Jones Company Edward Jones started the Jones Company Limited (JCL) as a sole proprietorship. It was later incor-- porated; ownership is now 50 percent

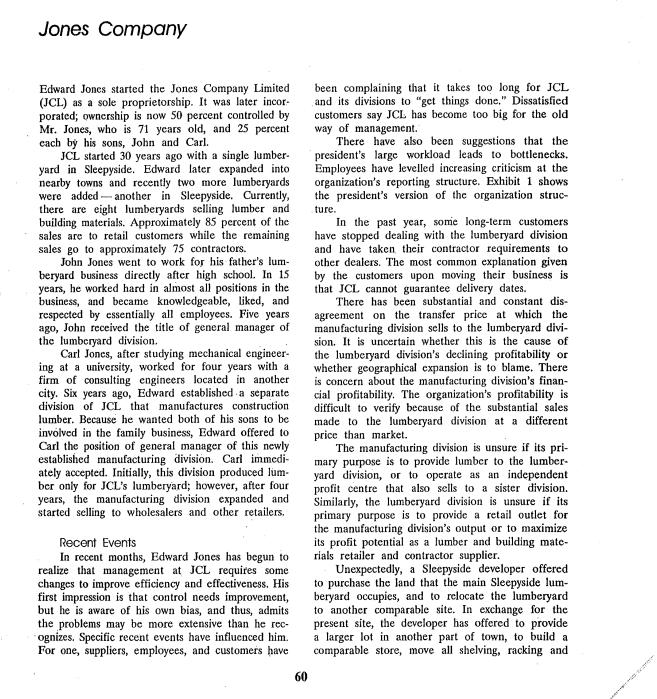

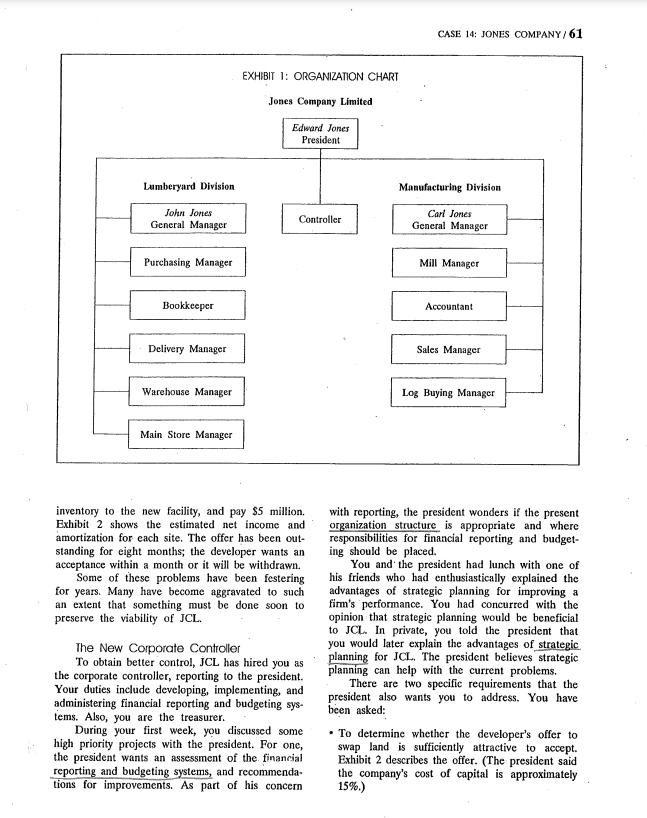

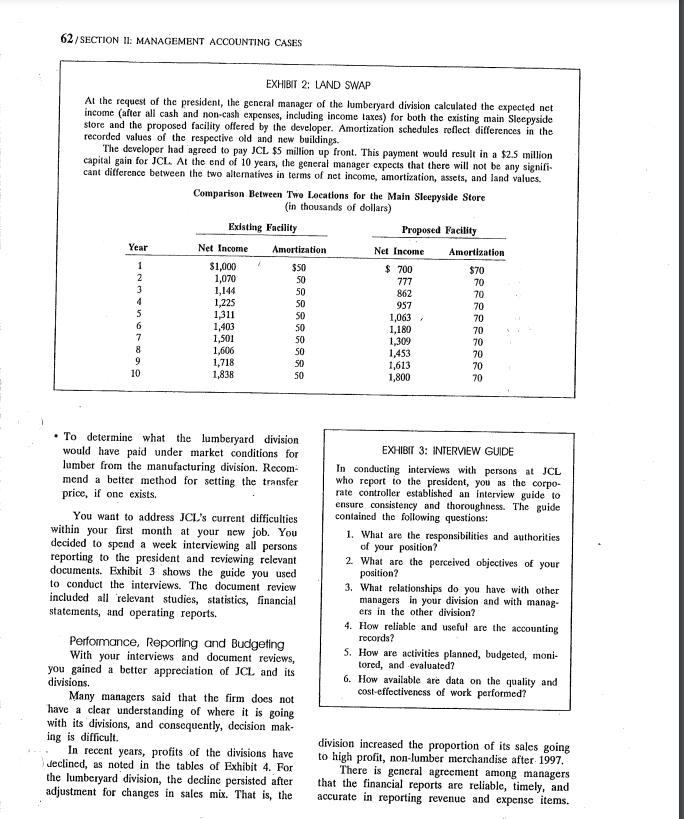

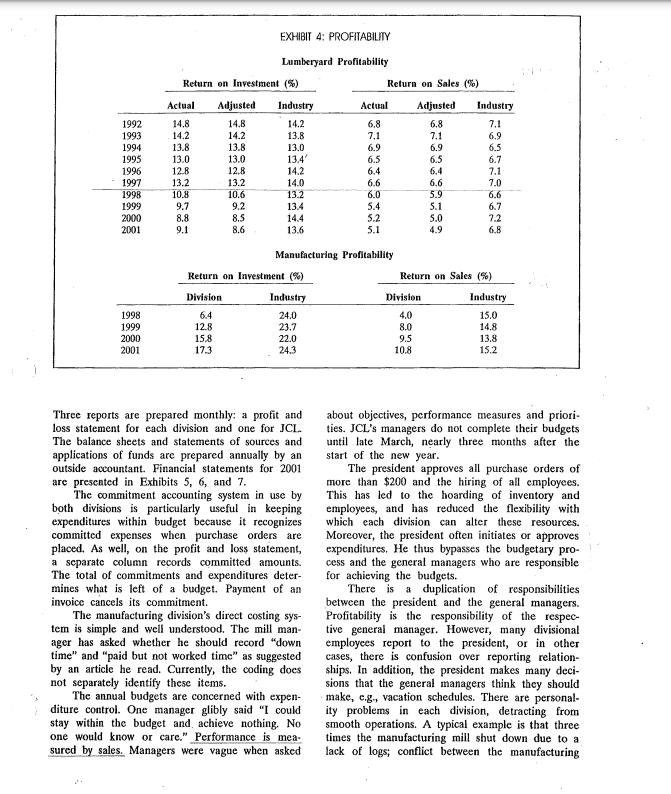

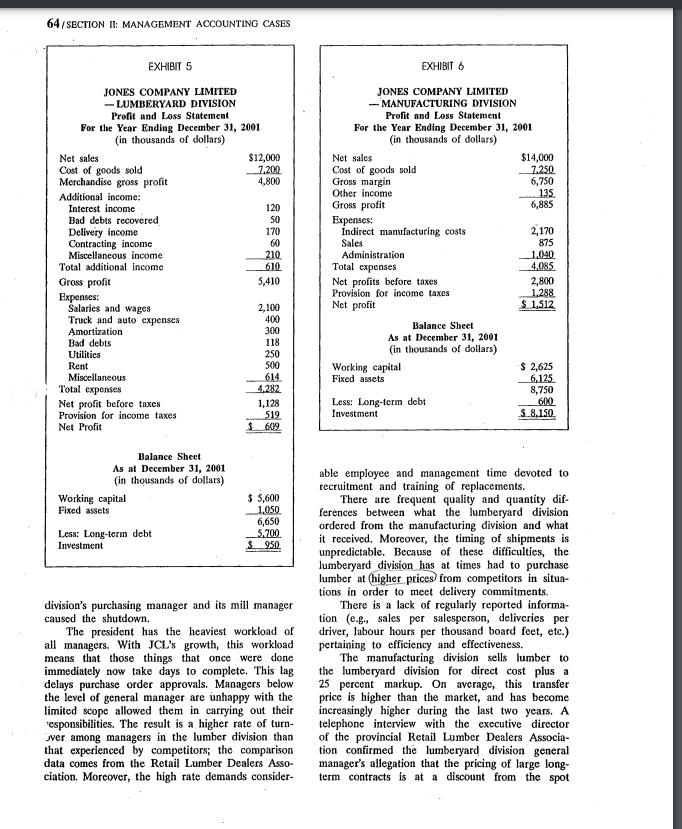

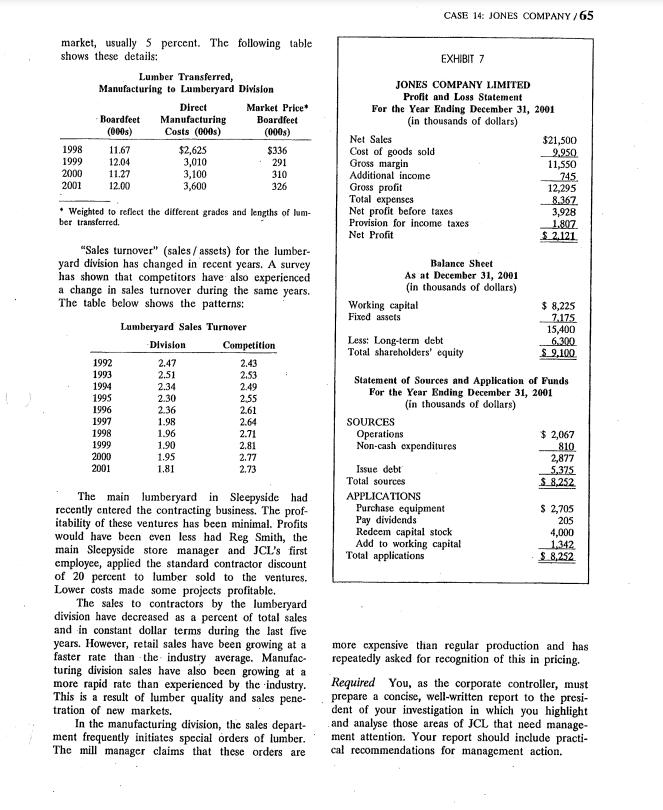

Jones Company Edward Jones started the Jones Company Limited (JCL) as a sole proprietorship. It was later incor-- porated; ownership is now 50 percent controlled by Mr. Jones, who is 71 years old, and 25 percent each by his sons, John and Carl. JCL started 30 years ago with a single lumber- yard in Sleepyside. Edward later expanded into nearby towns and recently two more lumberyards were added another in Sleepyside. Currently, there are eight lumberyards selling lumber and building materials. Approximately 85 percent of the sales are to retail customers while the remaining sales go to approximately 75 contractors. John Jones went to work for his father's lum- beryard business directly after high school. In 15 years, he worked hard in almost all positions in the business, and became knowledgeable, liked, and respected by essentially all employees. Five years. ago, John received the title of general manager of the lumberyard division. Carl Jones, after studying mechanical engineer- ing at a university, worked for four years with a firm of consulting engineers located in another city. Six years ago, Edward established a separate division of JCL that manufactures construction lumber. Because he wanted both of his sons to be involved in the family business, Edward offered to Carl the position of general manager of this newly established manufacturing division. Carl immedi- ately accepted. Initially, this division produced lum- ber only for JCL's lumberyard; however, after four years, the manufacturing division expanded and started selling to wholesalers and other retailers. Recent Events In recent months, Edward Jones has begun to realize that management at JCL requires some changes to improve efficiency and effectiveness. His first impression is that control needs improvement, but he is aware of his own bias, and thus, admits the problems may be more extensive than he rec- ognizes. Specific recent events have influenced him. For one, suppliers, employees, and customers have 60 been complaining that it takes too long for JCL and its divisions to "get things done." Dissatisfied customers say JCL has become too big for the old way of management. There have also been suggestions that the president's large workload leads to bottlenecks. Employees have levelled increasing criticism at the organization's reporting structure. Exhibit 1 shows the president's version of the organization struc- ture. In the past year, some long-term customers have stopped dealing with the lumberyard division and have taken their contractor requirements to other dealers. The most common explanation given by the customers upon moving their business is that JCL cannot guarantee delivery dates. There has been substantial and constant dis- agreement on the transfer price at which the manufacturing division sells to the lumberyard divi- sion. It is uncertain whether this is the cause of the lumberyard division's declining profitability or whether geographical expansion is to blame. There is concern about the manufacturing division's finan- cial profitability. The organization's profitability is difficult to verify because of the substantial sales made to the lumberyard division at a different price than market. The manufacturing division is unsure if its pri- mary purpose is to provide lumber to the lumber- yard division, or to operate as an independent profit centre that also sells to a sister division. Similarly, the lumberyard division is unsure if its primary purpose is to provide a retail outlet for the manufacturing division's output or to maximize its profit potential as a lumber and building mate- rials retailer and contractor supplier. Unexpectedly, a Sleepyside developer offered to purchase the land that the main Sleepyside lum- beryard occupies, and to relocate the lumberyard to another comparable site. In exchange for the present site, the developer has offered to provide a larger lot in another part of town, to build a comparable store, move all shelving, racking and Lumberyard Division John Jones General Manager Purchasing Manager Bookkeeper Delivery Manager Warehouse Manager Main Store Manager EXHIBIT 1: ORGANIZATION CHART Jones Company Limited Edward Jones President Controller inventory to the new facility, and pay $5 million. Exhibit 2 shows the estimated net income and amortization for each site. The offer has been out- standing for eight months; the developer wants an acceptance within a month or it will be withdrawn. Some of these problems have been festering for years. Many have become aggravated to such an extent that something must be done soon to preserve the viability of JCL. The New Corporate Controller To obtain better control, JCL has hired you as the corporate controller, reporting to the president. Your duties include developing, implementing, and administering financial reporting and budgeting sys tems. Also, you are the treasurer. During your first week, you discussed some high priority projects with the president. For one, the president wants an assessment of the financial reporting and budgeting systems, and recommenda- tions for improvements. As part of his concern CASE 14: JONES COMPANY/61 Manufacturing Division Carl Jones General Manager Mill Manager Accountant Sales Manager Log Buying Manager with reporting, the president wonders if the present organization structure is appropriate and where responsibilities for financial reporting and budget- ing should be placed. You and the president had lunch with one of his friends who had enthusiastically explained the advantages of strategic planning for improving a firm's performance. You had concurred with the opinion that strategic planning would be beneficial to JCL. In private, you told the president that you would later explain the advantages of strategic planning for JCL. The president believes strategic planning can help with the current problems. There are two specific requirements that the president also wants you to address. You have been asked: To determine whether the developer's offer to swap land is sufficiently attractive to accept. Exhibit 2 describes the offer. (The president said the company's cost of capital is approximately 15%.) 62/SECTION II: MANAGEMENT ACCOUNTING CASES EXHIBIT 2: LAND SWAP At the request of the president, the general manager of the lumberyard division calculated the expected net income (after all cash and non-cash expenses, including income taxes) for both the existing main Sleepyside store and the proposed facility offered by the developer. Amortization schedules reflect differences in the recorded values of the respective old and new buildings. The developer had agreed to pay JCL $5 million up front. This payment would result in a $2.5 million capital gain for JCL. At the end of 10 years, the general manager expects that there will not be any signifi cant difference between the two alternatives in terms of net income, amortization, assets, and land values. Comparison Between Two Locations for the Main Sleepyside Store (in thousands of dollars) Existing Facility Year 1 2 3 enoto 5 6 7 9 10 Net Income $1,000 1,070 1,144 1,225 1,311 1,403 1,501 1,606 1,718 1,838 Amortization $50 50 50 50 50 50 50 50 50 50 To determine what the lumberyard division would have paid under market conditions for lumber from the manufacturing division. Recom- mend a better method for setting the transfer price, if one exists. You want to address JCL's current difficulties within your first month at your new job. You decided to spend a week interviewing all persons reporting to the president and reviewing relevant documents. Exhibit 3 shows the guide you used to conduct the interviews. The document review included all relevant studies, statistics, financial statements, and operating reports. Performance, Reporting and Budgeting With your interviews and document reviews, you gained a better appreciation of JCL and its divisions. Many managers said that the firm does not have a clear understanding of where it is going with its divisions, and consequently, decision mak- ing is difficult. In recent years, profits of the divisions have declined, as noted in the tables of Exhibit 4. For the lumberyard division, the decline persisted after adjustment for changes in sales mix. That is, the Proposed Facility Net Income $ 700 777 862 957 1,063, 1,180 1,309 1,453 1,613 1,800 Amortization $70 70 70 70 70 70 70 70 EXHIBIT 3: INTERVIEW GUIDE In conducting interviews with persons at JCL who report to the president, you as the corpo- rate controller established an interview guide to ensure consistency and thoroughness. The guide contained the following questions: 1. What are the responsibilities and authorities of your position? 2. What are the perceived objectives of your position? 3. What relationships do you have with other managers in your division and with manag- ers in the other division? 4. How reliable and useful are the accounting records? 5. How are activities planned, budgeted, moni- tored, and evaluated? 6. How available are data on the quality and cost-effectiveness of work performed? division increased the proportion of its sales going to high profit, non-lumber merchandise after 1997. There is general agreement among managers that the financial reports are reliable, timely, and accurate in reporting revenue and expense items. 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 1998 1999 2000 2001 Return on Investment (%) Actual Adjusted Industry 14.8 14.2 14.2 13.8 13.8 13.0 13.0 13.4' 12,8 14.2 14.0 13.2 13.4 14.4 13.6 14.8 14.2 13.8 13.0 12.8 13.2 10.8 9.7 8.8 9.1 EXHIBIT 4: PROFITABILITY Lumberyard Profitability 13.2 10.6 9.2 8.5 8.6 15,8 17.3 Return on Investment (%) Division 6.4 12.8 Industry 24.0 23.7 22.0 24.3 Manufacturing Profitability Three reports are prepared monthly: a profit and loss statement for each division and one for JCL The balance sheets and statements of sources and applications of funds are prepared annually by an outside accountant. Financial statements for 2001 are presented in Exhibits 5, 6, and 7. The commitment accounting system in use by both divisions is particularly useful in keeping expenditures within budget because it recognizes committed expenses when purchase orders are placed. As well, on the profit and loss statement, a separate column records committed amounts. The total of commitments and expenditures deter- mines what is left of a budget. Payment of an invoice cancels its commitment. The manufacturing division's direct costing sys- tem is simple and well understood. The mill man- ager has asked whether he should record "down time" and "paid but not worked time" as suggested by an article he read. Currently, the coding does not separately identify these items. The annual budgets are concerned with expen- diture control. One manager glibly said "I could stay within the budget and achieve nothing. No one would know or care." Performance is mea- sured by sales. Managers were vague when asked Return on Sales (%) Actual Adjusted 6,8 6.8 7.1 6.9 6.5 6.4 6.6 6.0 5.4 5.2 5.1 7.1 6.9 6.5 6.4 6.6 5.9 5.1 5.0 4.9 Division 4.0 8.0 9.5 10.8 Industry 7.1 6.9 6.5 6.7 7,1 7.0 6.6 6.7 7.2 6.8 Return on Sales (%) Industry 15.0 14.8 13.8 15.2 about objectives, performance measures and priori- ties. JCL's managers do not complete their budgets until late March, nearly three months after the start of the new year. The president approves all purchase orders of more than $200 and the hiring of all employees. This has led to the hoarding of inventory and employees, and has reduced the flexibility with which each division can alter these resources. Moreover, the president often initiates or approves expenditures. He thus bypasses the budgetary pro- cess and the general managers who are responsible for achieving the budgets. There is a duplication of responsibilities between the president and the general managers. Profitability is the responsibility of the respec tive general manager. However, many divisional employees report to the president, or oth cases, there is confusion over reporting relation- ships. In addition, the president makes many deci- sions that the general managers think they should make, e.g., vacation schedules. There are personal- ity problems in each division, detracting from smooth operations. A typical example is that three times the manufacturing mill shut down due to a lack of logs; conflict between the manufacturing 64/SECTION II: MANAGEMENT ACCOUNTING CASES EXHIBIT 5 JONES COMPANY LIMITED -LUMBERYARD DIVISION Profit and Loss Statement For the Year Ending December 31, 2001 (in thousands of dollars) Net sales Cost of goods sold Merchandise gross profit Additional income: Interest income Bad debts recovered Delivery income Contracting income Miscellaneous income Total additional income Gross profit Expenses: Salaries and wages Truck and auto expenses Amortization Bad debts Utilities Rent Miscellaneous Total expenses Net profit before taxes Provision for income taxes Net Profit Balance Sheet As at December 31, 2001 (in thousands of dollars) Working capital Fixed assets Less: Long-term debt Investment $12,000 7.200 4,800 120 50 170 60 210 610 5,410 888888 2,100 400 300 118 250 500 614 4,282 1,128 519 609 $ 5,600 1,050 6,650 5.700 $ 950 division's purchasing manager and its mill manager caused the shutdown. The president has the heaviest workload of all managers. With JCL's growth, this workload means that those things that once were done immediately now take days to complete. This lag delays purchase order approvals. Managers below the level of general manager are unhappy with the limited scope allowed them in carrying out their responsibilities. The result is a higher rate of turn- ver among managers in the lumber division than that experienced by competitors; the comparison data comes from the Retail Lumber Dealers Asso- ciation. Moreover, the high rate demands consider- JONES COMPANY LIMITED - MANUFACTURING DIVISION Profit and Loss Statement For the Year Ending December 31, 2001 (in thousands of dollars) Net sales Cost of goods sold Gross margin Other income Gross profit EXHIBIT 6 Expenses: Indirect manufacturing costs Sales Administration Total expenses Net profits before taxes Provision for income taxes Net profit Balance Sheet As at December 31, 2001. (in thousands of dollars) Working capital Fixed assets Less: Long-term debt Investment $14,000 7.250 6,750 135 6,885 2,170 875 1.040 4,085 2,800 1,288 $1,512 $ 2,625 6,125 8,750 600 $ 8,150 able employee and management time devoted to recruitment and training of replacements. There are frequent quality and quantity dif- ferences between what the lumberyard division ordered from the manufacturing division and what it received. Moreover, the timing of shipments is unpredictable. Because of these difficulties, the lumberyard division has at times had to purchase lumber at (higher prices from competitors in situa- tions in order to meet delivery commitments. There is a lack of regularly reported informa- tion (e.g., sales per salesperson, deliveries per driver, labour hours per thousand board feet, etc.) pertaining to efficiency and effectiveness. The manufacturing division sells lumber to the lumberyard division for direct cost plus a 25 percent markup. On average, this transfer price is higher than the market, and has become increasingly higher during the last two years. A telephone interview with the executive director of the provincial Retail Lumber Dealers Associa- tion confirmed the lumberyard division general manager's allegation that the pricing of large long- term contracts is at a discount from the spot market, usually 5 percent. The following table shows these details: 1998 1999 2000 2001 Lumber Transferred, Manufacturing to Lumberyard Division Boardfeet (000s) 11.67 12.04 11.27 12.00 Direct Manufacturing Costs (000s) 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 $2,625 3,010 3,100 3,600 Weighted to reflect the different grades and lengths of lum- ber transferred. Market Price Boardfeet (000s) "Sales turnover" (sales/assets) for the lumber- yard division has changed in recent years. A survey has shown that competitors have also experienced a change in sales turnover during the same years. The table below shows the patterns: Lumberyard Sales Turnover Division 2.47 2.51 2.34 2.30 2.36 1.98 1.96 1.90 1.95 1,81 $336 291 310 326 Competition 2.43 2.53 2.49 2,55 2.61 2.64 2.71 2.81 2.77 2.73 The main lumberyard in Sleepyside had recently entered the contracting business. The prof- itability of these ventures has been minimal. Profits would have been even less had Reg Smith, the main Sleepyside store manager and JCL's first employee, applied the standard contractor discount of 20 percent to lumber sold to the ventures. Lower costs made some projects profitable. The sales to contractors by the lumberyard division have decreased as a percent of total sales and in constant dollar terms during the last five years. However, retail sales have been growing at a faster rate than the industry average. Manufac turing division sales have also been growing at a more rapid rate than experienced by the industry. This is a result of lumber quality and sales pene- tration of new markets. In the manufacturing division, the sales depart- ment frequently initiates special orders of lumber. The mill manager claims that these orders are EXHIBIT 7 JONES COMPANY LIMITED Profit and Loss Statement For the Year Ending December 31, 2001 (in thousands of dollars) CASE 14: JONES COMPANY/65 Net Sales Cost of goods sold Gross margin Additional income Gross profit Total expenses Net profit before taxes Provision for income taxes Net Profit Working capital Fixed assets Balance Sheet As at December 31, 2001 (in thousands of dollars) Less: Long-term debt Total shareholders' equity SOURCES Operations Non-cash expenditures $21,500 9,950 11,550 745 12,295 8.367 3,928 1.807 $ 2.121 Statement of Sources and Application of Funds For the Year Ending December 31, 2001 (in thousands of dollars) Issue debt Total sources APPLICATIONS Purchase equipment Pay dividends Redeem capital stock Add to working capital Total applications $ 8,225 7.175 15,400 6.300 $9,100 $ 2,067 810 2,877 5,375 $ 8,252 $ 2,705 205 4,000 1,342 $ 8,252 more expensive than regular production and has repeatedly asked for recognition of this in pricing. Required You, as the corporate controller, must prepare a concise, well-written report to the presi- dent of your investigation in which you highlight and analyse those areas of JCL that need manage- ment attention. Your report should include practi- cal recommendations for management action.

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Should JCL accept the developers offer to swap the land Analysis A property developer has offered to JCL to trade the main Sleepy Side lumberyard property for a larger lot in a similar area as well as ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started