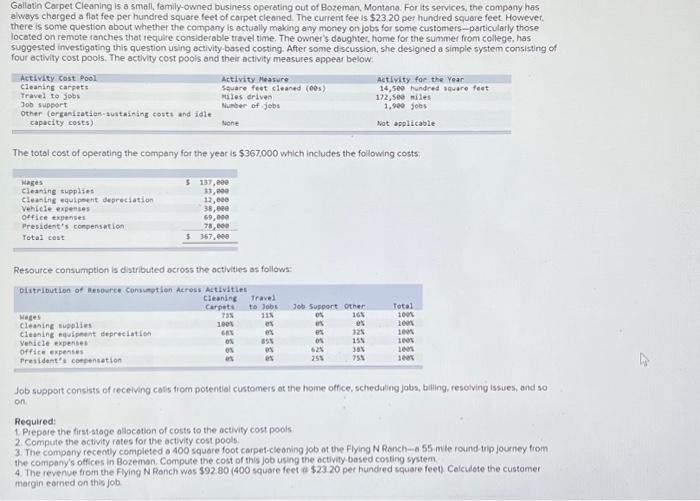

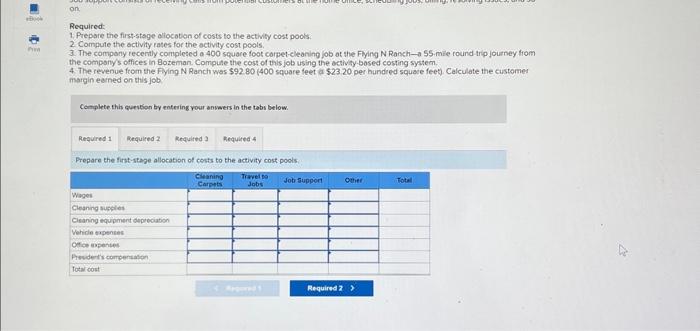

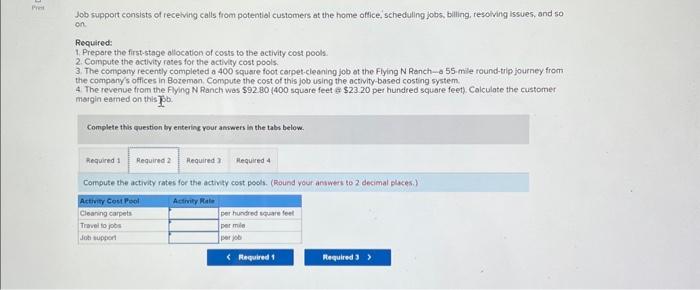

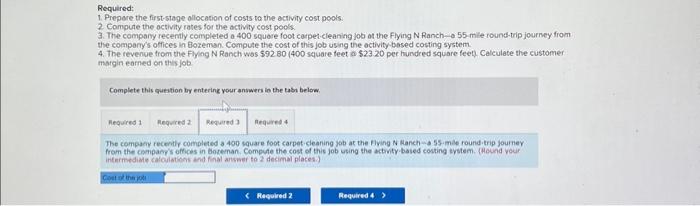

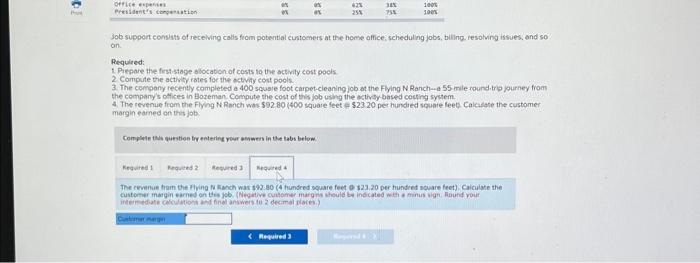

Job support consists of recelving calls from potential customers at the home oflice, scheduling jobs, billing, resolving issues, and so on Required: 1. Prepare the first-stage allocation of costs to the activity cost pools 2. Compute the activity rates for the activity cost pools. 3. The company recently completed a 400 square foot carpet-cleaning job at the Flying N Ranch- 855 -mile round-trip journey from the company's offices in Bozemon. Compute the cost of this job using the activity-based costing system. 4. The revenue trom the flying N Ranch was $92.80 (400 square feet e $23.20 per hundred square feet). Calculate the customer matgin earned on this pbp. Complete this question br entering youf answers in the tabs below. Compute the activity rates for the activily cost pools. (Round your anawers to 2 decimal plices.) Job support consuss of recelving calis fiom potential cuntomers at the home office, scheduling jobs, biling resolving issues, and so on. Pequired: 1. Pepore the firststage allocation of costs lo the activily cost pocis. 2 Compute the activity rates for the activity cost pools. 3. The company recently completed a 400 squsle foot carpet-cieaning job at the Flying N Ranch-a 55 -mile round.trig journey from the company's offices in Bozeman Compute the cost of this job using the activiy-based couting system. 4. The revenue from the Flying N Ranch was $92.80 (400 square feet $2320 per hundred souate feets Calcilate the customer margin earned on thes job. Comylele this aurstion frr entering your onswers in the tabs below. Gallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has always charged a flat fee per hundred square feet of corpet cleaned. The current fee is $2320 per hundred square feet However, there is some question about whether the company is actually making any money on jobs for some customers-particularly those located on remote ranches that require considerable travel time. The owner's doughter, home for the summer from college, has suggested investigating this question using octivity based costing. After some discussion, she designed a simple system consisting of four activity cost pools, The activity cost pools and their activity measures appear below: The total cost of operating the company for the year is $367,000 which includes the following costs: Resource consumption is distributed ocross the octivities as follows: Job support consists of receiving calis from potential customers ot the home office, scheduling jobs, billing, resolving issues, and so on Required: Required: 1. Prepore the first-stage allocotion of costs to the activity cost pools 2. Compute the octivity rates for the activity cost pools. 3. The compony recently completed o 400 square foot carpet-cleaning job ot the Flying N Ronch-a 55 -mile round- trip journey from the company's offices in Bozeman. Compule the cost of this job using the octivity based costing system 4 . The revenue from the Fying N Ranch was $92.80 ( 400 square feet a $23.20 pet hundied square feet) Calculote the customer margin earned on this job. Required: 1. Prepare the first-stage ollocation of costs to the activity cost pools. 2 Compute the octivity rates for the activity cost pools. 3. The company recently completed a 400 square foot carpet-cleaning job ot the Flying N Ranch-a 55 mile iound-trip journey from the company's offices in tioreman. Compute the cost of this job using the activity based costing system. 4. The revenue from the Flying N Ranch was $92 BO (400 square teet a $23.20 per hundred square feet). Calculate the customer margin earned on this job. Complete this qutstion by enterine your answers io the tass below. from the company's offices in boteinan. Compute the cost of this job using the actowitr based costing trstem. (AOund your Required: 1. Prepare the first-stage aliocotion of costs to the activity cost pools. 2 Compute the activity rates for the activity cost pools. 3. The company recently completed a 400 square foot corpet-cleaning job at the Fiying N Ranch SS.mie round trip journey from the company's offices in Bozeman. Compute the cost of this job using the octivity-bosed costing system. 4. The revenue from the Fying N Ranch was $9280 (400 square feet a $2320 per hundred squace feet). Calculate the customes margin earned on this job Complete this question by entering vour anvers in the tabs below. Prepare the first-stage allocation of cests to the activity cost pools