Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John incurred a number of expenses in relation to his legal practice and investment property for the current tax year ended 30 June: He

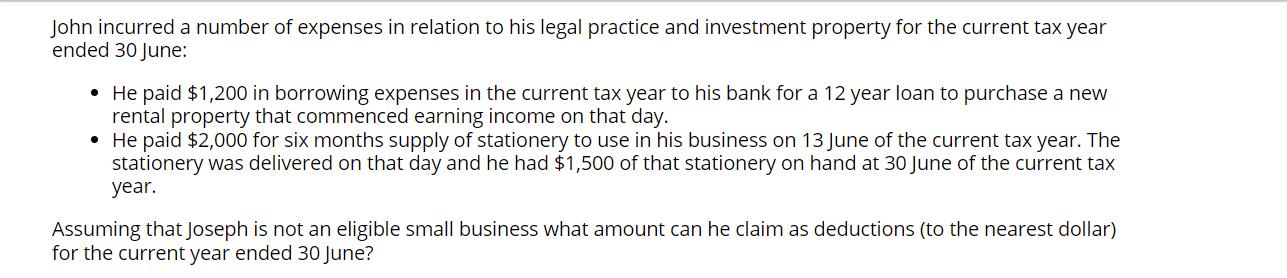

John incurred a number of expenses in relation to his legal practice and investment property for the current tax year ended 30 June: He paid $1,200 in borrowing expenses in the current tax year to his bank for a 12 year loan to purchase a new rental property that commenced earning income on that day. He paid $2,000 for six months supply of stationery to use in his business on 13 June of the current tax year. The stationery was delivered on that day and he had $1,500 of that stationery on hand at 30 June of the current tax year. Assuming that Joseph is not an eligible small business what amount can he claim as deductions (to the nearest dollar) for the current year ended 30 June?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the deductible expenses for Johns legal practice and investment property for the curren...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started