Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John and Jane met on January 1, 1988. They were married on January 15, 1990. They live in Miami, FL. On March 1, 1990,

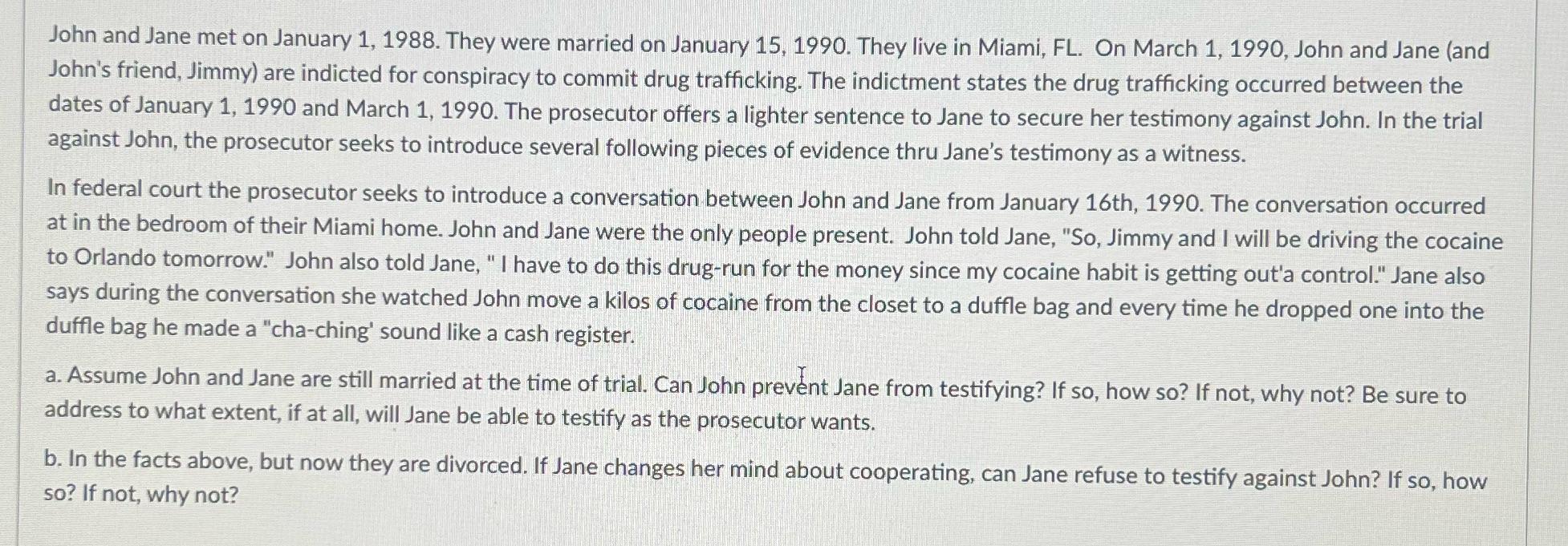

John and Jane met on January 1, 1988. They were married on January 15, 1990. They live in Miami, FL. On March 1, 1990, John and Jane (and John's friend, Jimmy) are indicted for conspiracy to commit drug trafficking. The indictment states the drug trafficking occurred between the dates of January 1, 1990 and March 1, 1990. The prosecutor offers a lighter sentence to Jane to secure her testimony against John. In the trial against John, the prosecutor seeks to introduce several following pieces of evidence thru Jane's testimony as a witness. In federal court the prosecutor seeks to introduce a conversation between John and Jane from January 16th, 1990. The conversation occurred at in the bedroom of their Miami home. John and Jane were the only people present. John told Jane, "So, Jimmy and I will be driving the cocaine to Orlando tomorrow." John also told Jane, "I have to do this drug-run for the money since my cocaine habit is getting out'a control." Jane also says during the conversation she watched John move a kilos of cocaine from the closet to a duffle bag and every time he dropped one into the duffle bag he made a "cha-ching' sound like a cash register. a. Assume John and Jane are still married at the time of trial. Can John prevent Jane from testifying? If so, how so? If not, why not? Be sure to address to what extent, if at all, will Jane be able to testify as the prosecutor wants. b. In the facts above, but now they are divorced. If Jane changes her mind about cooperating, can Jane refuse to testify against John? If so, how so? If not, why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Spousal privilege generally protects communications between spouses Howev...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started