Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John Taylor, CFO and management accountant at CiM Corporation, is confident in the company's financial position after four years of strategic focus. The company's steady

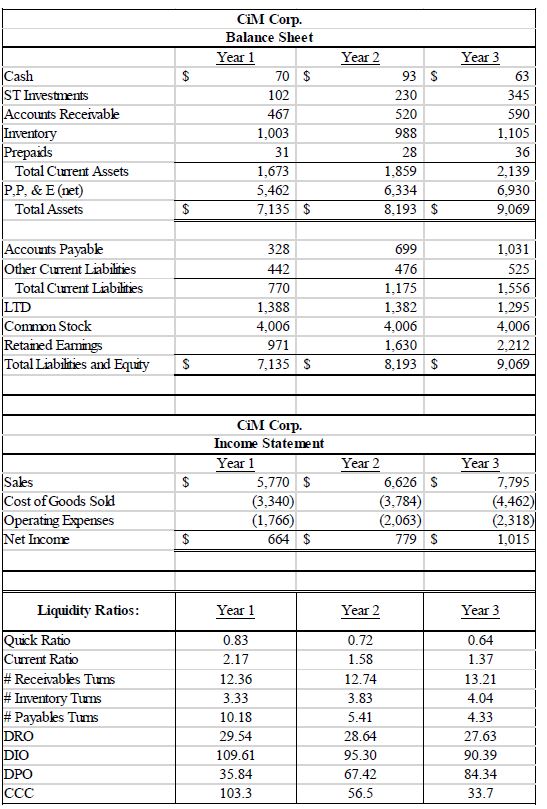

John Taylor, CFO and management accountant at CiM Corporation, is confident in the company's financial position after four years of strategic focus. The company's steady growth in sales and profitability is attributed to its liquidity. Taylor's first directive was to improve turnover for customer receivables and inventory.

CiM, a company, is facing cash flow issues and urgent payment needs due to its new vendor payment policy, which has significantly reduced cash flow and net working capital. The company has set a goal for days payables outstanding to be days, days longer than the current measure. CiM hired DJX Financial to offer working capital financing, but the policy was implemented without discussion, leading to staff outrage, supply chain issues, and two colleagues quitting due to stress and a negative work environment. The policy has a ripple effect, affecting local business owners and generating negative customer feedback.

The case revolves around John Taylor's aggressive cash management policies, focusing on optimizing turnover for customer receivables and inventory, and implementing a vendor payment deferral policy, have led to negative consequences, including affecting vendor relationships, causing employee stress, and generating negative customer feedback, despite his strategic focus on improving company liquidity. Questions: Analyses trends revenue, cost of goods sold, operating expenses and net income over the past few years.

Evaluate changes in current assets and liabilities to understand the effect of the new vendor payment policy on cash flow and working capital.

Analyze inventory levels to assess whether John focus on optimizing inventory turnover has led to stockouts or supply chain issues.

Review accounts payable and receivable to confirm the current days payables outstanding and to see the effect of the new vendor payment policy

Calculate the potential financial impact of the extended payment terms on vendor discounts lost, late payment penalties and potential damage to vendor relationships.

Calculate profitability

What Matrix to be used for Evaluation of Alternative Courses of Action

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started