Question

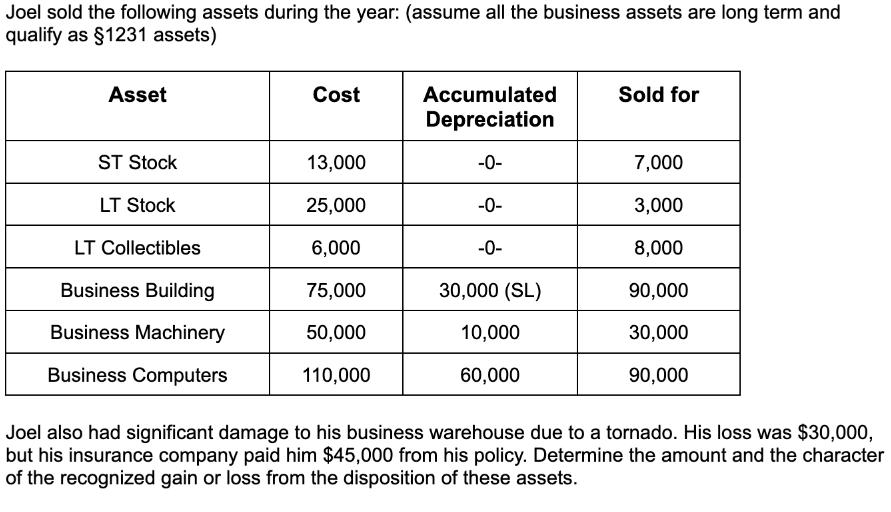

Joel sold the following assets during the year: (assume all the business assets are long term and qualify as 1231 assets) Asset ST Stock

Joel sold the following assets during the year: (assume all the business assets are long term and qualify as 1231 assets) Asset ST Stock LT Stock LT Collectibles Business Building Business Machinery Business Computers Cost 13,000 25,000 6,000 75,000 50,000 110,000 Accumulated Depreciation -0- -0- -0- 30,000 (SL) 10,000 60,000 Sold for 7,000 3,000 8,000 90,000 30,000 90,000 Joel also had significant damage to his business warehouse due to a tornado. His loss was $30,000, but his insurance company paid him $45,000 from his policy. Determine the amount and the character of the recognized gain or loss from the disposition of these assets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the amount and character of the recognized gain or loss from the disposition of these assets we need to calculate the gain or loss on eac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App