Answered step by step

Verified Expert Solution

Question

1 Approved Answer

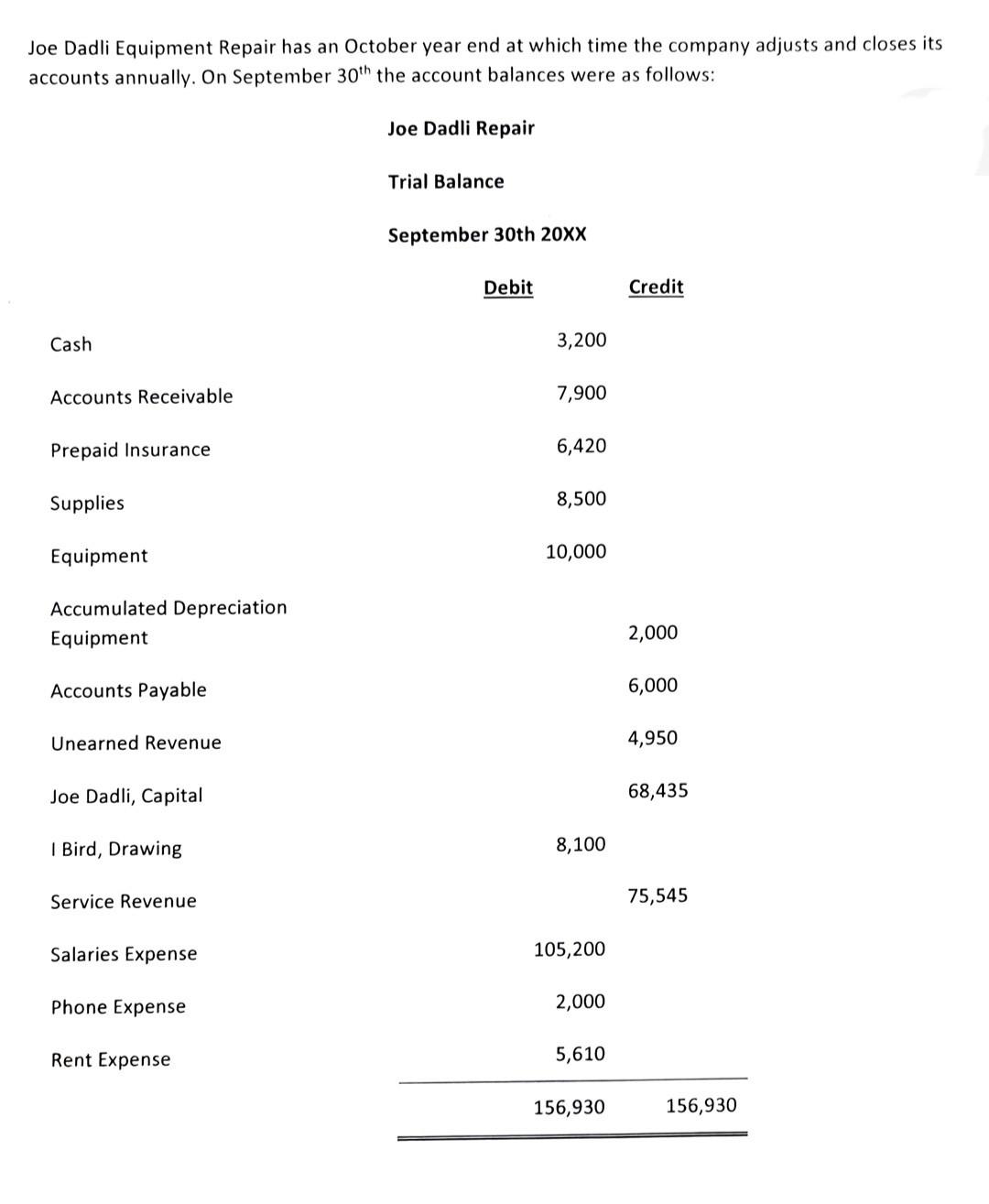

Joe Dadli Equipment Repair has an October year end at which time the company adjusts and closes its accounts annually. On September 30th the

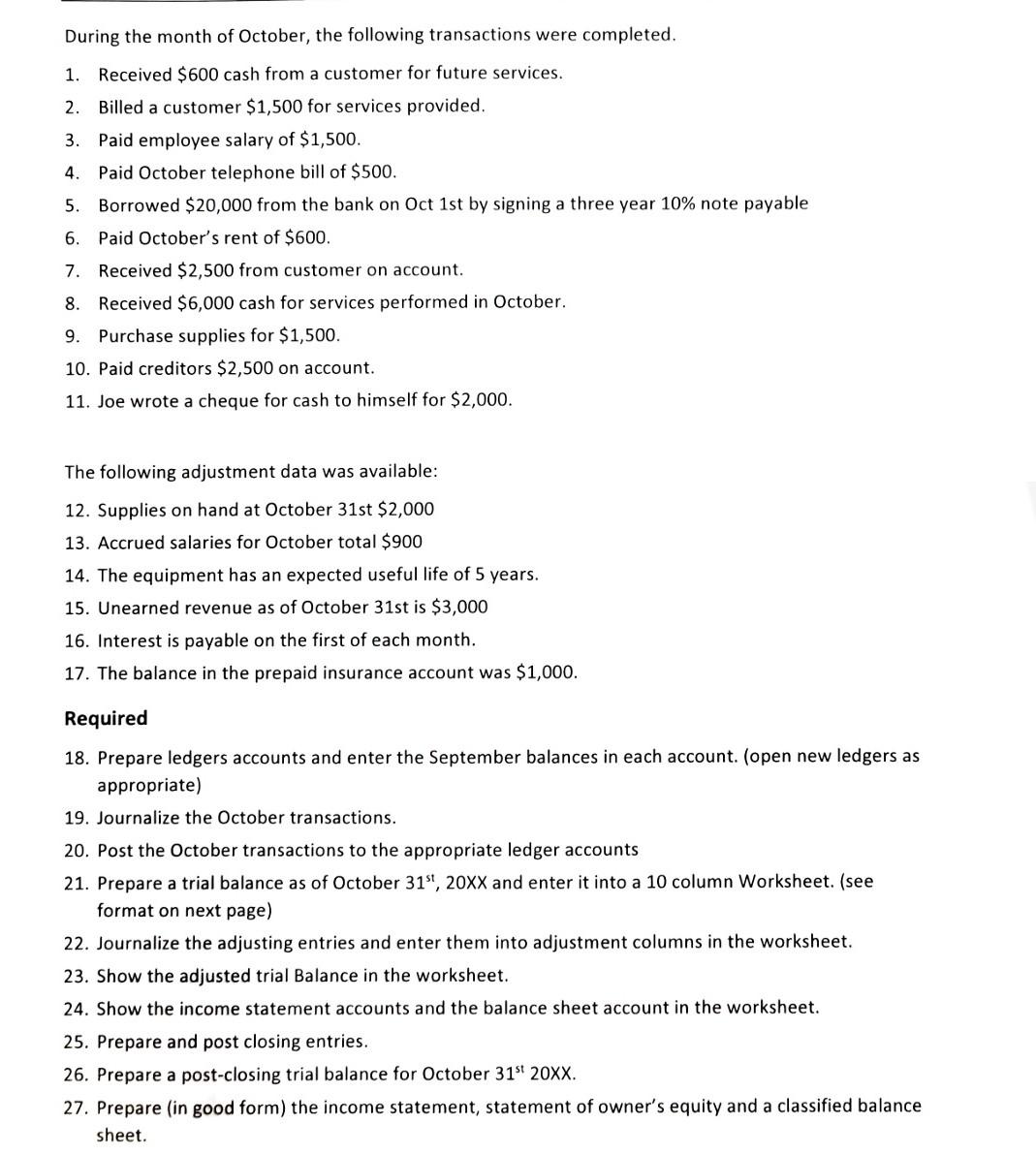

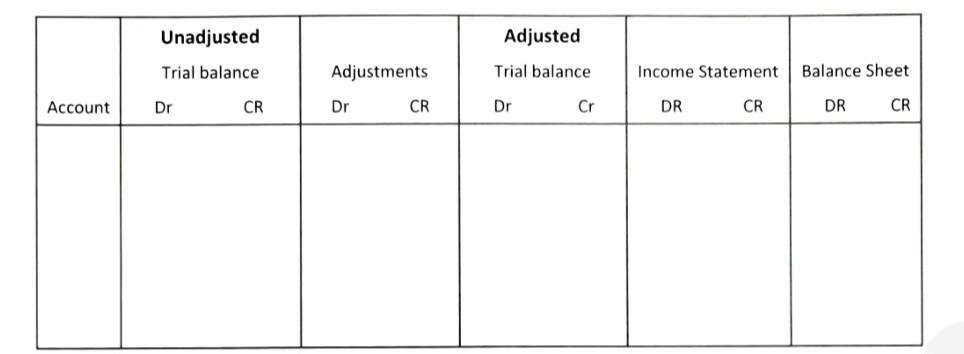

Joe Dadli Equipment Repair has an October year end at which time the company adjusts and closes its accounts annually. On September 30th the account balances were as follows: Joe Dadli Repair Cash Accounts Receivable Prepaid Insurance Supplies Equipment Accumulated Depreciation Equipment Accounts Payable Unearned Revenue Joe Dadli, Capital I Bird, Drawing Service Revenue Salaries Expense Phone Expense Rent Expense Trial Balance September 30th 20XX Debit 3,200 7,900 6,420 8,500 10,000 8,100 105,200 2,000 5,610 156,930 Credit 2,000 6,000 4,950 68,435 75,545 156,930 During the month of October, the following transactions were completed. 1. Received $600 cash from a customer for future services. 2. Billed a customer $1,500 for services provided. 3. Paid employee salary of $1,500. 4. Paid October telephone bill of $500. 5. Borrowed $20,000 from the bank on Oct 1st by signing a three year 10% note payable 6. Paid October's rent of $600. 7. Received $2,500 from customer on account. 8. Received $6,000 cash for services performed in October. 9. Purchase supplies for $1,500. 10. Paid creditors $2,500 on account. 11. Joe wrote a cheque for cash to himself for $2,000. The following adjustment data was available: 12. Supplies on hand at October 31st $2,000 13. Accrued salaries for October total $900 14. The equipment has an expected useful life of 5 years. 15. Unearned revenue as of October 31st is $3,000 16. Interest is payable on the first of each month. 17. The balance in the prepaid insurance account was $1,000. Required 18. Prepare ledgers accounts and enter the September balances in each account. (open new ledgers as appropriate) 19. Journalize the October transactions. 20. Post the October transactions to the appropriate ledger accounts 21. Prepare a trial balance as of October 31st, 20XX and enter it into a 10 column Worksheet. (see format on next page) 22. Journalize the adjusting entries and enter them into adjustment columns in the worksheet. 23. Show the adjusted trial Balance in the worksheet. 24. Show the income statement accounts and the balance sheet account in the worksheet. 25. Prepare and post closing entries. 26. Prepare a post-closing trial balance for October 31st 20XX. 27. Prepare (in good form) the income statement, statement of owner's equity and a classified balance sheet. Account Unadjusted Trial balance. Dr CR Adjustments Dr CR Adjusted Trial balance Dr Cr Income Statement DR CR Balance Sheet DR CR

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Sure I can help you with these accounting tasks Lets start by pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started