Answered step by step

Verified Expert Solution

Question

1 Approved Answer

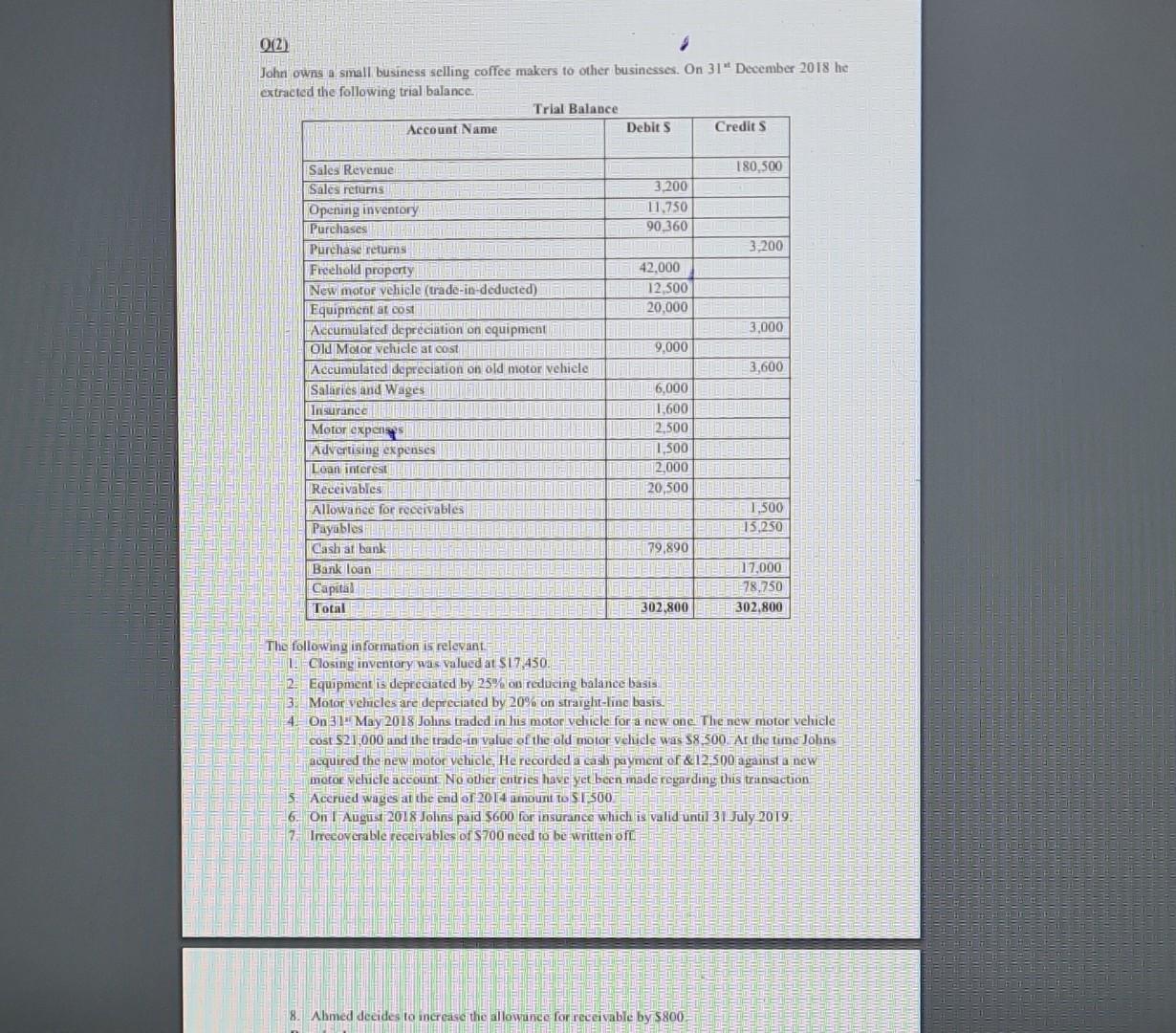

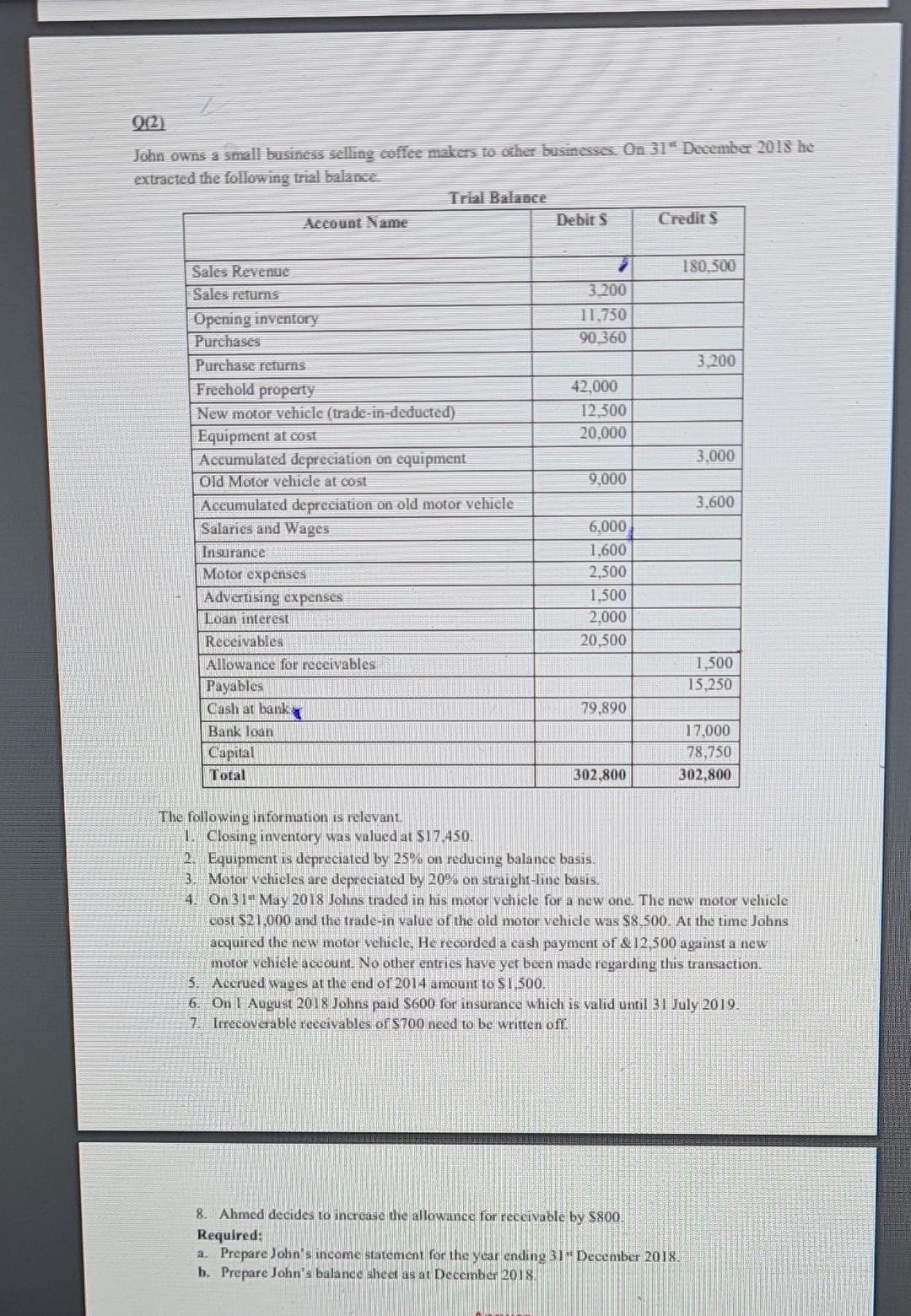

John owns a sinall business selling coffee makers to other businesses. On 31nt December 2018 he extracted the following trial balance: The following in formation

John owns a sinall business selling coffee makers to other businesses. On 31nt December 2018 he extracted the following trial balance: The following in formation is relevant 1. Closing inventary was valued at $17,450 2. Equipment is depreciated by 25% on reducing balance basis 3. Motor vehicles are depreciated by 20%6 on strarght-fine basis. 4. Dn 314 May 2018 Johins traded in lis motor vchicle for a new one. The new motor vehicle cost \$21,000 and the trade-in valueiof the old motor Velicic was 58,500 . Ar the time Johns acquired thenew motor vehicle, He recorded a castr payment of \&12,500 against a new motor velucle account No other critries have yet been made regarding this trunsaction 5. Acerued wages at the end of 20 l4 amount to Sl.500 6. On I Augus 2018 Johns paid 5600 for insurance which is valid until 31July 2019: 7. Irreeoverable receivables of $700 nced to be written oft 8. Ahmed decides to increase the allowunce for receivable by 5800 . John owns a small business selling coffee makers to aher businesses. On 31 de December 2018 he extracted the following trial balance. The following information is relevant. 1. Closing inventory was valued at $17,450. 2. Equipment is depreciated by 25% on reducing balance basis. 3. Motor vehicles are depreciated by 20% on straight-line basis. 4. On 31mMay2018 Johns traded in his motor vchicle for a new one. The new motor velicle cost $21,000 and the trade-in value of the old motor vehicle was $8,500. At the time Johns acquired the new motor vehicle, He recorded a cash payment of \&12,500 against a new motor vehiele aceount. No other entrics have yet been made regarding this transaction. 5. Acerued wages at the end of 2014 amount to $1,500. 6. On L August 2018 Johns paid $600 for insurance which is valid until 31 July 2019. 7. Irrecoverable receivables of $700 need to be written off. 8. Ahmed decides to incrcase the allowance for reccivable by $800. Required: a. Prepare John's income statement for the year ending 31 " December 2018 . b. Prepare John's balance sheet as at December 2018. John owns a sinall business selling coffee makers to other businesses. On 31nt December 2018 he extracted the following trial balance: The following in formation is relevant 1. Closing inventary was valued at $17,450 2. Equipment is depreciated by 25% on reducing balance basis 3. Motor vehicles are depreciated by 20%6 on strarght-fine basis. 4. Dn 314 May 2018 Johins traded in lis motor vchicle for a new one. The new motor vehicle cost \$21,000 and the trade-in valueiof the old motor Velicic was 58,500 . Ar the time Johns acquired thenew motor vehicle, He recorded a castr payment of \&12,500 against a new motor velucle account No other critries have yet been made regarding this trunsaction 5. Acerued wages at the end of 20 l4 amount to Sl.500 6. On I Augus 2018 Johns paid 5600 for insurance which is valid until 31July 2019: 7. Irreeoverable receivables of $700 nced to be written oft 8. Ahmed decides to increase the allowunce for receivable by 5800 . John owns a small business selling coffee makers to aher businesses. On 31 de December 2018 he extracted the following trial balance. The following information is relevant. 1. Closing inventory was valued at $17,450. 2. Equipment is depreciated by 25% on reducing balance basis. 3. Motor vehicles are depreciated by 20% on straight-line basis. 4. On 31mMay2018 Johns traded in his motor vchicle for a new one. The new motor velicle cost $21,000 and the trade-in value of the old motor vehicle was $8,500. At the time Johns acquired the new motor vehicle, He recorded a cash payment of \&12,500 against a new motor vehiele aceount. No other entrics have yet been made regarding this transaction. 5. Acerued wages at the end of 2014 amount to $1,500. 6. On L August 2018 Johns paid $600 for insurance which is valid until 31 July 2019. 7. Irrecoverable receivables of $700 need to be written off. 8. Ahmed decides to incrcase the allowance for reccivable by $800. Required: a. Prepare John's income statement for the year ending 31 " December 2018 . b. Prepare John's balance sheet as at December 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started