Answered step by step

Verified Expert Solution

Question

1 Approved Answer

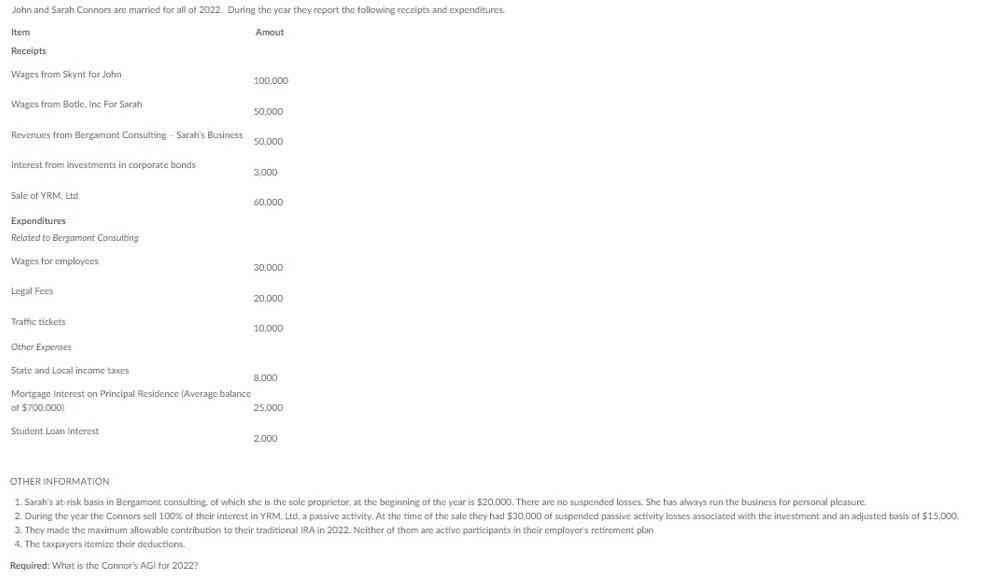

John and Sarah Connors are married for all of 2022. During the year they report the following receipts and expenditures. Amout Item Receipts Wages

John and Sarah Connors are married for all of 2022. During the year they report the following receipts and expenditures. Amout Item Receipts Wages from Skynt for John Wages from Botle, Inc For Sarah Revenues from Bergamont Consulting - Sarah's Business Interest from investments in corporate bonds Sale of YRM, Ltd. Expenditures Related to Bergamont Consulting Wages for employees Legal Fees Traffic tickets Other Expenses State and Local income taxes Mortgage Interest on Principal Residence (Average balance of $700,000) Student Loan Interest 100,000 50,000 50,000 3.000 60,000 30,000 20,000 10,000 8.000 25,000 2,000 OTHER INFORMATION 1. Sarah's at-risk basis in Bergamont consulting, of which she is the sole proprietor, at the beginning of the year is $20,000. There are no suspended losses. She has always run the business for personal pleasure. 2. During the year the Connors sell 100% of their interest in YRM, Ltd, a passive activity. At the time of the sale they had $30,000 of suspended passive activity losses associated with the investment and an adjusted basis of $15,000. 3. They made the maximum allowable contribution to their traditional IRA in 2022. Neither of them are active participants in their employer's retirement plant 4. The taxpayers itemize their deductions. Required: What is the Connor's AGI for 2022?

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Solution Computation of Adjusted Gross income for 2020 Particulars Realised Incomes wages B...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started