Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John Boy Walton purchased land in 2 0 2 3 and is building two new homes. He is interested in claiming Section 4 5 L

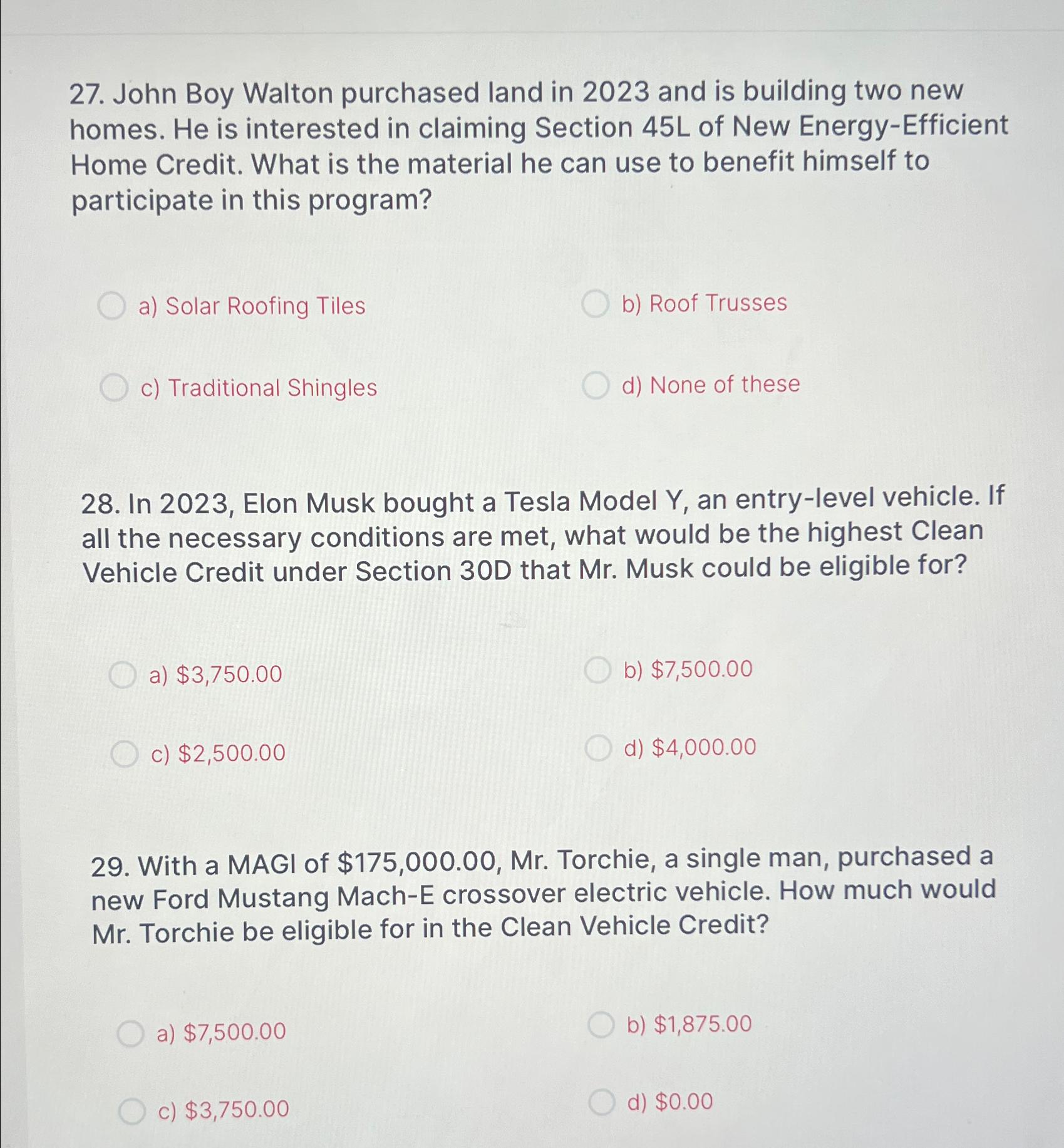

John Boy Walton purchased land in and is building two new homes. He is interested in claiming Section L of New EnergyEfficient Home Credit. What is the material he can use to benefit himself to participate in this program?

a Solar Roofing Tiles

b Roof Trusses

c Traditional Shingles

d None of these

In Elon Musk bought a Tesla Model an entrylevel vehicle. If all the necessary conditions are met, what would be the highest Clean Vehicle Credit under Section D that Mr Musk could be eligible for?

a $

b $

c $

d $

With a MAGI of $ Mr Torchie, a single man, purchased a new Ford Mustang MachE crossover electric vehicle. How much would Mr Torchie be eligible for in the Clean Vehicle Credit?

a $

b $

c $

d $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started