Question

Joseph Poorman graduated from San Diego State University in 1997 and began working as a professional. As he began his career, he immediately started investing

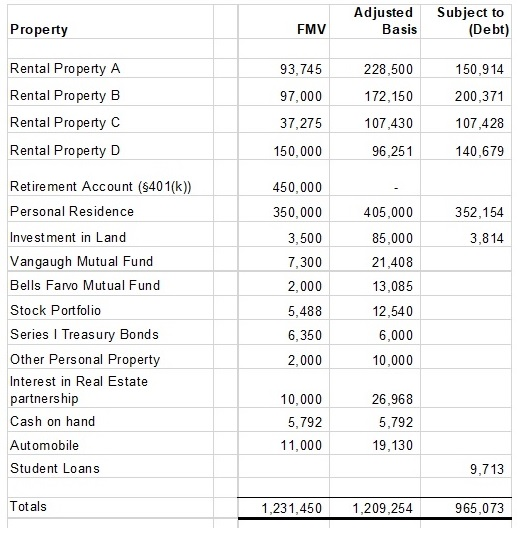

Joseph Poorman graduated from San Diego State University in 1997 and began working as a professional. As he began his career, he immediately started investing a part of his salary, using a variety of investment vehicles. Over about a decade, he had put together a healthy portfolio of investments, and was very satisfied with his life and finances. However, starting in 2015, both the real estate and the stock market and the overall economy took a drastic downturn, leaving many investors like Joseph devastated. In 2018, Josephs asset profile was as follows:

All loans secured by the properties were recourse debt. The proceeds of these loans were used to finance the acquisition, construction, or improvement of the related properties.

Joseph realized that his situation was no longer sustainable. The tenants in his rental were all experiencing financial difficulty and could not pay their rent, leaving him with a heavy load of negative cash flow on his rentals. He was able to short-sell Rental Property A, with net proceeds of $93,745 going to the lender in exchange for relief from the remaining loan balance on that property. Upon the completion of the short sale (on March 31, 2018), Joseph received correspondence from the bank informing him that the bank has relieved him of the unpaid balance of the loan on property A. The correspondence indicated that he will receive a Form 1099-C at the end of the year, informing him of the amount of the debt cancellation. Joseph then realized that this discharge of indebtedness may have tax consequences.

Joseph has come to you for advice. He wants to know if there is a way he can avoid paying tax on the amount of cancellation of debt income he has realized on property A.

Required:

- Compute the amount of COD income Joseph has realized.

- Advise Joseph as to whether this COD income is taxable to him, or whether there is a provision in the law that allows this income to be exempt from taxation.

- If there is a provision that allows Joseph to exclude this income from taxation, determine the consequences of this exemption on his tax attributes, including the basis of all his remaining assets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started