Question

Johnny ? s Lawn Service Contributed by Sandy Qu PhD , ?CGA Associate Professor, Schulich School of Business, York University, Toronto Johnny Wong, a third

Johnnys Lawn Service Contributed by Sandy Qu PhD ?CGA Associate Professor, Schulich School of Business, York University, Toronto Johnny Wong, a thirdyear university student majoring in international business, started his own parttime business in May X ?providing a grasscutting service in the neighbourhood where he lives with his parents. Before starting this, Johnny had been helping out an elderly neighbour, Jabir, who had broken his leg in an accident. Initially Jabir would treat Johnny to lunch and afternoon tea as a thankyou. After a couple of times, Jabir insisted on paying Johnny for the grasscutting. It was also Jabir who suggested Johnny consider starting a business to help the neighbourhood seniors and those who might be too busy to cut their own lawns. Johnny gave this some serious thought before deciding to go ahead. The neighbourhood has hundreds of large homes with big lawns, so it would provide enough business opportunity. He also thought it would be a great form of outdoor exercise during the summer as well as a decent way to make some money to pay for tuition and help out people. A lawn business would be a diff erent experience since Johnny has usually spent his summer from May to August ?working fulltime five days a week ?in McDonalds for $ ?an hour. Johnny paid $ ?for expenses related to business registration, which is valid for five years. He purchased a used highpower gas lawn mower plus some cleaning tools at a garage sale for $ ?and he was told the lawn mower would last for at least five summers. He borrowed the money interestfree from his parents and promised he would pay it back by the end of the summer. He charges customers $ ?each visit, cutting both the front and back yard, and it typically takes him about an hour and a half to finish the job, plus another ?to ?minutes or so to clean up the clippings and the mower itself. To advertise the business, Johnny posted flyers on central mailbox stations and sometimes knocked on doors and left a flyer if no one was at home. In total, the flyers and printing cost about $ ?In order to attract more regular customers during the summer months in which Johnny was able to work fulltime, he off ered a discounted price of $ ?per month that is ?$ ?per visit ?if the customer signs up for a weekly service for the entire summer from June to August ?This promotion worked very well, since by the end of May he had more than ?customers signed up for the monthly discount. Johnny kept a detailed journal of all his customers, recording their addresses, telephone numbers, the date and time of service, and the payment they have made. The summer of X ?had a lot of rain and the grass grew fast. Johnny was kept busy all summer long and occasionally he would hire his brother Luke to help out. Luke just finished his last year in high school and Johnny agreed to pay him $ ?for every job he did. The total would be paid by the end of the summer. On average, Johnny worked five days a week, with four to six customer visits per day. Most of his time was spent cutting the lawn, with ?of his time spent managing customerand paymentrelated information. For most customers, Johnny would need to drive a short distance usually less than ?minutes ?in his car carrying his lawn mower. This cost him extra gasoline and time. Johnny kept all the receipts for amounts he spent buying gas for the lawn mower as well as for his car. Since gas prices have been at an alltime high, Johnny felt fortunate that he did not have to drive too far to provide services. By the end of August, Johnny still had about $ ?worth of gas left for the lawn mower. By the end of September, Johnny thought it was time to prepare an income statement for the period from May to August to see how well his business had been running Exhibit ?Not shown on the income statement is the fact that he needs to pay back the money he borrowed from his parents.

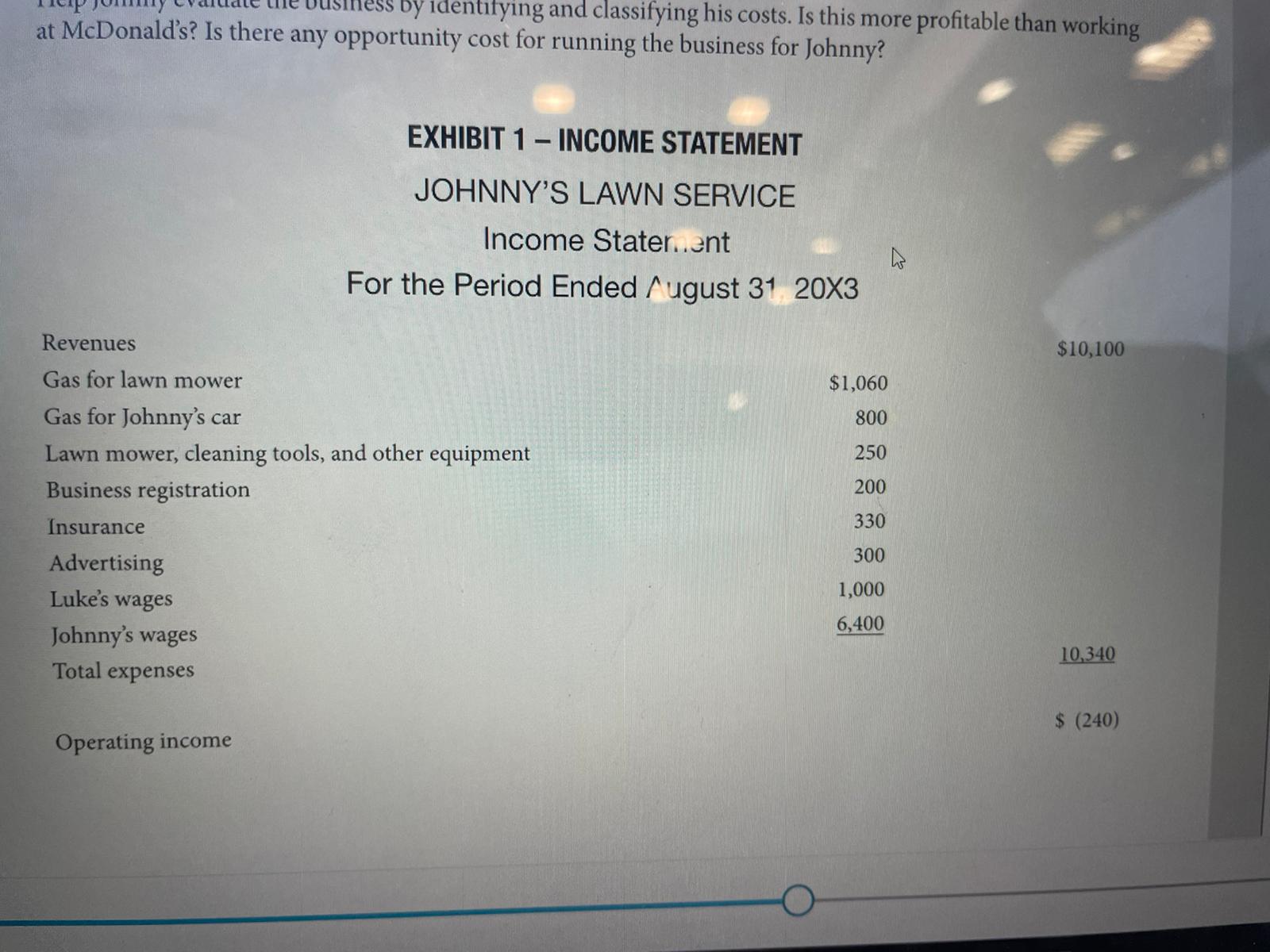

When Johnny started his business, he thought that it would be more profitable than working in McDonalds but he was disappointed to see on the income statement that he was wrong. He was therefore considering whether it was worthwhile to continue the business next summer, despite the fact that quite a number of satisfied neighbours were keen to sign up next year. One factor for Johnny to consider in his decision is that if the business is to be discontinued, the money he spent on the registration, insurance, and equipment would be totally wasted. Required Help Johnny evaluate the business by identifying and classifying his costs. Is this more profitable than working at McDonalds ?Is there any opportunity cost for running the business for Johnny?entifying and classifying his costs. Is this more profitable than working IcDonald's? Is there any opportunity cost for running the business for Johnny?

EXHIBIT ?INCOME STATEMENT JOHNNY'S LAWN SERVICE Income Stater...ent For the Perio

by identifying and classifying his costs. Is this more profitable than working at McDonald's? Is there any opportunity cost for running the business for Johnny? EXHIBIT 1 INCOME STATEMENT - JOHNNY'S LAWN SERVICE Income Stater..ent For the Period Ended August 31 20X3 Revenues Gas for lawn mower Gas for Johnny's car Lawn mower, cleaning tools, and other equipment Business registration Insurance Advertising Luke's wages Johnny's wages Total expenses Operating income $10,100 $1,060 800 250 200 330 300 1,000 6,400 10,340 $ (240)

Step by Step Solution

3.46 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

To evaluate the business and classify Johnnys costs lets examine the information provided Revenues Johnnys lawn service generated 10100 in revenue dur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started