest is 7%, compounded annually. there are no withdrawals from the plan