Answered step by step

Verified Expert Solution

Question

1 Approved Answer

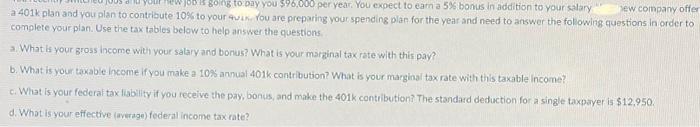

Job is going to pay you $96,000 per year. You expect to earn a 5% bonus in addition to your salary. new company offer a

Job is going to pay you $96,000 per year. You expect to earn a 5% bonus in addition to your salary. new company offer a 401k plan and you plan to contribute 10% your 4UIK. You are preparing your spending plan for the year and need to answer the following questions in order to complete your plan. Use the tax tables below to help answer the questions. a. What is your gross income with your salary and bonus? What is your marginal tax rate with this pay? b. What is your taxable income if you make a 10% annual 401k contribution? What is your marginal tax rate with this taxable income? c. What is your federal tax liability if you receive the pay, bonus, and make the 401k contribution? The standard deduction for a single taxpayer is $12,950. d. What is your effective (average) federal income tax rate?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started