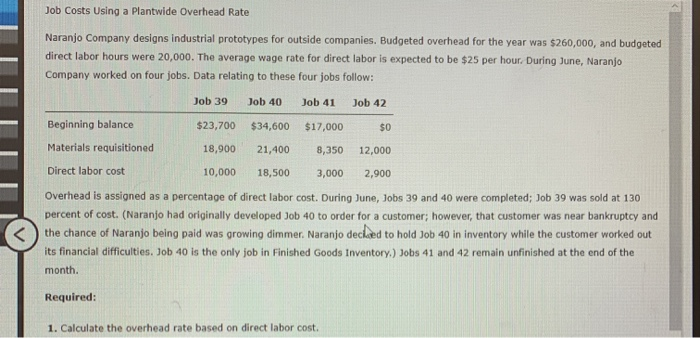

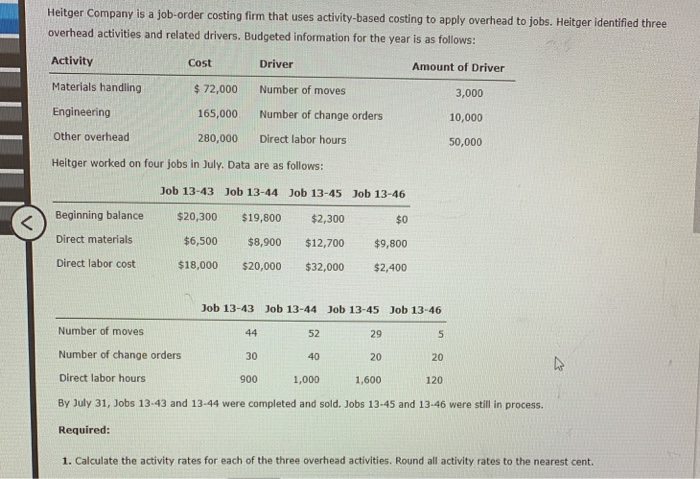

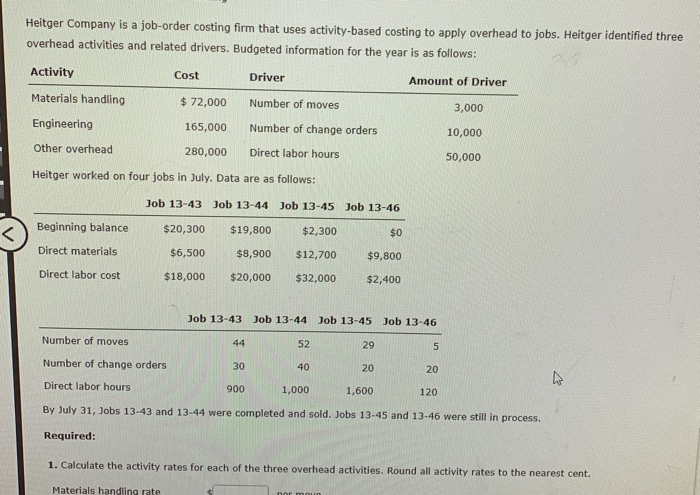

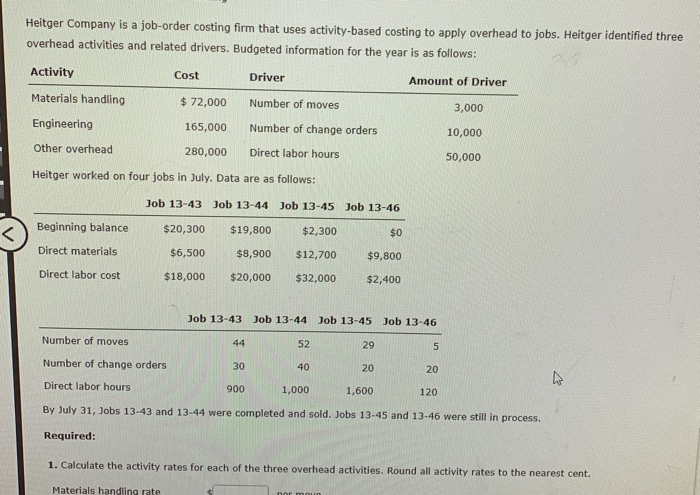

Job Costs Using a Plantwide Overhead Rate Naranjo Company designs industrial prototypes for outside companies, Budgeted overhead for the year was $260,000, and budgeted direct labor hours were 20,000. The average wage rate for direct labor is expected to be $25 per hour. During June, Naranjo Company worked on four jobs. Data relating to these four jobs follow: Job 39 Job 40 Job 41 Job 42 Beginning balance $23,700 $34,600 $17,000 $0 Materials requisitioned 18,900 21,400 8,350 12,000 Direct labor cost 10,000 18,500 3,000 2,900 Overhead is assigned as a percentage of direct labor cost. During June, Jobs 39 and 40 were completed; Job 39 was sold at 130 percent of cost. (Naranjo had originally developed Job 40 to order for a customer; however, that customer the chance of Naranjo being paid was growing dimmer. Naranjo declad to hold Job 40 in inventory while the customer worked out its financial difficulties. Job 40 is the only job in Finished Goods Inventory.) Jobs 41 and 42 remain unfinished at the end of the month. Required: 1. Calculate the overhead rate based on direct labor cost. Heitger Company is a job-order costing firm that uses activity-based costing to apply overhead to jobs. Heitger identified three overhead activities and related drivers. Budgeted information for the year is as follows: Activity Cost Driver Amount of Driver Materials handling $72,000 Number of moves 3,000 Engineering 165,000 280,000 Number of change orders Direct labor hours 10,000 50,000 Other overhead Heitger worked on four jobs in July. Data are as follows: Job 13-43 Job 13-44 Job 13-45 Job 13-46 Beginning balance $0 $20,300 $6,500 $18,000 Direct materials Direct labor cost $19,800 $8,900 $20,000 $2,300 $12,700 $32,000 $9,800 $2,400 Number of moves 5 Job 13-43 Job 13-44 Job 13-45 Job 13-46 52 29. 30 40 20 20 900 1,000 1,600 120 Number of change orders Direct labor hours By July 31, Jobs 13-43 and 13-44 were completed and sold. Jobs 13-45 and 13-46 were still in process. Required: 1. Calculate the activity rates for each of the three overhead activities. Round all activity rates to the nearest cent. Heitger Company is a job-order costing firm that uses activity-based costing to apply overhead to jobs. Heitger identified three overhead activities and related drivers. Budgeted information for the year is as follows: Activity Cost Driver Amount of Driver Materials handling 3,000 Number of moves Number of change orders Engineering $ 72,000 165,000 280,000 10,000 Other overhead Direct labor hours 50,000 Heitger worked on four jobs in July. Data are as follows: Job 13-43 Job 13-44 Job 13-45 Job 13-46 Beginning balance Direct materials $20,300 $6,500 $18,000 $19,800 $8,900 $20,000 $2,300 $12,700 $32,000 $9,800 $2,400 Direct labor cost Job 13-43 Job 13-44 Job 13-45 Job 13-46 Number of moves 40 20 Number of change orders 20 Direct labor hours 1,000 1,600 120 By July 31, Jobs 13-43 and 13.44 were completed and sold. Jobs 13.45 and 13-46 were still in process. Required: 1. Calculate the activity rates for each of the three overhead activities. Round all activity rates to the nearest cent