Question

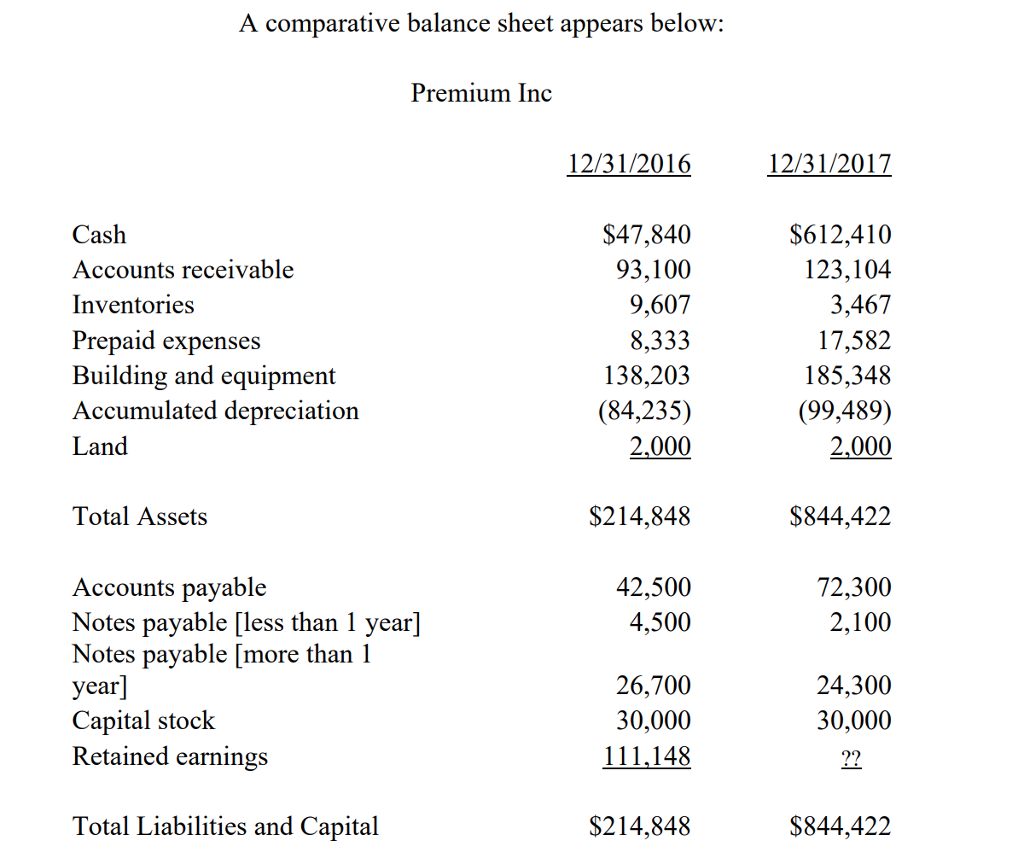

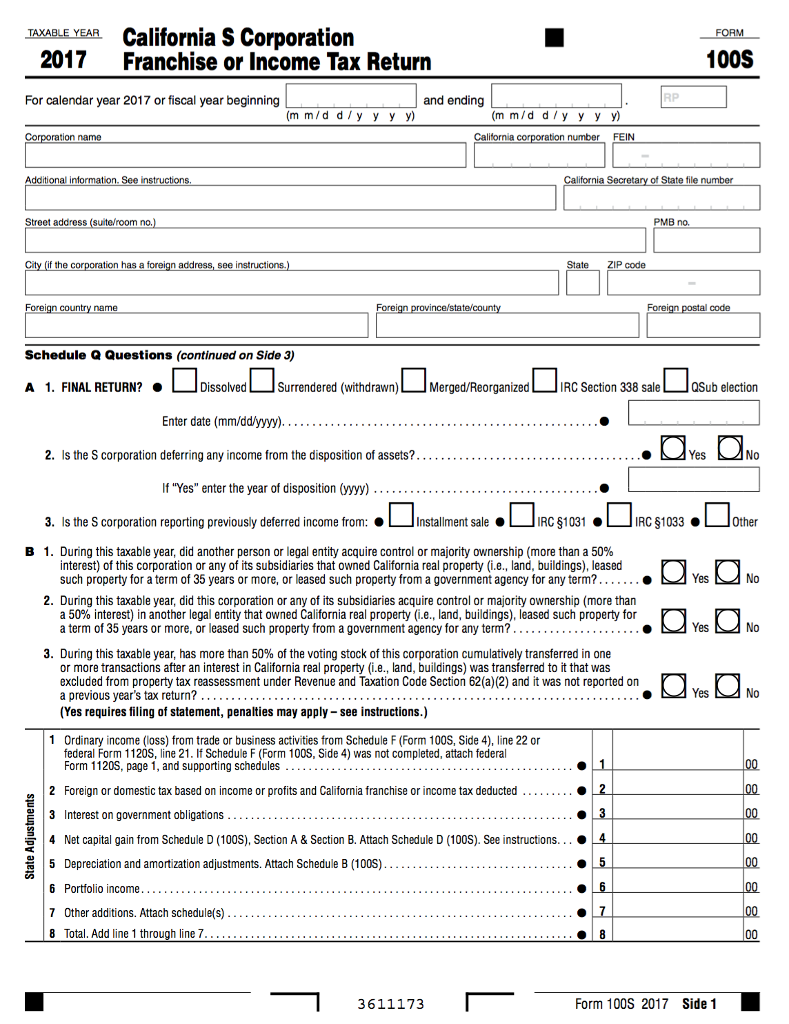

John Parsons [123-45-6781] and George Smith [123-45-6782] 70% and 30% owners, respectively, of Premium Inc. [11-111111] a candy company located at 1005 16th Street, San

John Parsons [123-45-6781] and George Smith [123-45-6782] 70% and 30% owners, respectively, of Premium Inc. [11-111111] a candy company located at 1005 16th Street, San Diego, CA 92101, Premiums S election was made on January 15, 2009, its date of incorporation. The following information was taken from the companys 2016 income statement. Premium Inc 2017

Income Statement Items

Interest income 100,000

Gross receipts 2,410,000

Beginning inventory 9,607

Direct labor (203,102)

Direct materials purchased (278,143)

Direct other costs (249,356)

Ending inventory 3,467

Salaries and wages (442,103)

Officers salaries [$75,000 each] (150,000)

Repairs (206,106)

Depreciation expenses, tax and book (15,254)

Interest expense (35,222)

Rent expense (40,000) Taxes (65,101)

Charitable contributions (20,000)

Advertising expenses (20,000)

Payroll penalties (15,000)

Other deductions (59,899)

Book income 704,574

Premium provides the following additional information

Distributions to shareholders $100,000

Beginning balance, Accumulated adjustments account $111,148

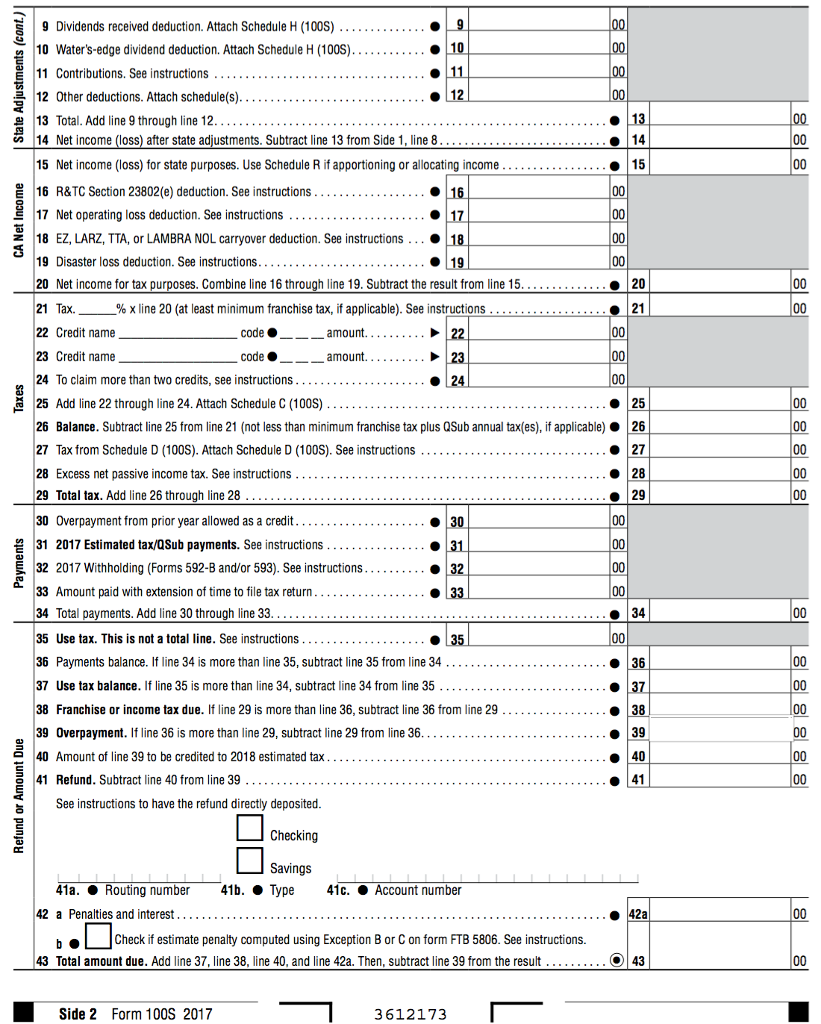

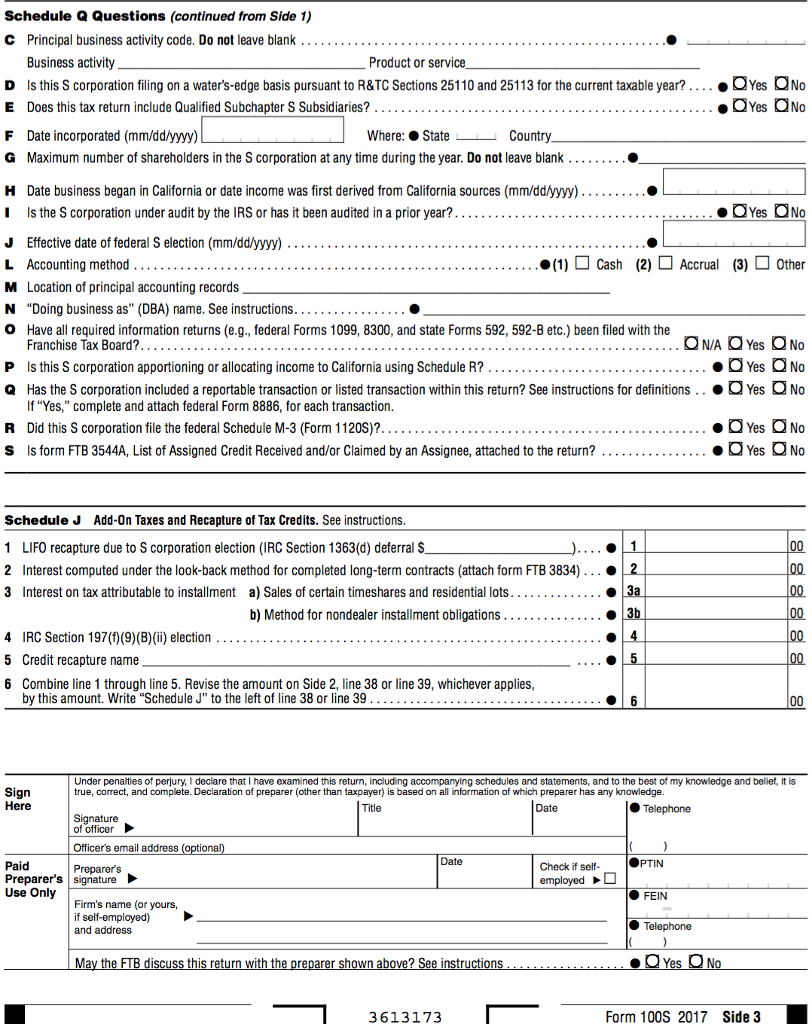

Using the preceding information prepare a complete Form 1120S and Schedule K-1s for John Parsons 5607 20th Street, San Diego, CA 92101 and George Smith 8714 Grand Avenue, San Diego, CA 92102. You do not need to complete the Form 4562. If any information is missing make realistic assumptions.

Using the preceding information prepare a complete Form 1120S and Schedule K-1s for John Parsons 5607 20th Street, San Diego, CA 92101 and George Smith 8714 Grand Avenue, San Diego, CA 92102. You do not need to complete the Form 4562. If any information is missing make realistic assumptions.

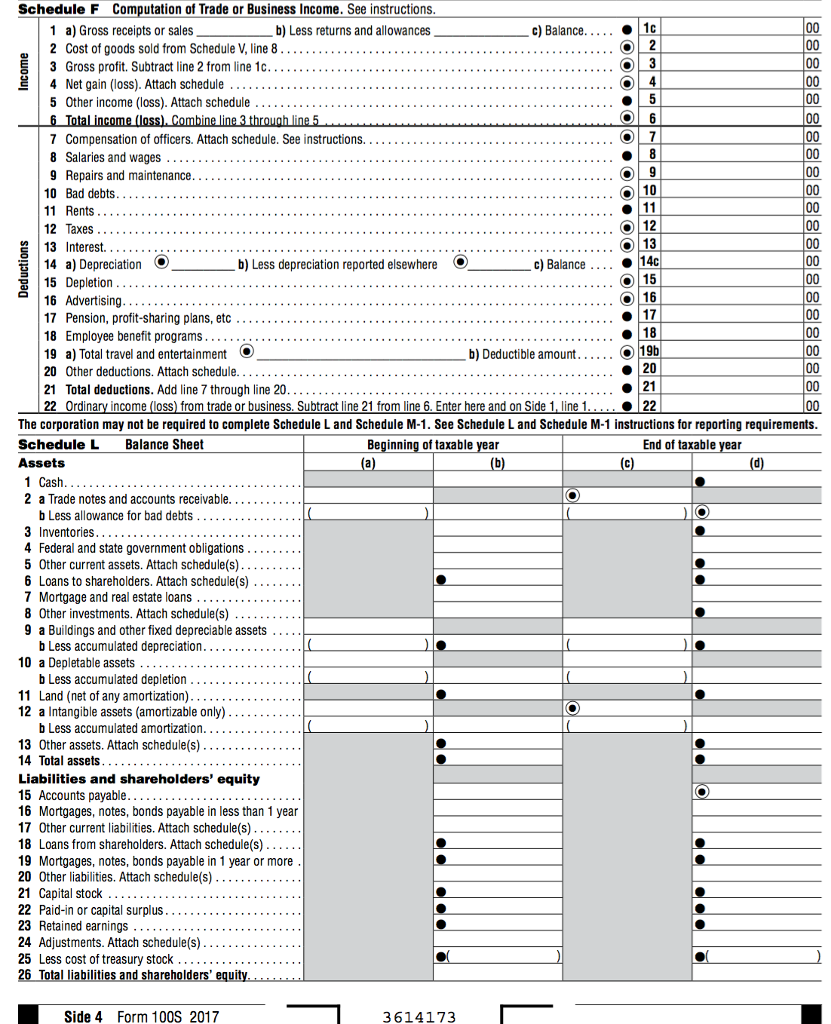

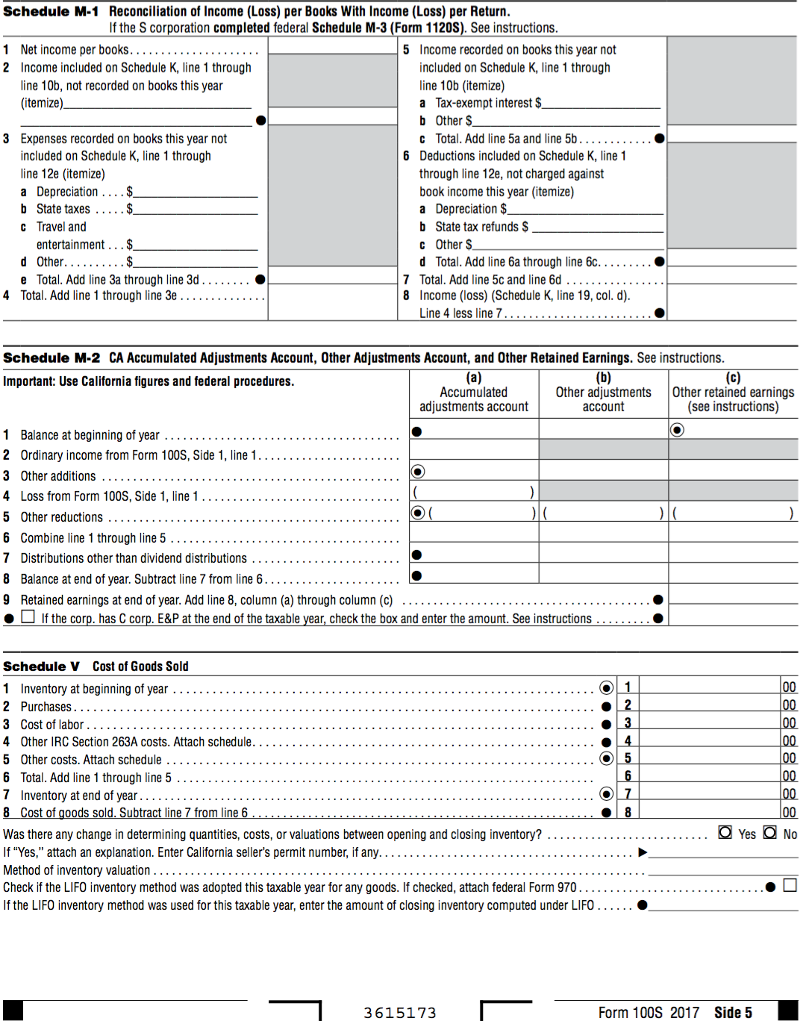

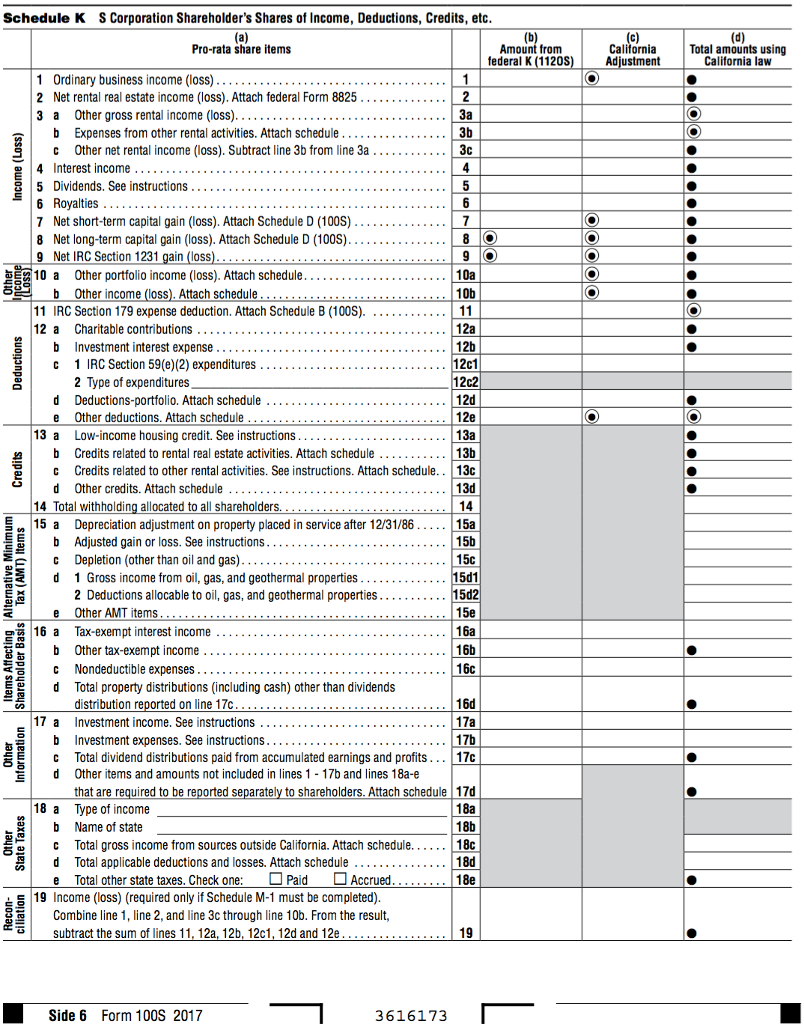

Can you please help me fill out the California 100s !

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started