Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Johnny has $400,000 to invest and is considering the merits of two stocks: HCBC & SBB. The two stocks have the following possible expected

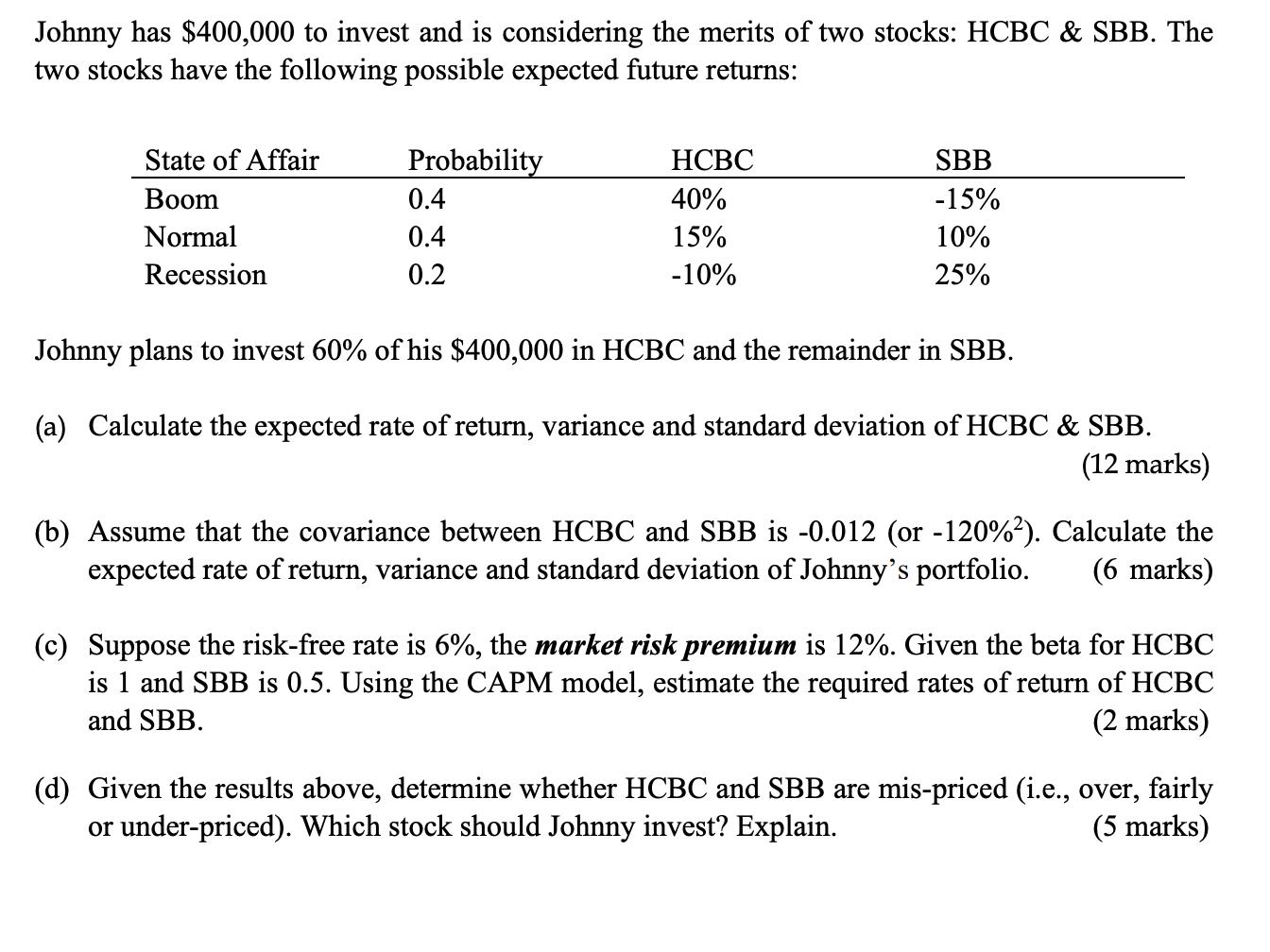

Johnny has $400,000 to invest and is considering the merits of two stocks: HCBC & SBB. The two stocks have the following possible expected future returns: State of Affair Boom Probability 0.4 Normal 0.4 Recession 0.2 HCBC 40% 15% -10% SBB -15% 10% 25% Johnny plans to invest 60% of his $400,000 in HCBC and the remainder in SBB. (a) Calculate the expected rate of return, variance and standard deviation of HCBC & SBB. (12 marks) (b) Assume that the covariance between HCBC and SBB is -0.012 (or -120%). Calculate the expected rate of return, variance and standard deviation of Johnny's portfolio. (6 marks) (c) Suppose the risk-free rate is 6%, the market risk premium is 12%. Given the beta for HCBC is 1 and SBB is 0.5. Using the CAPM model, estimate the required rates of return of HCBC and SBB. (2 marks) (d) Given the results above, determine whether HCBC and SBB are mis-priced (i.e., over, fairly or under-priced). Which stock should Johnny invest? Explain. (5 marks)

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Expected Rate of return HCBC 04 40 04 15 02 10 16 SBB 04 15 04 10 02 25 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started