Question

John has created an incredibly successful wine operation in the Northeast.He has vineyard lands along the Seneca and Cayuga wine trails in the Finger Lakes

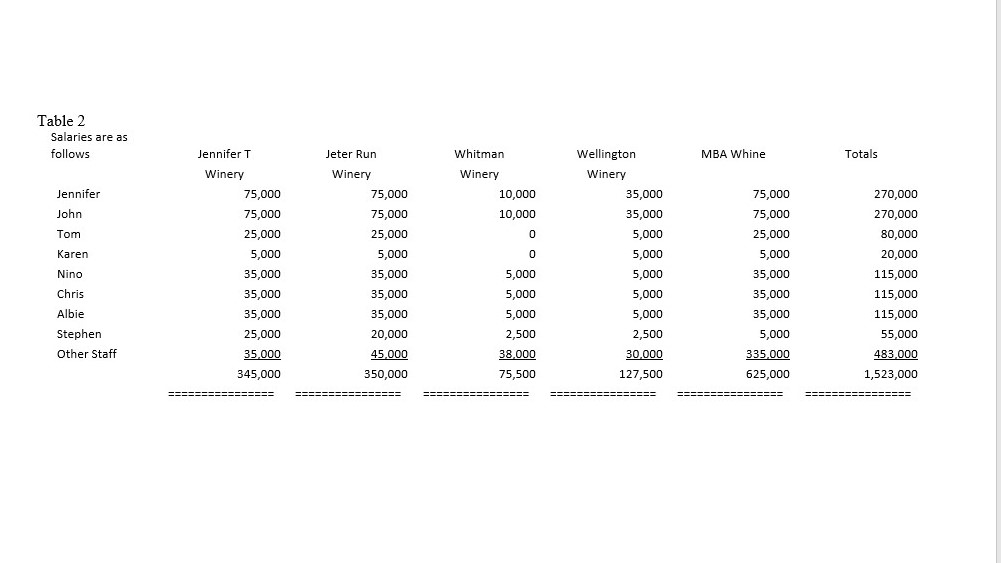

John has created an incredibly successful wine operation in the Northeast.He has vineyard lands along the Seneca and Cayuga wine trails in the Finger Lakes of New York.Many of his wineries are considered some of the best on the East Coast, and one of them, "Jennifer T" was recently named winery of the year by Wine Spectator magazine.In all, there are 5 different wineries operations each in a different corporation.All 5 are in a separate S-Corporation with all the stock owned by the parent Company Petosa Vineyards Inc, also an S-Corporation.John and his wife Jennifer own 75% of the stock of the parent Company which means they own 75% of all of the value of the entities.Jennifer and John are each other's second marriage.John has three children from his prior marriage and Jennifer has 2 children from her previous marriage.John and Jennifer's family have been an important part of the Company's growth.John's brother, Tom became a partner in the business providing much needed capital when the wineries were in a growth stage.Tom owns 20% of the remaining stock and he has 2 children who work at the winery on weekends doing wine tasting, but have other jobs during the week.Jennifer's sister Karen owns the remaining 5% of the outstanding shares.Karen has 3 children, none of which are involved in the wine operations.However, Karen has one son, Stephen, who has an engineering degree from Georgia Tech and has been helpful in development of the winery's bio-dynamic farming operations.Stephen has expressed an interest in becoming a bigger part of the overall operations as he enjoys the laid back lifestyle the winery offers.Jennifer has been the driving force behind the winery's commitment to bio-dynamic, organic farming.She has been in charge of the vineyard operations and overall marketing.Jennifer's two sons have also been very involved in the winery operations.Albert received his degree from Syracuse University in Economics and Entrepreneurship.After a few summers working as a landscaper, he learned that he loved to work the land and has been the one to implement his mother's organic farming techniques at the various vineyards.Nino graduated from Syracuse University with a degree in information studies.He has been in charge of the information systems for the wineries.He has also been responsible for the social media and other electronic marketing methods that have catapulted the growth in the company's exports to other states and overseas markets.Only Christopher, of John's three children has been involved in the wineries.Chris, a graduate of SU's Whitman School of Management with a degree in accounting and the Syracuse College of Law, has been the CFO of the Company and the lead wine maker following in his father's footsteps.It has been Chris' adept touch and penchant for knowing just when to harvest the grapes that has been crucial to the recent accolades received by various wine rating agencies.Jay and Allyson are John's other two children and although they come and visit the wineries frequently, they are both medical professionals and have never expressed an interest in being a part of the wine business.

Of course, John has been the visionary leader that we have come to expect in a family business leader.He gave up teaching after Chris graduated from undergraduate school to concentrate on the wine business.His combination of accounting and legal knowledge, as well as his many contacts in the business world has been one of the major reasons for the winery's success.His greatest contribution however, is that of winemaker.After much trial and error, he has become one of the best wine makers in the world, owning much of his success to his grandfather's teaching and the assistance of Paul Hobbs, one of the greatest wine makers ever.

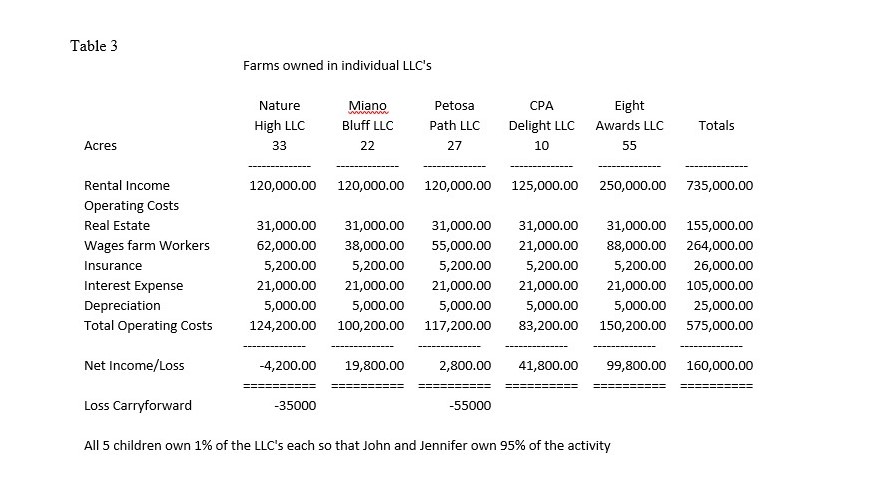

All the land is owned by John and Jennifer in separate LLC's.Each LLC charges the respective S-Corporations rent for the use of the land.The rent charged is usually enough to cover the cost of the real estate taxes, insurance and mortgage on the properties.However, 2 of the LLC's have loss carryforwards since they just started operations and the business end of the winery could not afford a fair market rent.The LLC's elected to be treated as partnerships.Jennifer and John have included their children as minority owners of the LLC's.

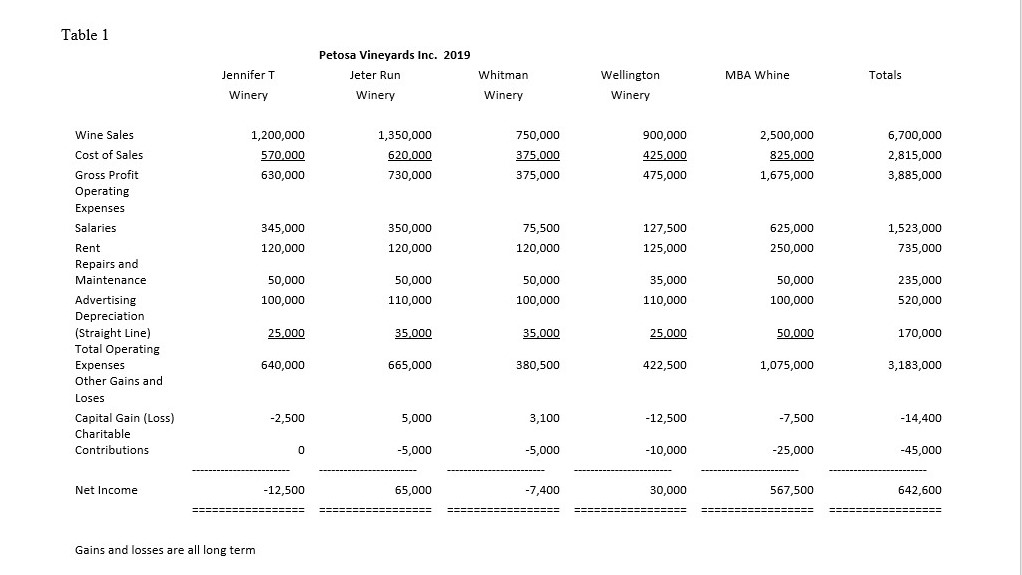

Specific requirements based on the information provided in Tables 1, 2 and 3 compute the following:

- Using the information provided, compute the 2019 tax return for John and Jennifer based on the S corporation and the LLC's activity.Be sure to show line item detail of the 1040 and any supporting schedules.You may use the actual forms but it is not necessary.John and Jennifer use the standard deduction and have no other income items such as interest, dividends etc. outside of the information provided in the tables.

- Compute the overall tax effect if the S corporations were C corporations including the revised individual income tax consequence to John and Jennifer.Comment on the effect.

- Compute the overall tax effect if all the S corporations, and the LLC's are taxed as C corporations including the revised individual income tax consequence to John and Jennifer.Comment on the effect.

- Do you recommend any additional entity revisions to lower John and Jennifer's overall tax consequence in light of the new tax law changes?

- Returning to the original scenario, if John and Jennifer were interested in funding the $4,000,000 expansion of the Tennity Ice Pavilion to include a lacrosse and baseball field to further the Men's club hockey, lacrosse and baseball programs in honor of their three sons who were all the captains of their respective teams while attending Syracuse University how would this potentially impact their current or future tax returns and tax liability?

Assume that John and Jennifer use the standard deduction on their personal return, since they live on the winery property and have no separate mortgage or interest expense. Be sure to take advantage of any credits available using the new tax laws and consider all sales from the winery business to qualify as domestic production activity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started