Answered step by step

Verified Expert Solution

Question

1 Approved Answer

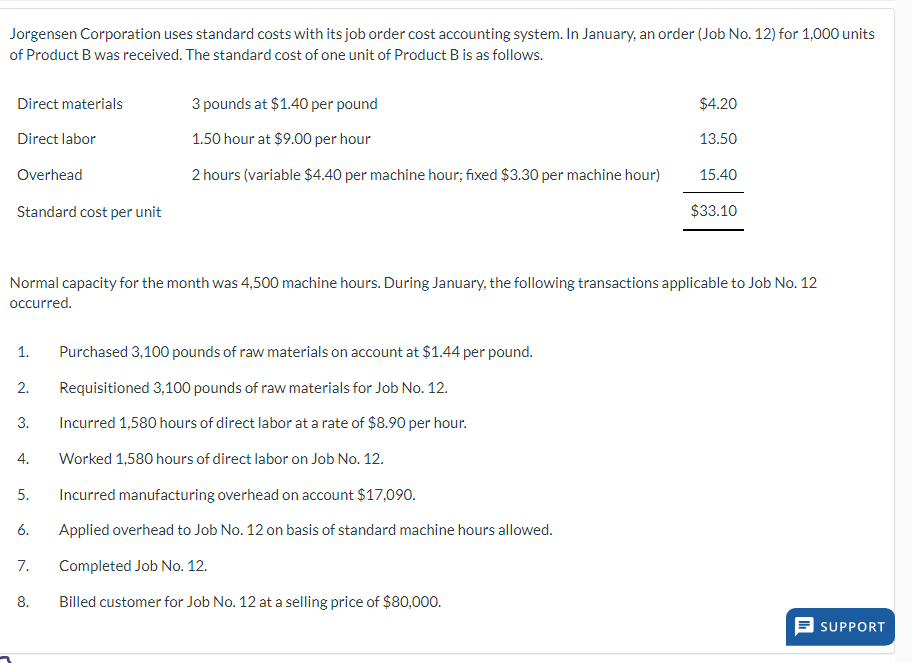

Jorgensen Corporation uses standard costs with its job order cost accounting system. In January, an order (Job No. 12) for 1,000 units of Product

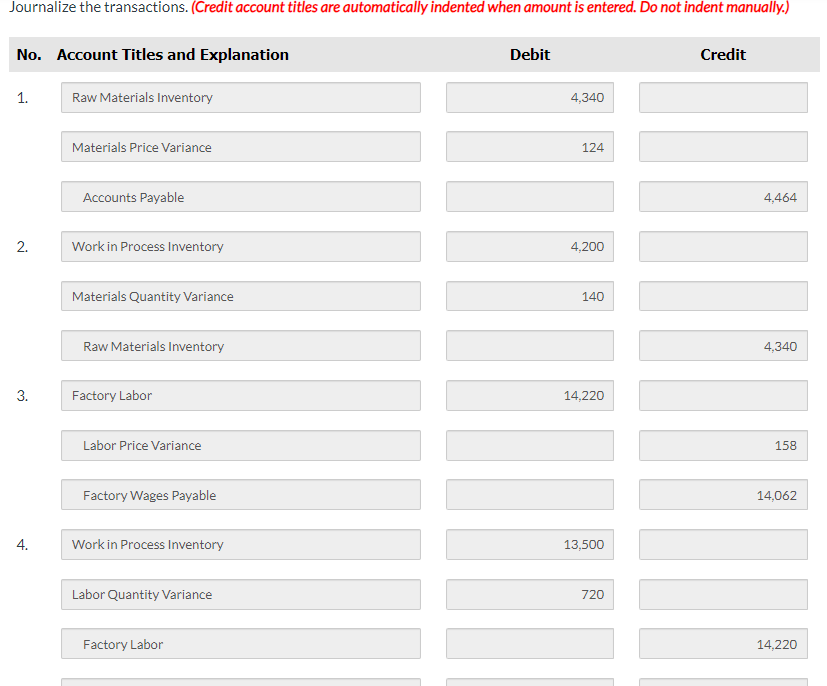

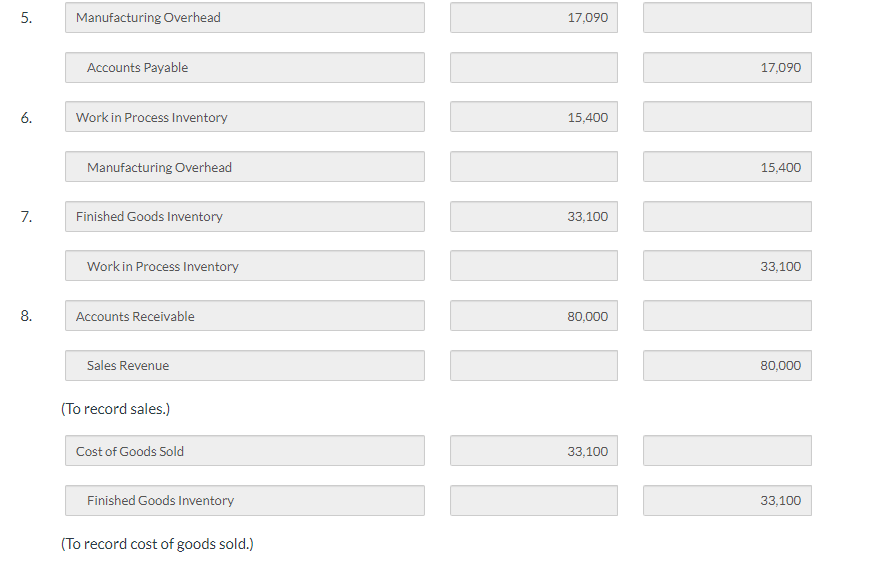

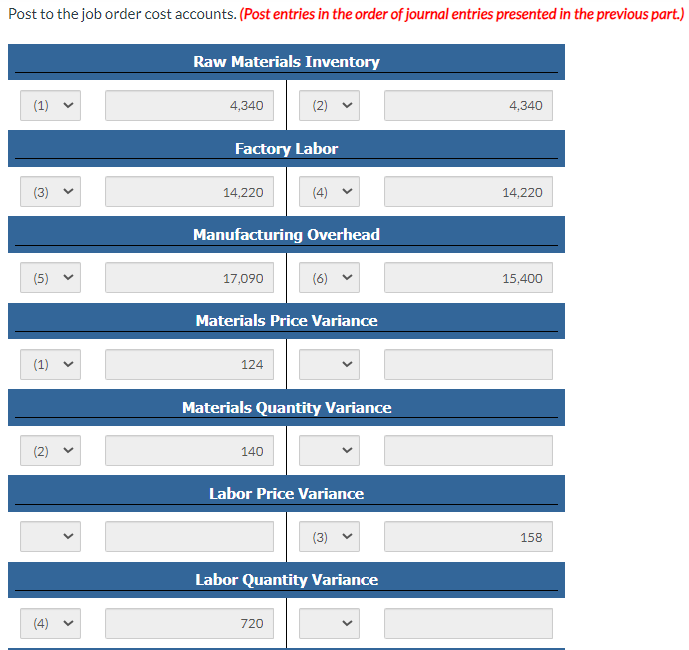

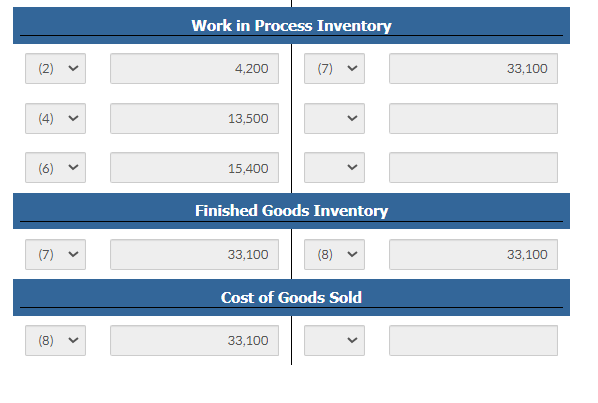

Jorgensen Corporation uses standard costs with its job order cost accounting system. In January, an order (Job No. 12) for 1,000 units of Product B was received. The standard cost of one unit of Product B is as follows. Direct materials 3 pounds at $1.40 per pound $4.20 Direct labor 1.50 hour at $9.00 per hour 13.50 Overhead 2 hours (variable $4.40 per machine hour; fixed $3.30 per machine hour) 15.40 Standard cost per unit $33.10 Normal capacity for the month was 4,500 machine hours. During January, the following transactions applicable to Job No. 12 occurred. 1. Purchased 3,100 pounds of raw materials on account at $1.44 per pound. 2. Requisitioned 3,100 pounds of raw materials for Job No. 12. 3. Incurred 1,580 hours of direct labor at a rate of $8.90 per hour. 4. Worked 1,580 hours of direct labor on Job No. 12. 5. Incurred manufacturing overhead on account $17,090. 6. Applied overhead to Job No. 12 on basis of standard machine hours allowed. 7. Completed Job No. 12. 8. Billed customer for Job No. 12 at a selling price of $80,000. SUPPORT Journalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation 1. Raw Materials Inventory Materials Price Variance Accounts Payable 2. Work in Process Inventory Materials Quantity Variance Raw Materials Inventory 3. Factory Labor Labor Price Variance Factory Wages Payable Debit 4,340 124 4,200 140 14,220 13,500 4. Work in Process Inventory Labor Quantity Variance Factory Labor 720 Credit 4,464 4,340 158 14,062 14,220 5. 6. Manufacturing Overhead Accounts Payable 17,090 Work in Process Inventory 15,400 Manufacturing Overhead 7. Finished Goods Inventory Work in Process Inventory 8. Accounts Receivable Sales Revenue (To record sales.) Cost of Goods Sold Finished Goods Inventory (To record cost of goods sold.) 33,100 80,000 33,100 17,090 15,400 33,100 80,000 33,100 Post to the job order cost accounts. (Post entries in the order of journal entries presented in the previous part.) Raw Materials Inventory (1) 4,340 (2) Factory Labor (3) 14,220 (4) Manufacturing Overhead (5) (1) 17,090 (6) Materials Price Variance 124 Materials Quantity Variance 140 Labor Price Variance (3) Labor Quantity Variance (4) > 720 4,340 14,220 15,400 158 (4) (6) > > > (7) (8) > Work in Process Inventory 4,200 13,500 15,400 Finished Goods Inventory 33,100 (8) Cost of Goods Sold 33,100 33,100 33,100 (c) Prepare the entry to recognize the total overhead variance. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started