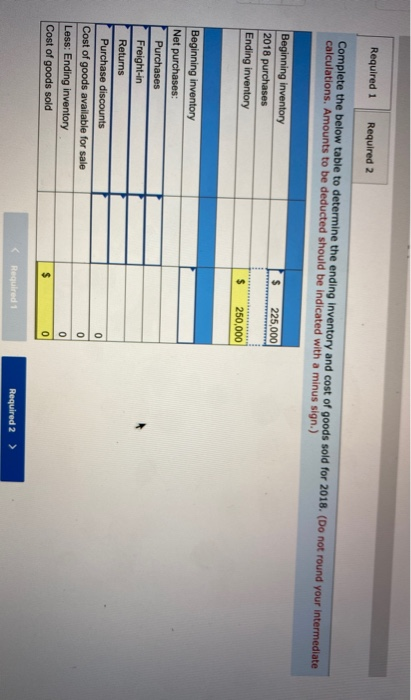

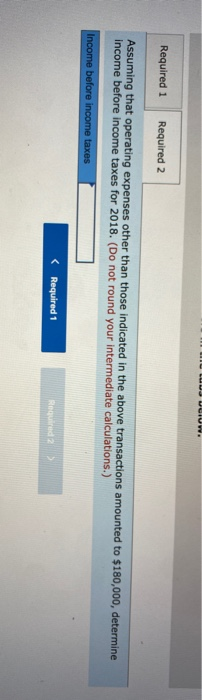

Johnson Corporation began 2018 with inventory of 25,000 units of its only product. The units cost $9 each. The company uses a periodic Inventory system and the LIFO cost method. The following transactions occurred during 2018 a. Purchased 125.000 additional units at a cost of $10 per unit. Terms of the purchases were 3/10, 1/30, and 100% of the purchases were paid for within the 10-day discount period. The company uses the gross method to record purchase discounts. The merchandise was purchased to.b, shipping point and freight charges of $0.60 per unit were paid by Johnson b. 2,500 units purchased during the year were returned to suppliers for credit Johnson was also given credit for the freight charges of $0.60 per unit it had paid on the original purchase. The units were defective and were returned two days after they were received. c. Sales for the year totaled 120,000 units at $16 per unit d. On December 28, 2018, Johnson purchased 6.500 additional units at $11 each. The goods were shipped fo.b. destination and arrived at Johnson's warehouse on January 4, 2019 e. 27,500 units were on hand at the end of 2018 Required: 1. Complete the below table to determine the ending inventory and cost of goods sold for 2018, 2. Assuming that operating expenses other than those indicated in the abbve transactions amounted to $180,000, determine income before income taxes for 2018. Required 1 Required 2 Complete the below table to determine the ending inventory and cost of goods sold for 2018. (Do not round your intermediate calculations. Amounts to be deducted should be indicated with a minus sign.) $ 225,000 Beginning inventory 2018 purchases Ending inventory $ 250,000 Beginning inventory Net purchases: Purchases Freight-in Returns Purchase discounts Cost of goods available for sale Less: Ending inventory Cost of goods sold Heuredi Required 2 > Required 1 Required 2 Assuming that operating expenses other than those indicated in the above transactions amounted to $180,000, determine income before income taxes for 2018. (Do not round your intermediate calculations.) Income before income taxes