Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joey, age 49 , who is single, is not covered by another qualified retirement plan and earns $140,000 (AGI is $140,000 ) at his job

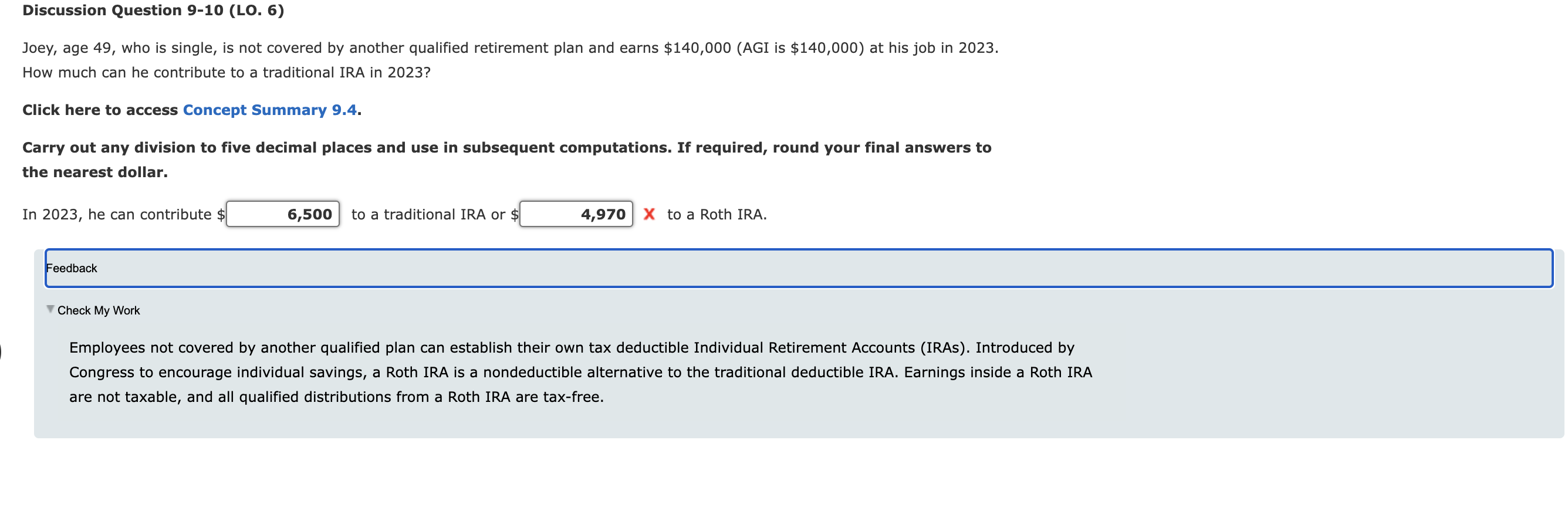

Joey, age 49 , who is single, is not covered by another qualified retirement plan and earns $140,000 (AGI is $140,000 ) at his job in 2023 . How much can he contribute to a traditional IRA in 2023 ? Click here to access Concept Summary 9.4. Carry out any division to five decimal places and use in subsequent computations. If required, round your final answers to the nearest dollar. In 2023 , he can contribute $ to a traditional IRA or $ X to a Roth IRA. Feedback Check My Work Employees not covered by another qualified plan can establish their own tax deductible Individual Retirement Accounts (IRAs). Introduced by Congress to encourage individual savings, a Roth IRA is a nondeductible alternative to the traditional deductible IRA. Earnings inside a Roth IRA are not taxable, and all qualified distributions from a Roth IRA are tax-free

Joey, age 49 , who is single, is not covered by another qualified retirement plan and earns $140,000 (AGI is $140,000 ) at his job in 2023 . How much can he contribute to a traditional IRA in 2023 ? Click here to access Concept Summary 9.4. Carry out any division to five decimal places and use in subsequent computations. If required, round your final answers to the nearest dollar. In 2023 , he can contribute $ to a traditional IRA or $ X to a Roth IRA. Feedback Check My Work Employees not covered by another qualified plan can establish their own tax deductible Individual Retirement Accounts (IRAs). Introduced by Congress to encourage individual savings, a Roth IRA is a nondeductible alternative to the traditional deductible IRA. Earnings inside a Roth IRA are not taxable, and all qualified distributions from a Roth IRA are tax-free Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started