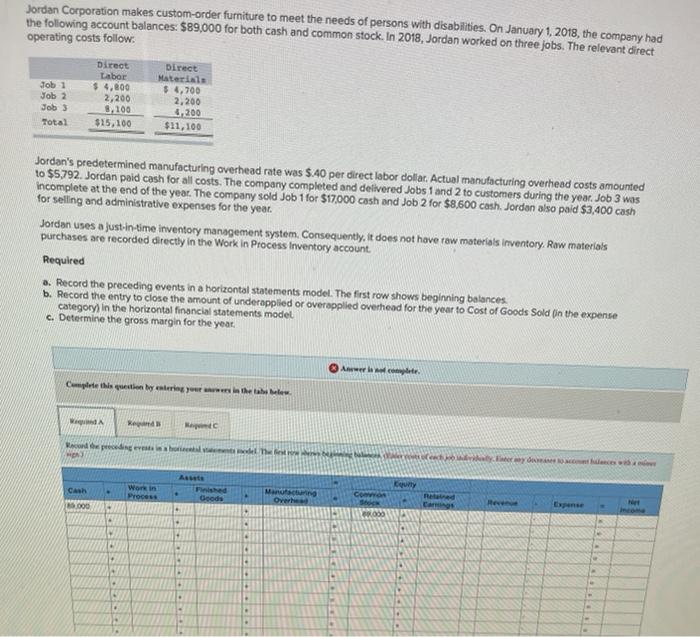

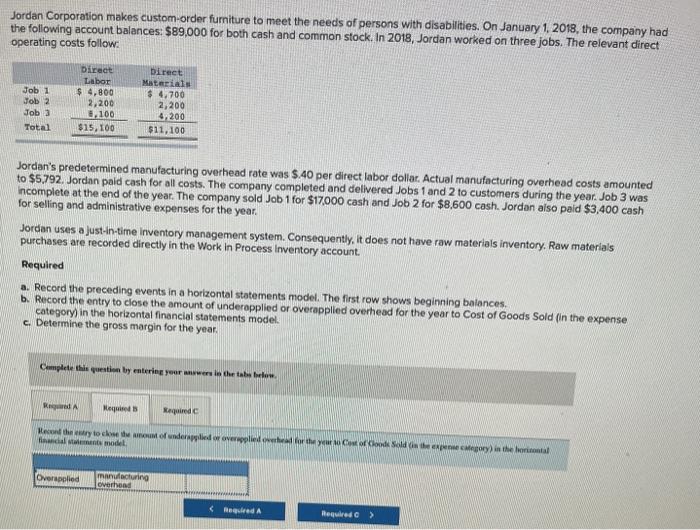

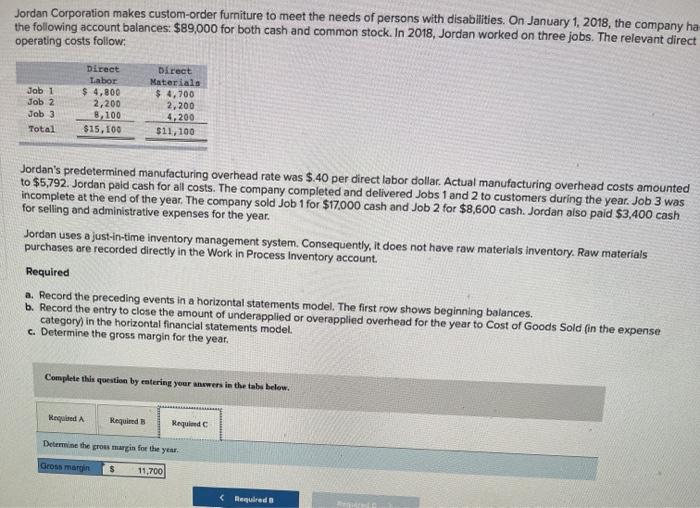

Jordan Corporation makes custom-order furniture to meet the needs of persons with disabilities. On January 1, 2018, the company had the following account balances: $89,000 for both cash and common stock. In 2018, Jordan worked on three jobs. The relevant direct operating costs follow: Job 1 Job 2 Job 3 Total Direct Labor $ 4,800 2,200 8.100 $15,100 Direct Materials $4,700 2,200 3.200 $11,100 Jordan's predetermined manufacturing overhead rate was $.40 per direct labor dollar. Actual manufacturing overhead costs amounted to $5,792. Jordan paid cash for all costs. The company completed and delivered Jobs 1 and 2 to customers during the year. Job 3 was incomplete at the end of the year. The company sold Job 1 for $17,000 cash and Job 2 for $8,600 cash. Jordon also paid $3,400 cash for selling and administrative expenses for the year. Jordan uses a just-in-time inventory management system. Consequently, it does not have raw materials inventory. Raw materials purchases are recorded directly in the Work in Process Inventory account Required a. Record the preceding events in a horizontal statements model. The first row shows beginning balances. b. Record the entry to close the amount of underapplied or overapplied overhead for the year to Cost of Goods Sold in the expense category) in the horizontal financial statements model c. Determine the gross margin for the year. were Complete this question by catering your in the tablete WA X Mac corde pedig a hotel The tal Asuste Work in Kurty Cash 65.000 Manufacturing Overhe Jordan Corporation makes custom order furniture to meet the needs of persons with disabilities. On January 1, 2018, the company had the following account balances: $89,000 for both cash and common stock. In 2018, Jordan worked on three jobs. The relevant direct operating costs follow Job 1 Jobs Joba Total Direct Labor $ 4,800 2,200 3.100 $15,100 Direct Materials $ 4.700 2,200 4,200 $11,100 Jordan's predetermined manufacturing overhead rate was $.40 per direct labor dollar. Actual manufacturing overhead costs amounted to $5792. Jordan paid cash for all costs. The company completed and delivered Jobs 1 and 2 to customers during the year. Job 3 was Incomplete at the end of the year. The company sold Job 1 for $17,000 cash and Job 2 for $8,600 cash. Jordan also paid $3,400 cash for selling and administrative expenses for the year. Jordan uses a just-in-time inventory management system. Consequently, it does not have raw materials inventory. Raw materials purchases are recorded directly in the Work in Process Inventory account Required a. Record the preceding events in a horizontal statements model. The first row shows beginning balances, b. Record the entry to close the amount of underapplied or overapplied overhead for the year to Cost of Goods Sold in the expense category) in the horizontal financial statements model. c. Determine the gross margin for the year Complete this question by entering your wens is the tabs below RA Required Required Record the wry to see funderpplied or overleve for the yow Cost of Good Sheppy) in the local financial man model Overapplied manufacturing overhead Jordan Corporation makes custom-order furniture to meet the needs of persons with disabilities. On January 1, 2018, the company ha the following account balances: $89,000 for both cash and common stock. In 2018, Jordan worked on three jobs. The relevant direct operating costs follow: Jab 1 Job 2 Job 3 Direct Tabor $ 4,800 2,200 8,100 $15, 100 Direct Materials $ 4,700 2,200 4,200 $11,100 Total Jordan's predetermined manufacturing overhead rate was $.40 per direct labor dollar. Actual manufacturing overhead costs amounted to $5,792. Jordan paid cash for all costs. The company completed and delivered Jobs 1 and 2 to customers during the year. Job 3 was incomplete at the end of the year. The company sold Job 1 for $17,000 cash and Job 2 for $8,600 cash. Jordan also paid $3,400 cash for selling and administrative expenses for the year. Jordan uses a just-in-time inventory management system. Consequently, it does not have raw materials inventory. Raw materials purchases are recorded directly in the Work in Process Inventory account. Required a. Record the preceding events in a horizontal statements model. The first row shows beginning balances. b. Record the entry to close the amount of underapplied or overapplied overhead for the year to Cost of Goods Sold (in the expense category) in the horizontal financial statements model c. Determine the gross margin for the year. Complete this question by entering your answers in the tabs below. Requid Requimd Requid Determine the grous margin for the year Gross margin $ 11,700