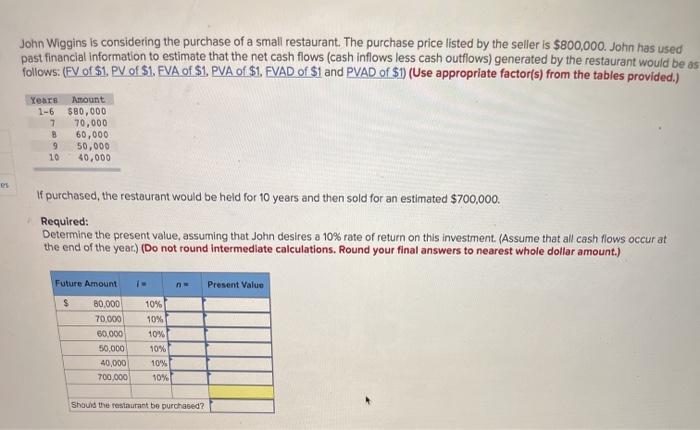

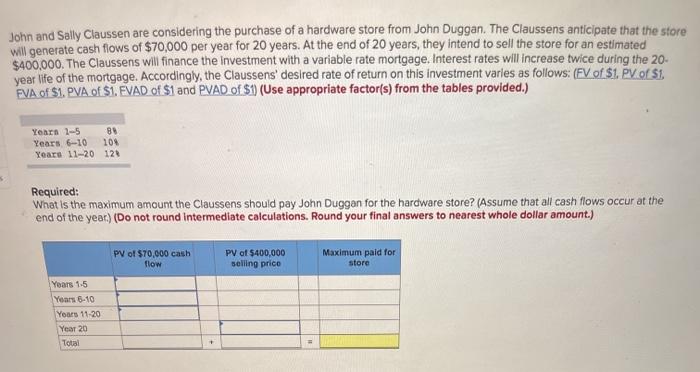

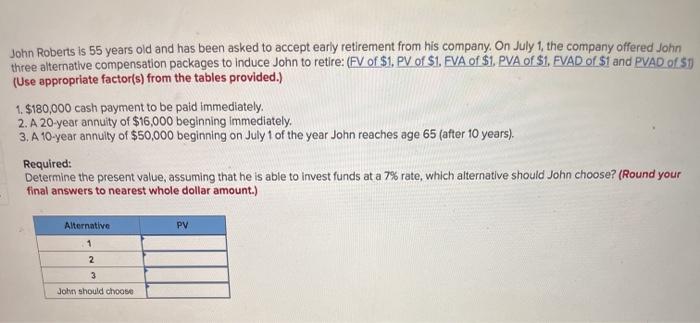

John Wiggins is considering the purchase of a small restaurant. The purchase price listed by the seller is $800,000. John has used past financial information to estimate that the net cash flows (cash inflows less cash outflows) generated by the restaurant would be as follows: (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1 (Use appropriate factor(s) from the tables provided.) Years 1-6 7 8 9 10 Amount $80,000 70,000 60,000 50,000 40,000 If purchased, the restaurant would be held for 10 years and then sold for an estimated $700,000. Required: Determine the present value, assuming that John desires a 10% rate of return on this investment. (Assume that all cash flows occur at the end of the year) (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) Future Amount Present Value $ 80.000 70.000 60,000 50.000 40.000 700,000 10% 10% 10% 10% 10% 10% Should the restaurant be purchased? John and Selly Claussen are considering the purchase of a hardware store from John Duggan. The Claussens anticipate that the store will generate cash flows of $70,000 per year for 20 years. At the end of 20 years, they intend to sell the store for an estimated $400,000. The Claussens will finance the investment with a variable rate mortgage. Interest rates will increase twice during the 20- year life of the mortgage. Accordingly, the Claussens' desired rate of return on this investment varies as follows: (FV of $1. PV of si PVA of $1. PVA of $1. EVAD of $1 and PVAD of $1 (Use appropriate factor(s) from the tables provided.) Yearn 1-5 89 Years 6-10 100 Years 11-2012 Required: What is the maximum amount the Claussens should pay John Duggan for the hardware store? (Assume that all cash flows occur at the end of the year) (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) PV of $70,000 cash flow PV of $400,000 selling price Maximum paid for store Years 1.5 Years 6-10 Yours 11-20 Year 20 Total John Roberts is 55 years old and has been asked to accept early retirement from his company. On July 1, the company offered John three alternative compensation packages to induce John to retire: (FV of $1. PV of $1. EVA of $1. PVA of $1. FVAD of $1 and PVAD of 51 (Use appropriate factor(s) from the tables provided.) 1. $180,000 cash payment to be paid immediately. 2. A 20 year annulty of $16,000 beginning immediately 3. A 10-year annuity of $50,000 beginning on July 1 of the year John reaches age 65 (after 10 years). Required: Determine the present value, assuming that he is able to invest funds at a 7% rate, which alternative should John choose? (Round your final answers to nearest whole dollar amount.) Alternative PV 1 2 3 Johny should choose