Question

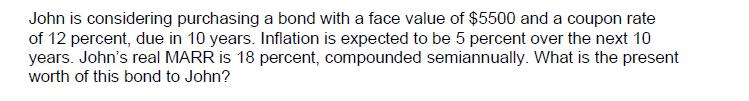

John is considering purchasing a bond with a face value of $5500 and a coupon rate of 12 percent, due in 10 years. Inflation

John is considering purchasing a bond with a face value of $5500 and a coupon rate of 12 percent, due in 10 years. Inflation is expected to be 5 percent over the next 10 years. John's real MARR is 18 percent, compounded semiannually. What is the present worth of this bond to John?

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To find the present worth of the bond to John we need to consider the effect of inflation and discount the future cash flows at Johns real MA...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Finance

Authors: Thomas Garman, Raymond Forgue

12th edition

9781305176409, 1133595839, 1305176405, 978-1133595830

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App