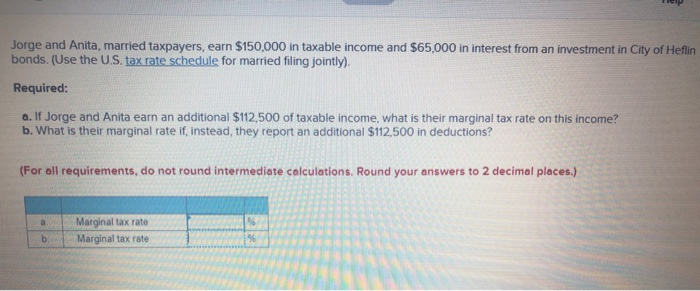

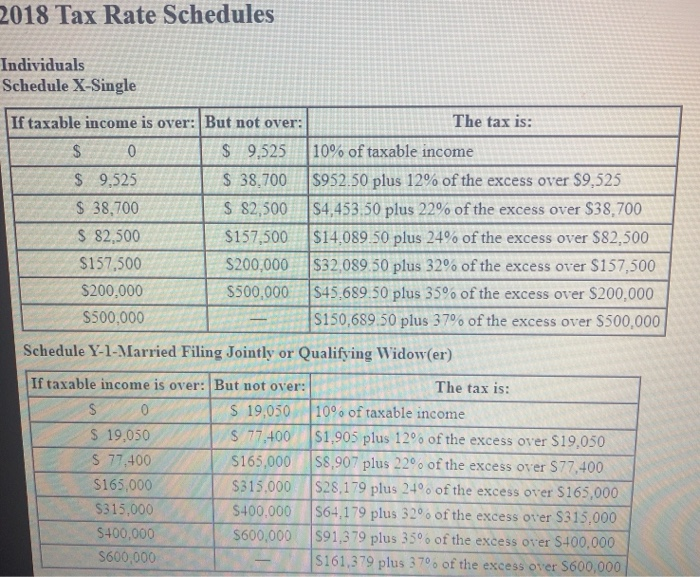

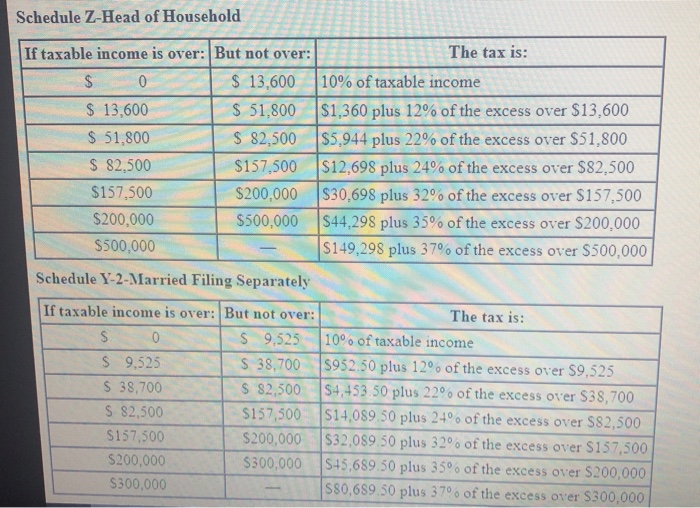

Jorge and Anita, married taxpayers, earn $150,000 in taxable income and $65,000 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule for married filing jointly). Required: a. If Jorge and Anita earn an additional $112,500 of taxable income, what is their marginal tax rate on this income? b. What is their marginal rate if, instead, they report an additional $112,500 in deductions? (For all requirements, do not round Intermediate calculations. Round your answers to 2 decimal places.) Marginal tax rate b. Marginal tax rate 2018 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 9,525 10% of taxable income $ 9,525 $ 38,700 $952.50 plus 12% of the excess over $9,525 $ 38,700 $ 82,500 $4,453.50 plus 22% of the excess over $38,700 $ 82,500 $157,500 $14,089.50 plus 24% of the excess over $82,500 $157,500 $200,000 $32,089 50 plus 32% of the excess over $157,500 $200,000 $500,000 $45.689 50 plus 35% of the excess over $200,000 $500,000 - $150,689 50 plus 37% of the excess over $500,000 Schedule Y-1- Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: S 0 S S 19,050 19.050 100 10% of taxable income $ 19,050 $ 77,400 $1,905 plus 12% of the excess over $19,050 S 77.400 S165,000 58,907 plus 22% of the excess over $77,400 S165,000 $315.000 S28,179 plus 24% of the excess over $165,000 $315.000 $400.000 $64,179 plus 32 of the excess over S315,000 S400,000 $600,000 $91,379 plus 35% of the excess over $400,000 $600,000 5161,379 plus 37% of the excess over $600,000 Schedule Z-Head of Household If taxable income is over: But not over: $ 0 $ 13,600 $ 13,600 $ 51,800 $ 51,800 $ 82,500 $ 82,500 $157,500 $157,500 $200,000 $200,000 $500,000 $500,000 The tax is: 10% of taxable income $1,360 plus 12% of the excess over $13,600 $5,944 plus 22% of the excess over $51,800 $12,698 plus 24% of the excess over $82,500 $30,698 plus 32% of the excess over $157,500 $44,298 plus 35% of the excess over $200.000 $149,298 plus 37% of the excess over $500,000 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: S O S 9,525 10% of taxable income $ 9,525 $ 38,700 S952.50 plus 12% of the excess over $9,525 $ 38,700 S 82,500 $4,453.50 plus 22 of the excess over $38,700 S 82,500 $157,500 $14,089 50 plus 24% of the excess over $82,500 $157,500 $200,000 $32,089.50 plus 32% of the excess over $157,500 $200,000 $300,000 $45,689 50 plus 35% of the excess over $200,000 $300,000 - 880,689.50 plus 37 of the excess over $300,000