JOSEPH VIGNEAULT & THE CAPITAL POOL COMPANY PROGRAM

3. 3. Model out the share structure of the CPC after it completes the hypothetical qualifying transaction described by Vigneault. What ownership stake will Vigneault and his partners retain?

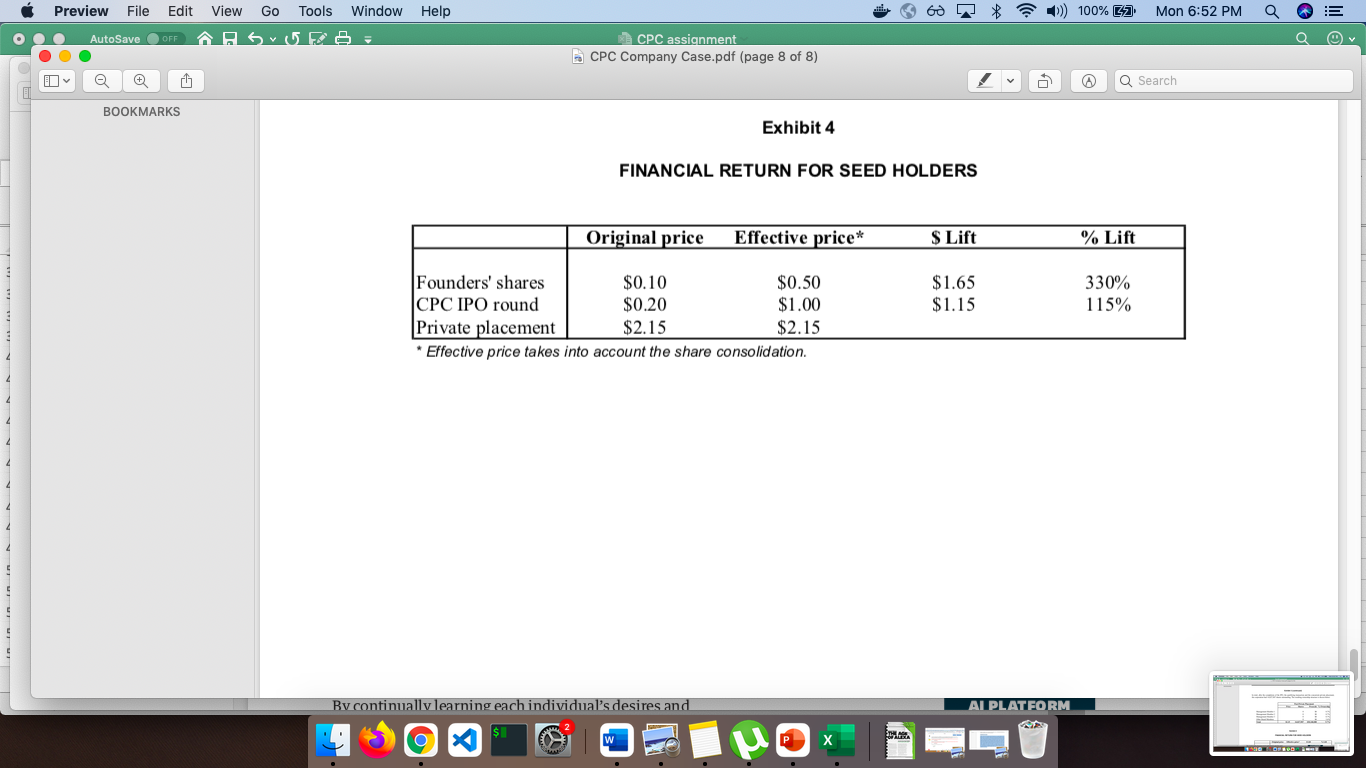

4. What return would Vigneault realize on his original investment of seed money?

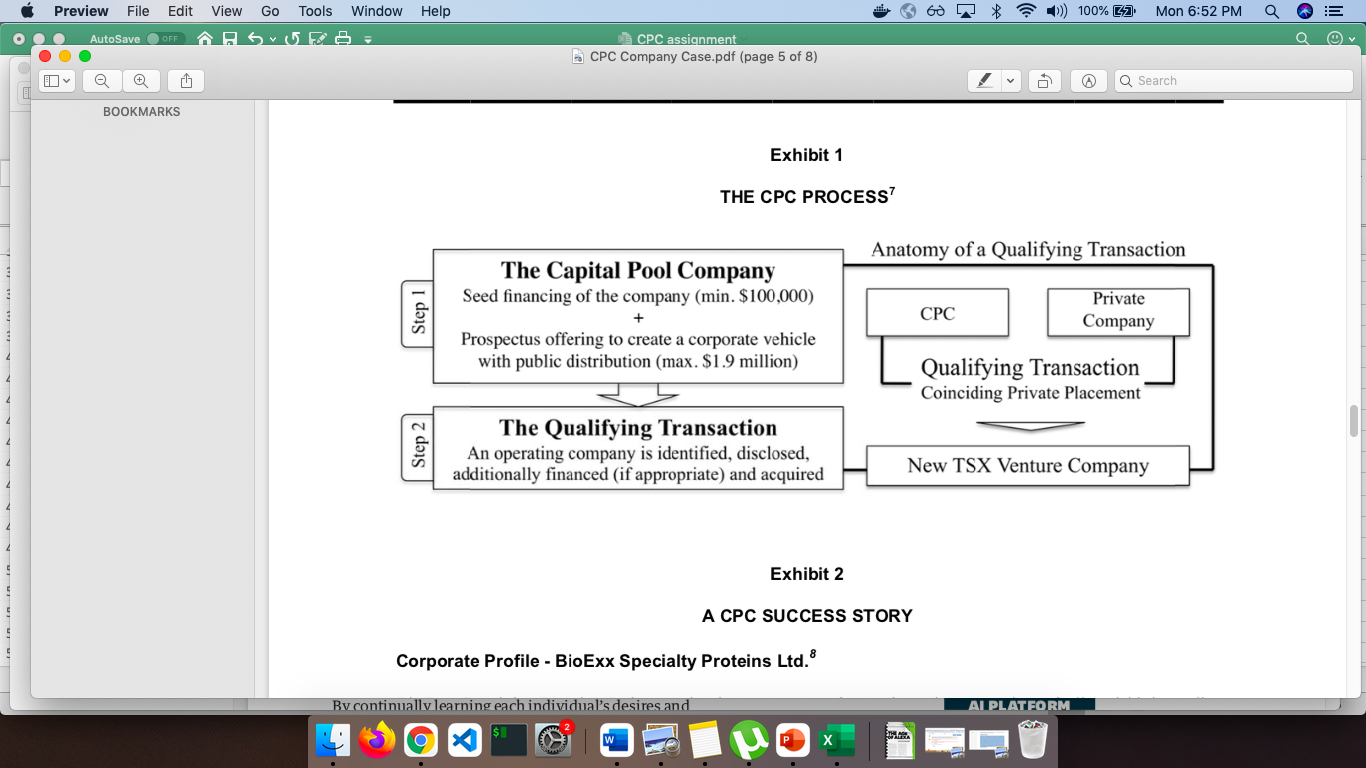

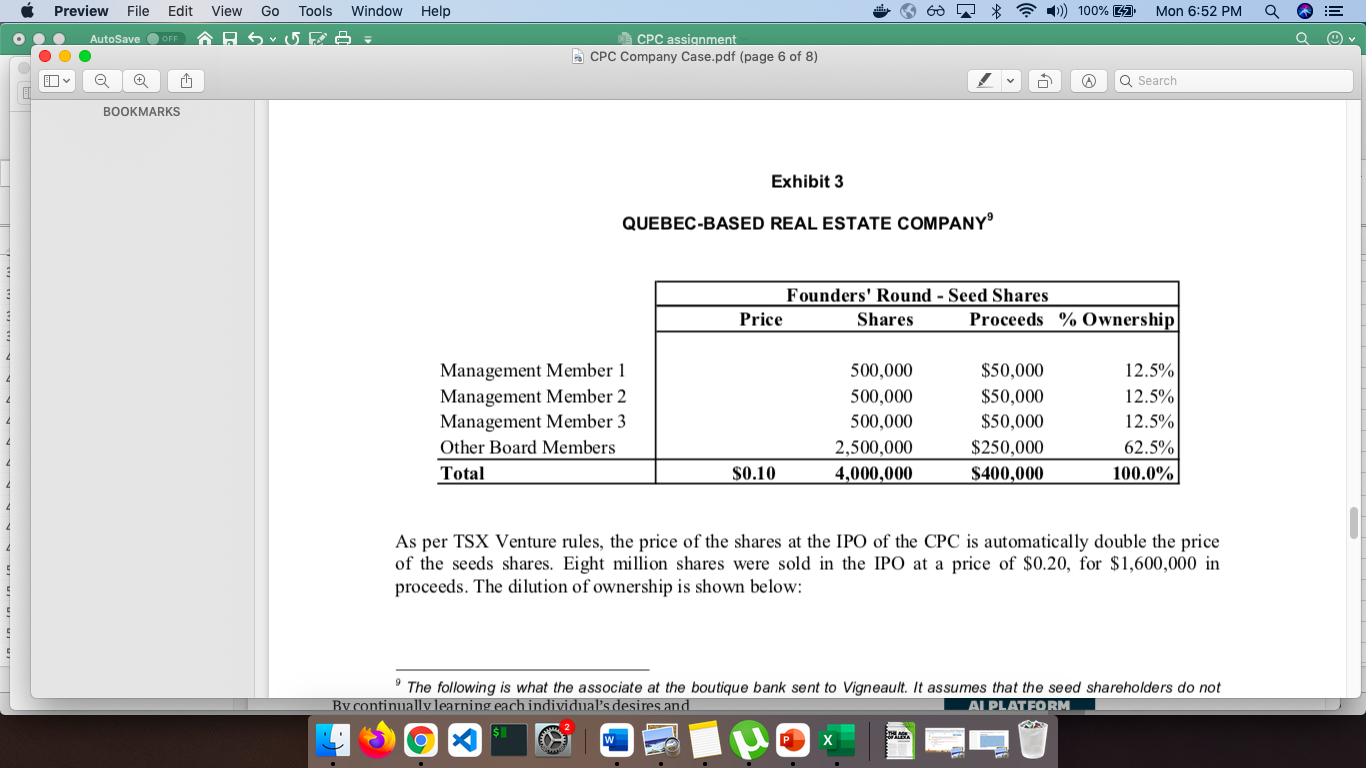

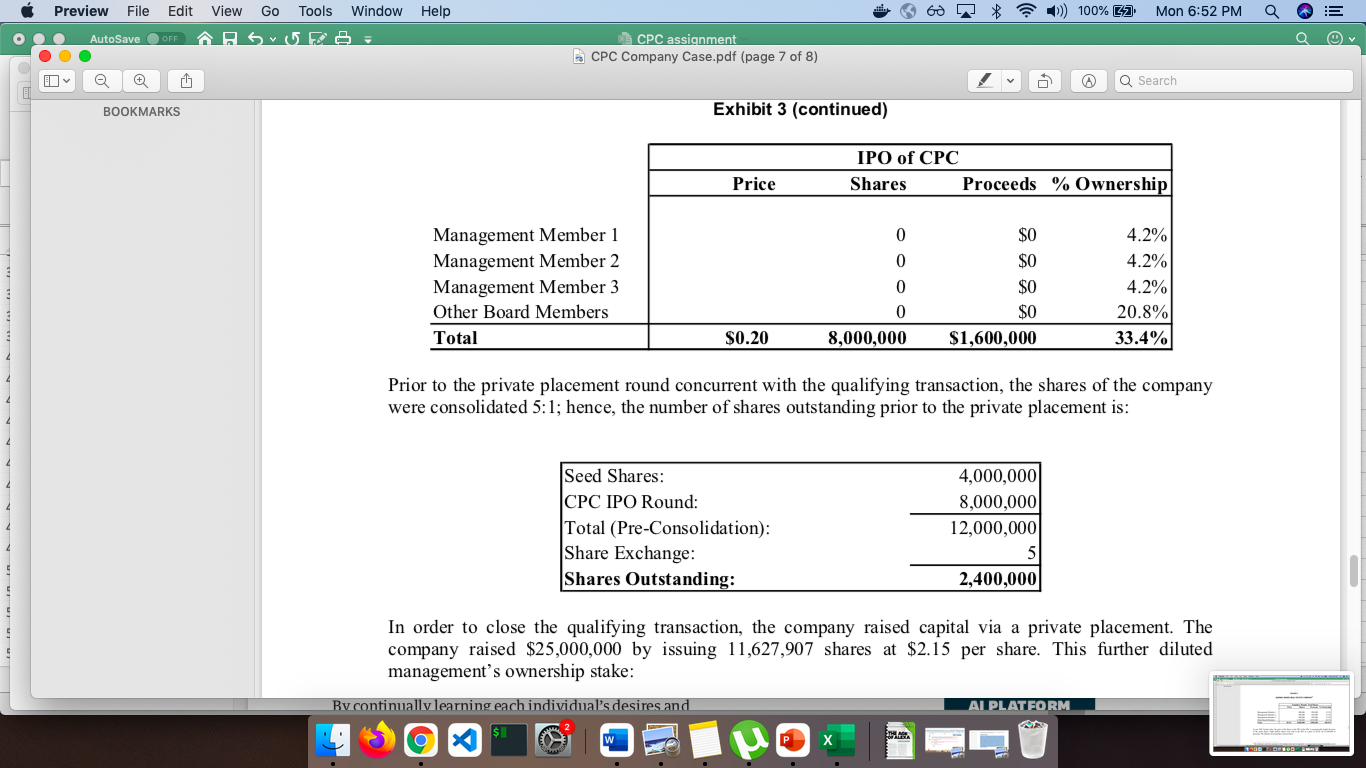

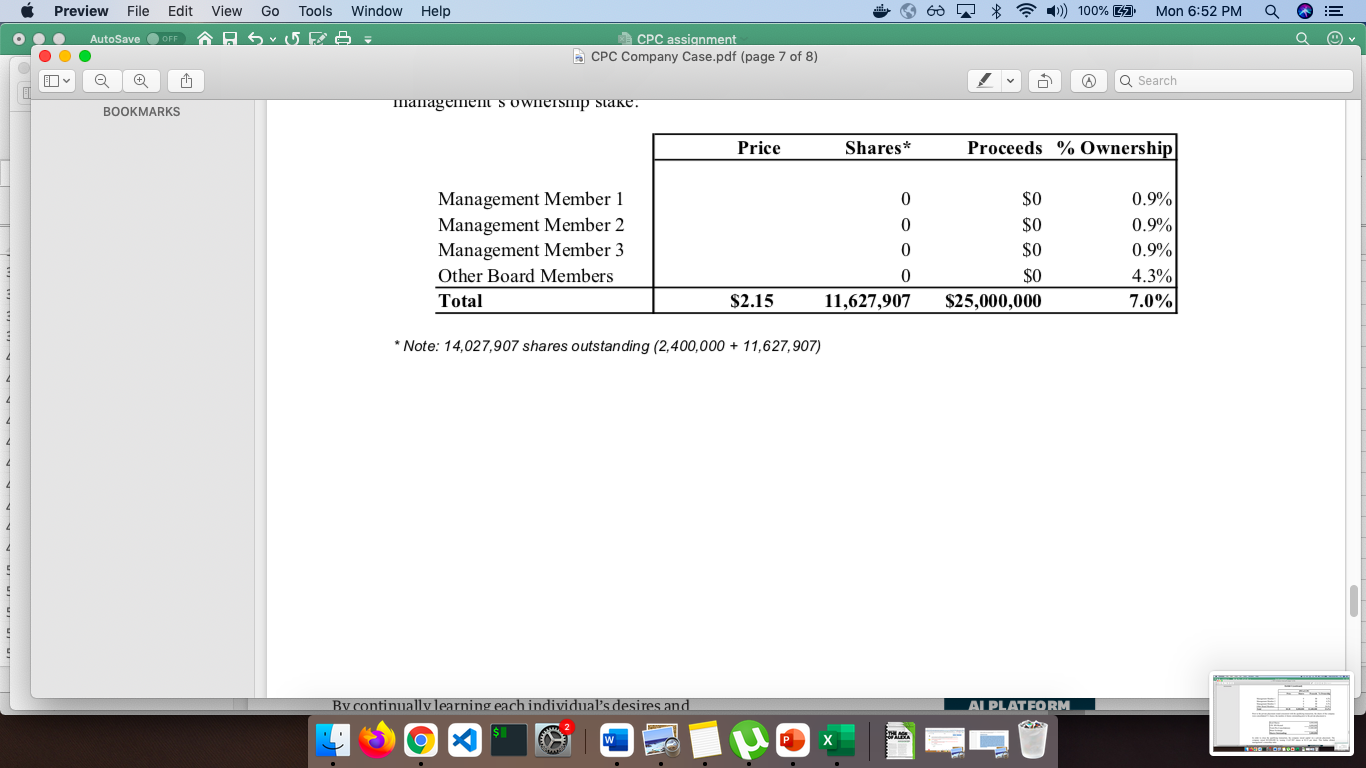

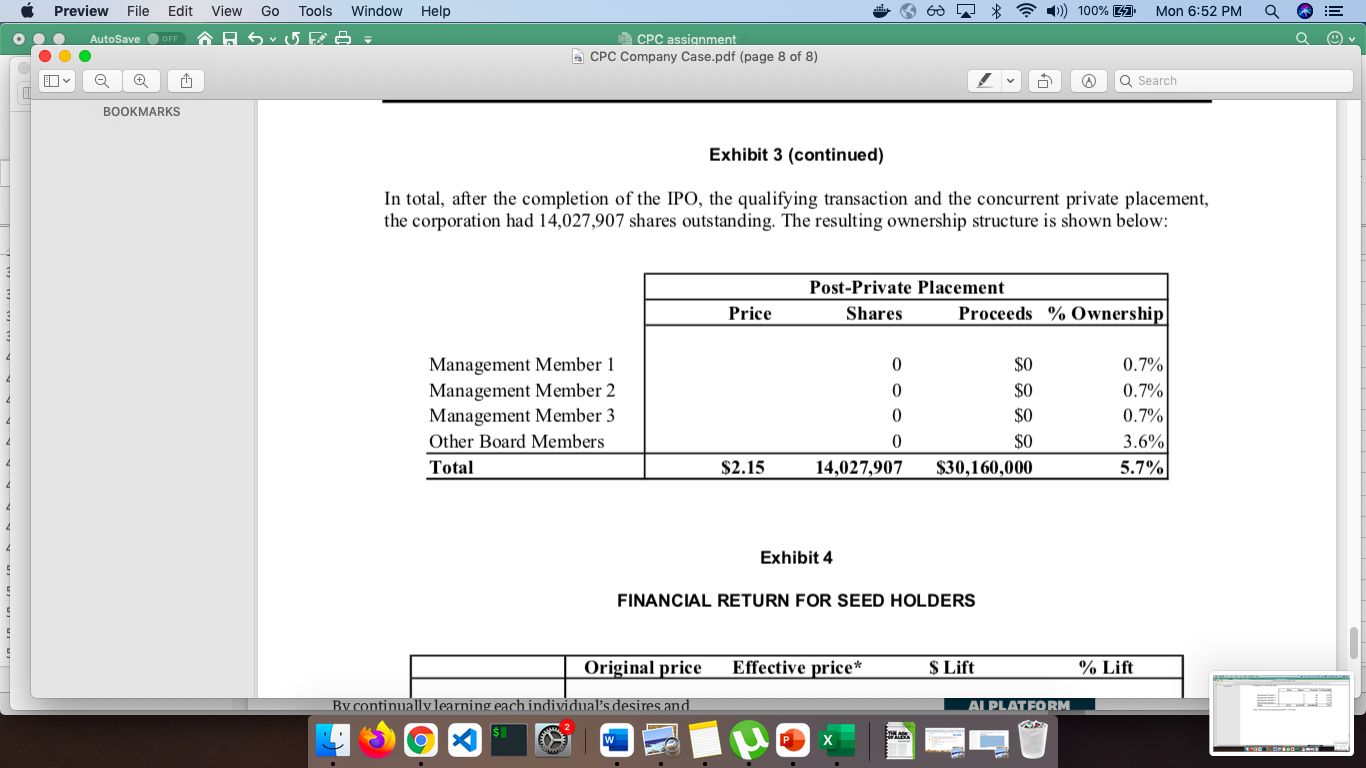

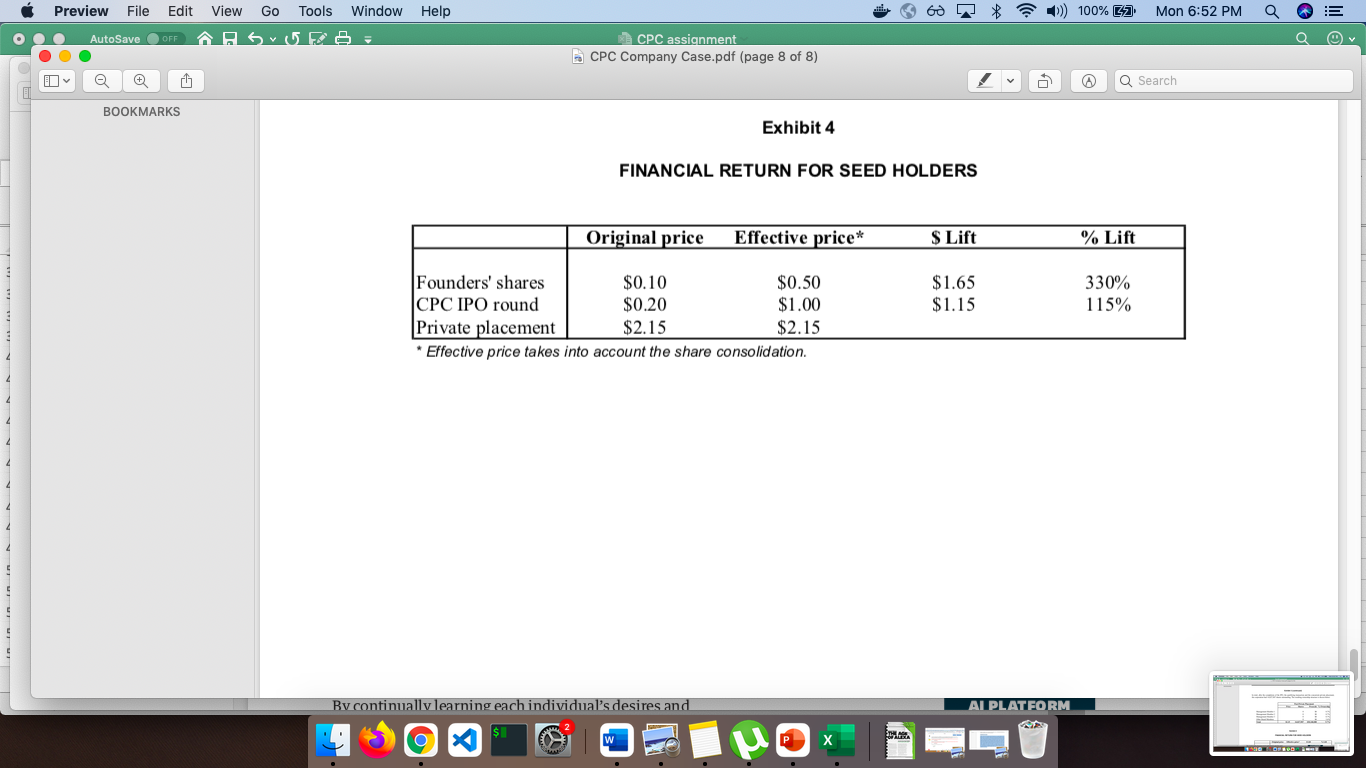

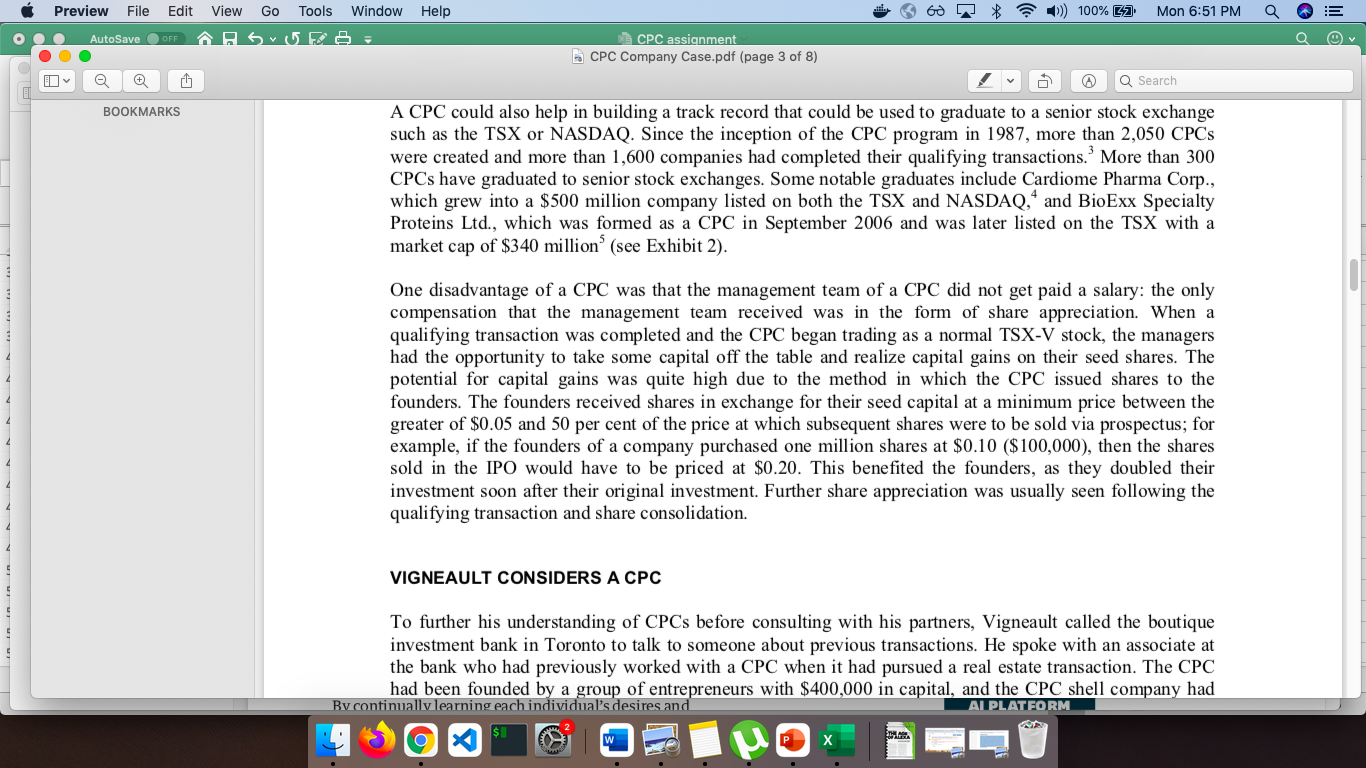

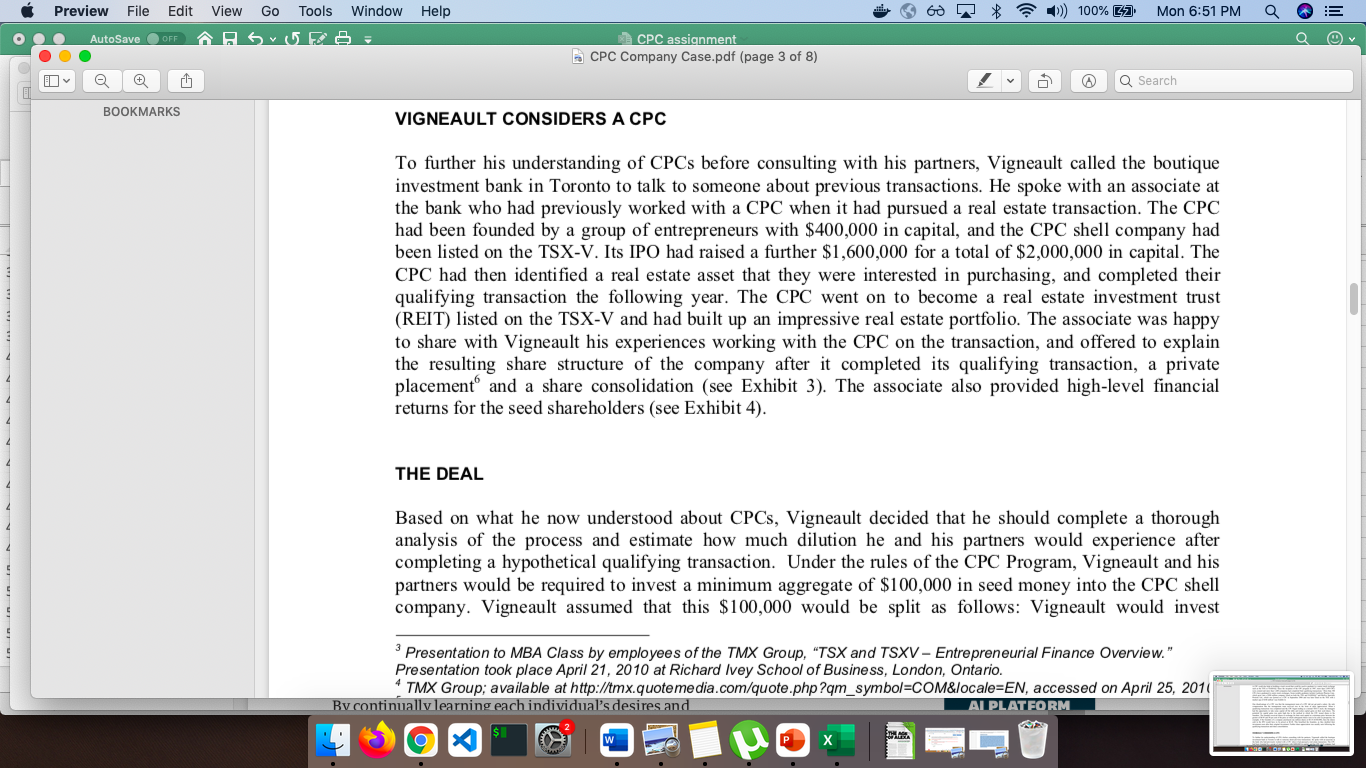

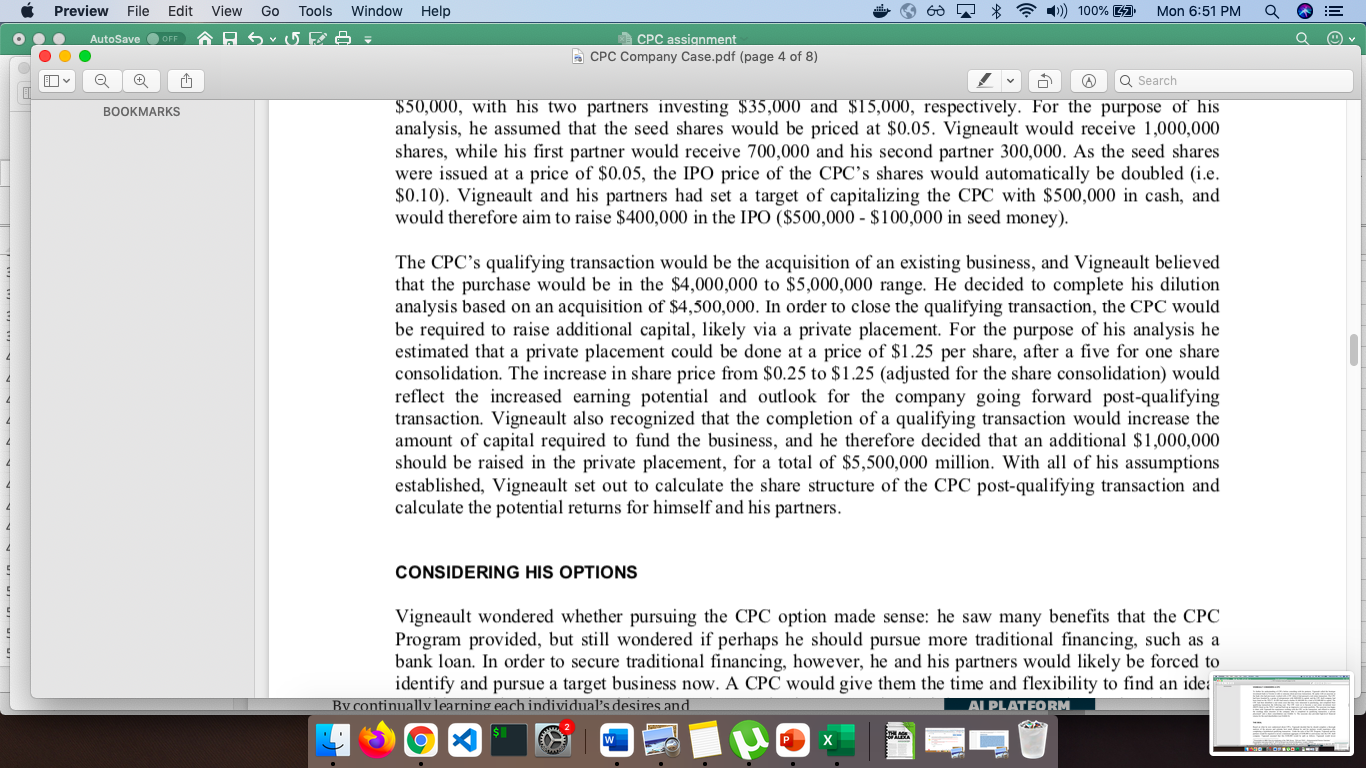

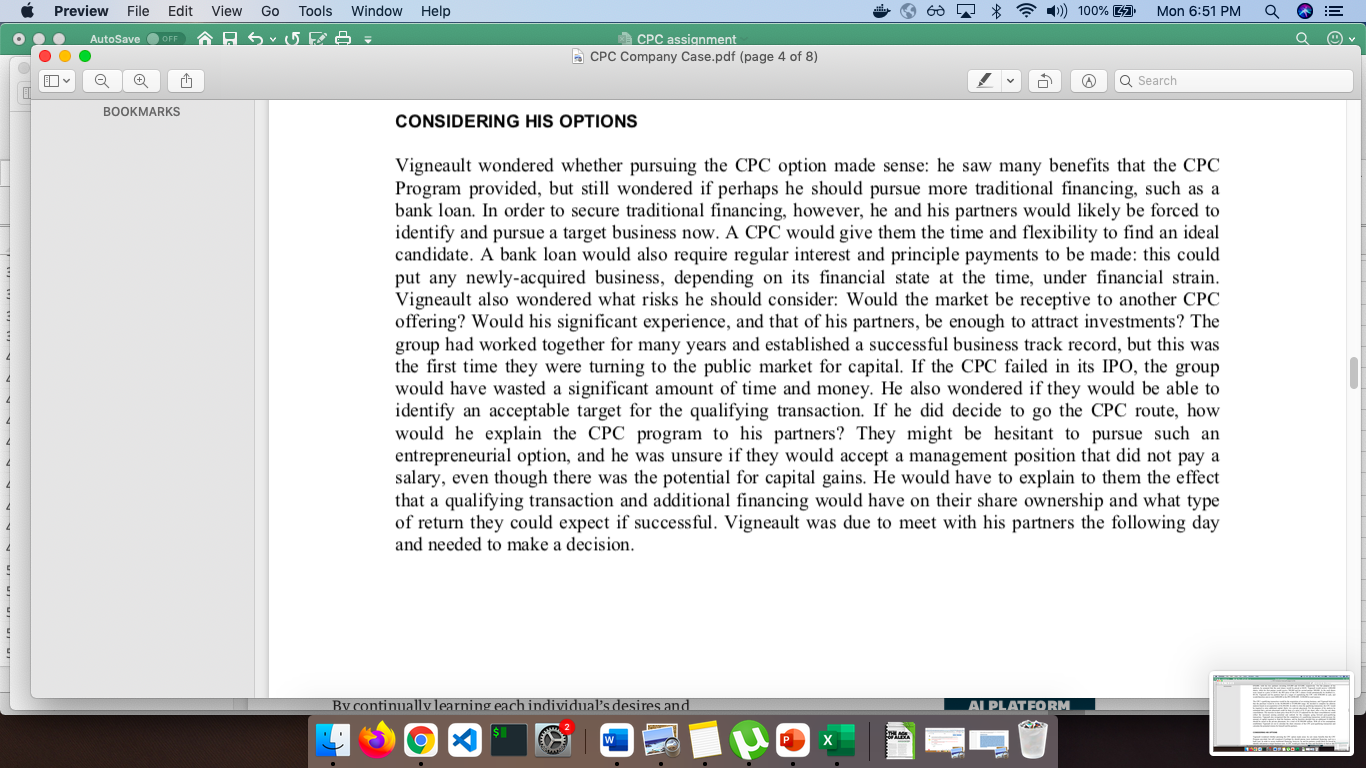

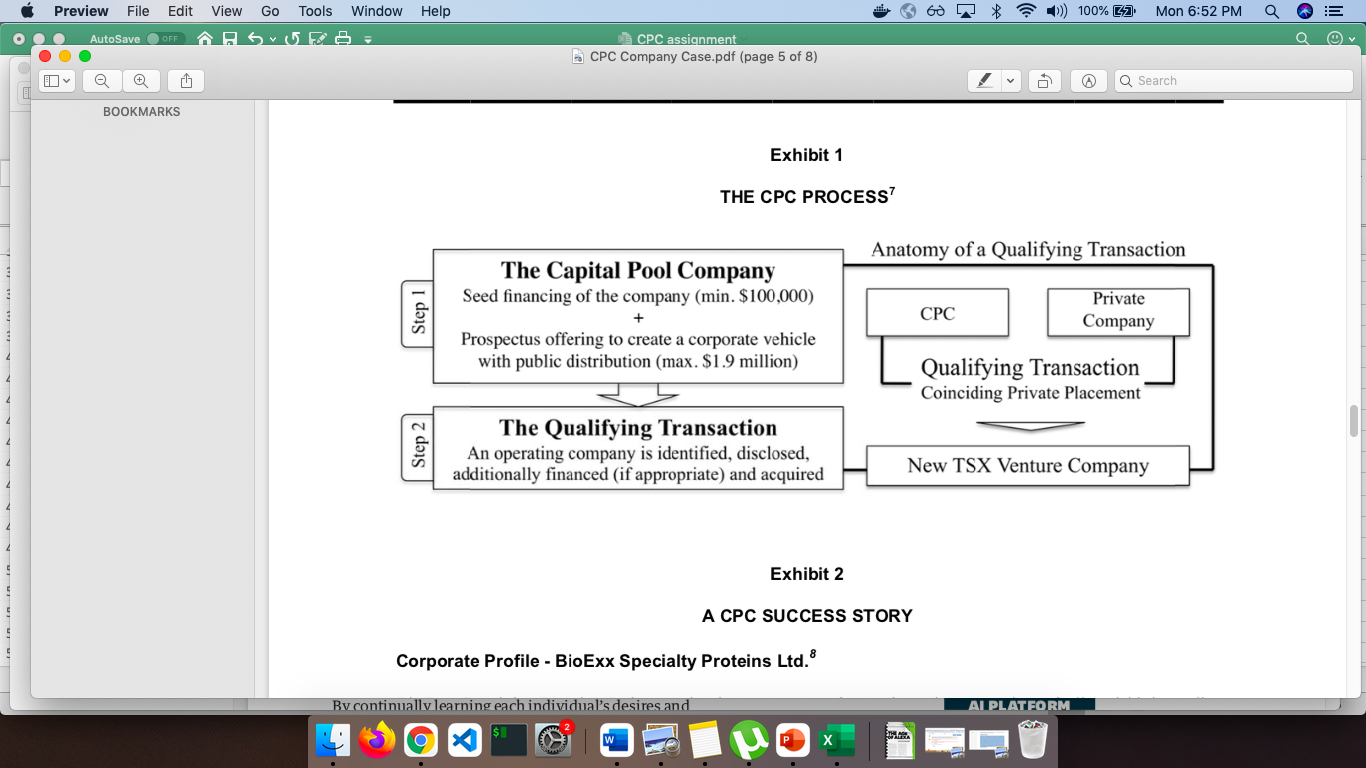

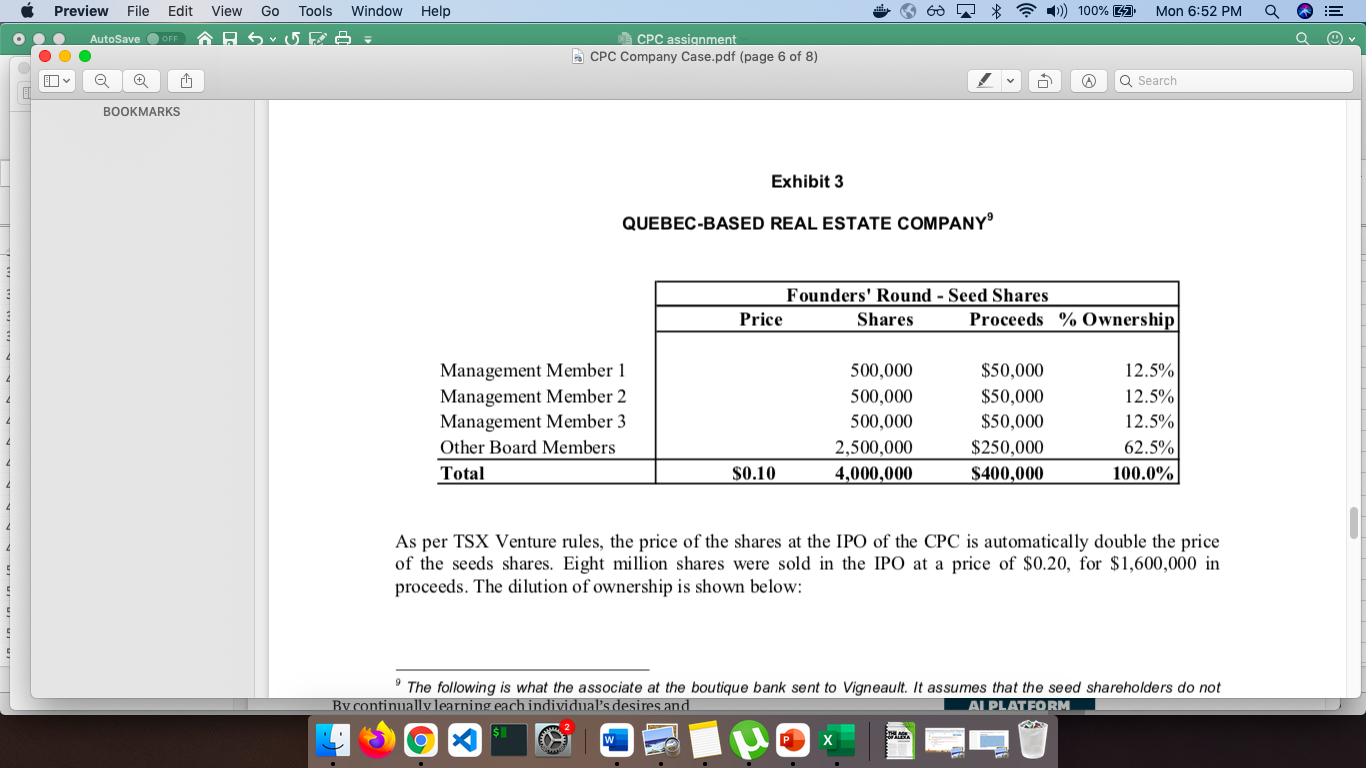

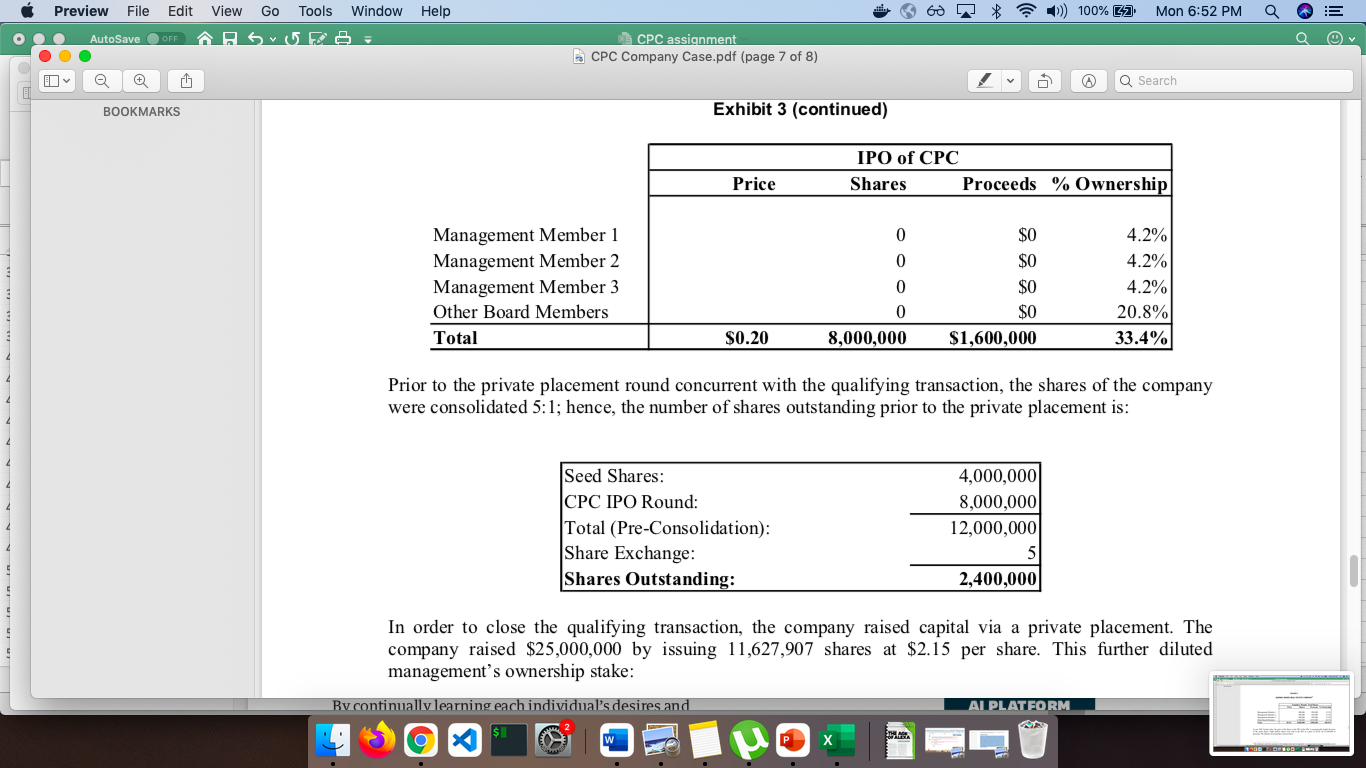

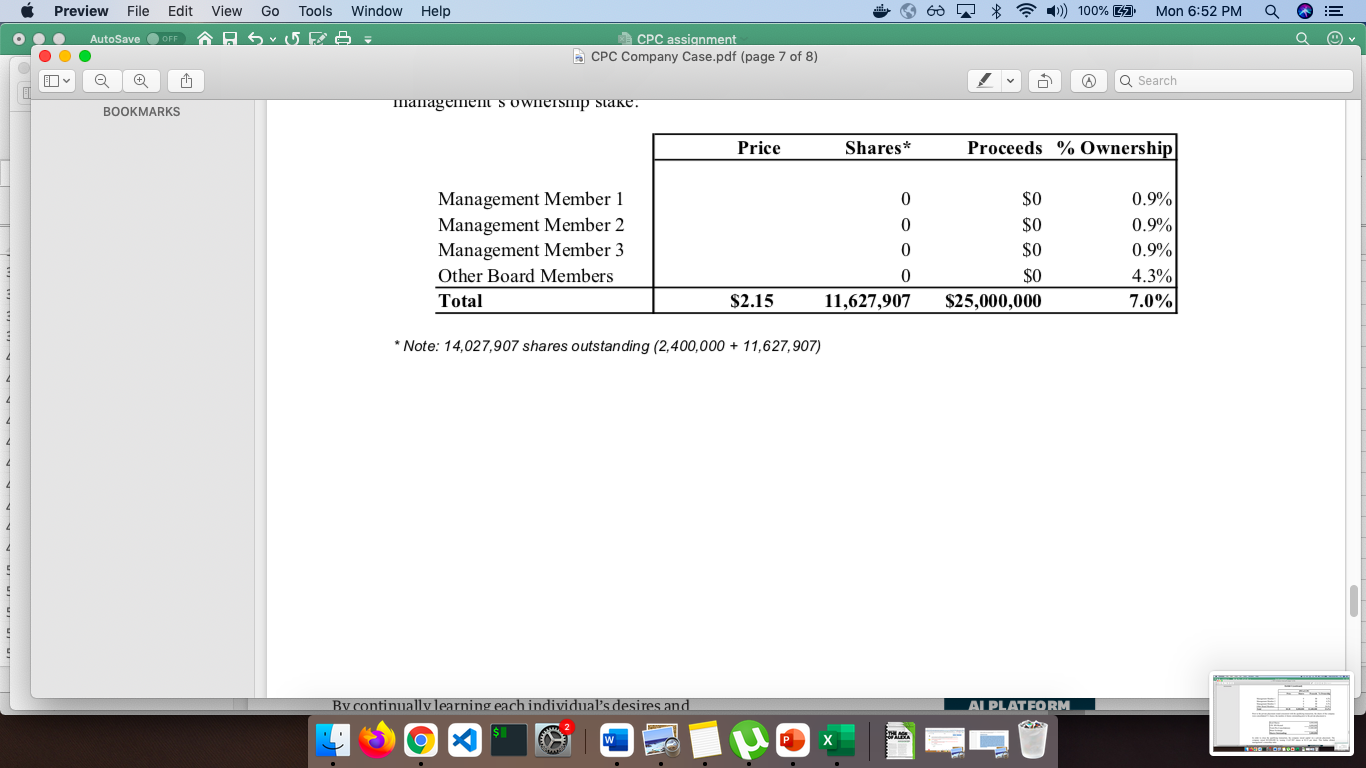

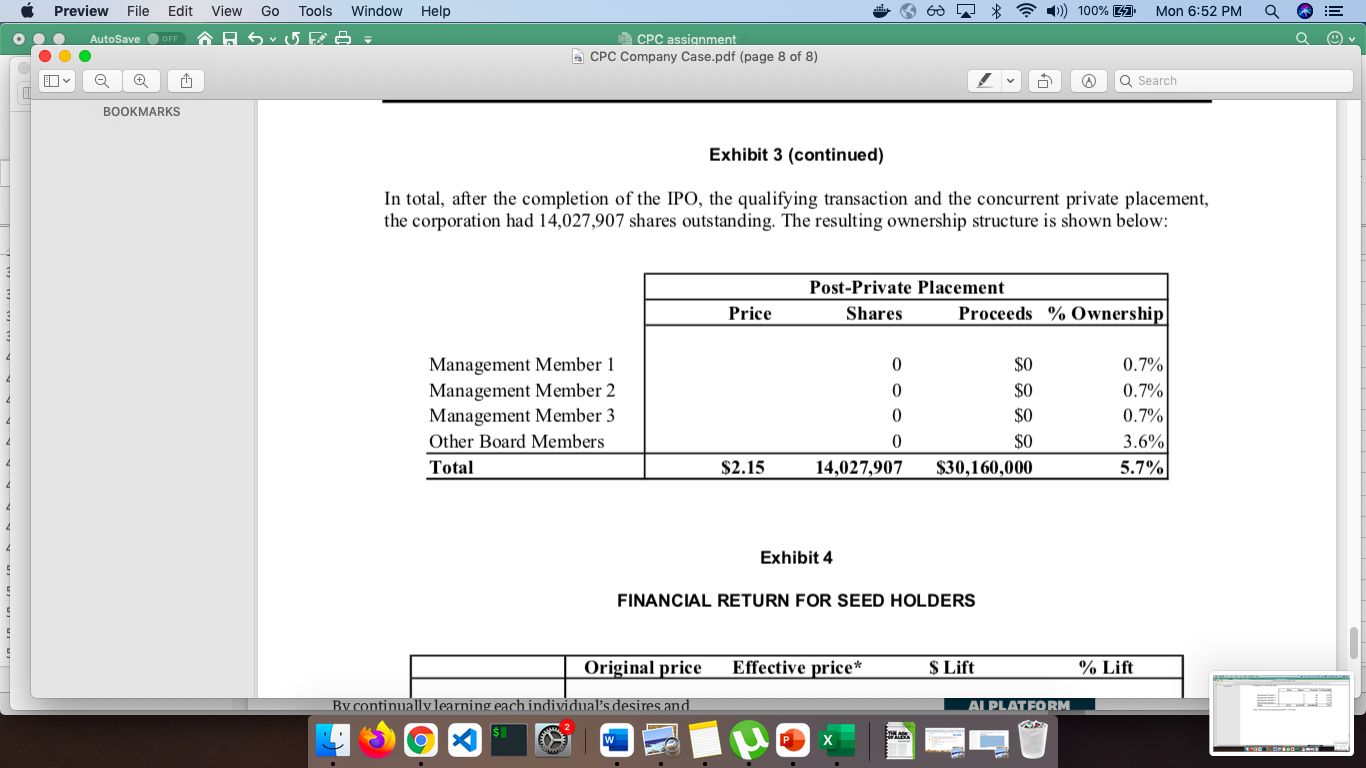

Help 1) 100% GA Mon 6:51 PM Q Preview File Edit View Go Tools Window AutoSave OFF AA SUF CPC assignment CPC Company Case.pdf (page 3 of 8) @ G. Q Search BOOKMARKS A CPC could also help in building a track record that could be used to graduate to a senior stock exchange such as the TSX or NASDAQ. Since the inception of the CPC program in 1987, more than 2,050 CPCs were created and more than 1,600 companies had completed their qualifying transactions. More than 300 CPCs have graduated to senior stock exchanges. Some notable graduates include Cardiome Pharma Corp., which grew into a $500 million company listed on both the TSX and NASDAQ,* and BioExx Specialty Proteins Ltd., which was formed as a CPC in September 2006 and was later listed on the TSX with a market cap of $340 million (see Exhibit 2). One disadvantage of a CPC was that the management team of a CPC did not get paid a salary: the only compensation that the management team received was in the form of share appreciation. When a qualifying transaction was completed and the CPC began trading as a normal TSX-V stock, the managers had the opportunity to take some capital off the table and realize capital gains on their seed shares. The potential for capital gains was quite high due to the method in which the CPC issued shares to the founders. The founders received shares in exchange for their seed capital at a minimum price between the greater of $0.05 and 50 per cent of the price at which subsequent shares were to be sold via prospectus; for example, if the founders of a company purchased one million shares at $0.10 ($100,000), then the shares sold in the IPO would have to be priced at $0.20. This benefited the founders, as they doubled their investment soon after their original investment. Further share appreciation was usually seen following the qualifying transaction and share consolidation. VIGNEAULT CONSIDERS A CPC To further his understanding of CPCs before consulting with his partners, Vigneault called the boutique investment bank in Toronto to talk to someone about previous transactions. He spoke with an associate at the bank who had previously worked with a CPC when it had pursued a real estate transaction. The CPC had been founded by a group of entrepreneurs with $400,000 in capital, and the CPC shell company had By continually learning each individual's desires and AI PLATFORM $1 W UO O w SA > % 100% GA Mon 6:51 PM Q Preview File Edit View Go Tools Window Help AutoSave OFF AA SUF CPC assignment CPC Company Case.pdf (page 3 of 8) @ G. Q Search BOOKMARKS VIGNEAULT CONSIDERS A CPC To further his understanding of CPCs before consulting with his partners, Vigneault called the boutique investment bank in Toronto to talk to someone about previous transactions. He spoke with an associate at the bank who had previously worked with a CPC when it had pursued a real estate transaction. The CPC had been founded by a group of entrepreneurs with $400,000 in capital, and the CPC shell company had been listed on the TSX-V. Its IPO had raised a further $1,600,000 for a total of $2,000,000 in capital. The CPC had then identified a real estate asset that they were interested in purchasing, and completed their qualifying transaction the following year. The CPC went on to become a real estate investment trust (REIT) listed on the TSX-V and had built up an impressive real estate portfolio. The associate was happy to share with Vigneault his experiences working with the CPC on the transaction, and offered to explain the resulting share structure of the company after it completed its qualifying transaction, a private placement and a share consolidation (see Exhibit 3). The associate also provided high-level financial returns for the seed shareholders (see Exhibit 4). THE DEAL Based on what he now understood about CPCs, Vigneault decided that he should complete a thorough analysis of the process and estimate how much dilution he and his partners would experience after completing a hypothetical qualifying transaction. Under the rules of the CPC Program, Vigneault and his partners would be required to invest a minimum aggregate of $100,000 in seed money into the CPC shell company. Vigneault assumed that this $100,000 would be split as follows: Vigneault would invest 3 Presentation to MBA Class by employees of the TMX Group, "TSX and TSXV - Entrepreneurial Finance Overview." Presentation took place April 21, 2010 at Richard Ivey School of Business, London, Ontario. * TMX Group; available at http://tmx.quote media.com/quote.php?qm_symbol=COM&locale=EN, accessed on April 25, 2014 By continually learning each individual's desires and AL PLATFORM $ VISA LW LOFOP Q @ Preview File Edit View Go Tools Window Help ))) 100% G2 % Mon 6:51 PM AutoSave OFF AA SUF CPC assignment CPC Company Case.pdf (page 4 of 8) G. Q Search $50,000, with his two partners investing $35,000 and $15,000, respectively. For the purpose of his analysis, he assumed that the seed shares would be priced at $0.05. Vigneault would receive 1,000,000 shares, while his first partner would receive 700,000 and his second partner 300,000. As the seed shares were issued at a price of $0.05, the IPO price of the CPC's shares would automatically be doubled (i.e. $0.10). Vigneault and his partners had set a target of capitalizing the CPC with $500,000 in cash, and would therefore aim to raise $400,000 in the IPO ($500,000 - $100,000 in seed money). BOOKMARKS The CPC's qualifying transaction would be the acquisition of an existing business, and Vigneault believed that the purchase would be in the $4,000,000 to $5,000,000 range. He decided to complete his dilution analysis based on an acquisition of $4,500,000. In order to close the qualifying transaction, the CPC would be required to raise additional capital, likely via a private placement. For the purpose of his analysis he estimated that a private placement could be done at a price of $1.25 per share, after a five for one share consolidation. The increase in share price from $0.25 to $1.25 (adjusted for the share consolidation) would reflect the increased earning potential and outlook for the company going forward post-qualifying transaction. Vigneault also recognized that the completion of a qualifying transaction would increase the amount of capital required to fund the business, and he therefore decided that an additional $1,000,000 should be raised in the private placement, for a total of $5,500,000 million. With all of his assumptions established, Vigneault set out to calculate the share structure of the CPC post-qualifying transaction and calculate the potential returns for himself and his partners. CONSIDERING HIS OPTIONS Vigneault wondered whether pursuing the CPC option made sense: he saw many benefits that the CPC Program provided, but still wondered if perhaps he should pursue more traditional financing, such as a bank loan. In order to secure traditional financing, however, he and his partners would likely be forced to identify and pursue a target business now. A CPC would give them the time and flexibility to find an ide: By continually learning each individual's desires and AI PLATFORM $ Her O W > % 100% GA Mon 6:51 PM Q Preview File Edit View Go Tools Window Help AutoSave OFF AA SUF CPC assignment CPC Company Case.pdf (page 4 of 8) @ G. Q Search BOOKMARKS CONSIDERING HIS OPTIONS Vigneault wondered whether pursuing the CPC option made sense: he saw many benefits that the CPC Program provided, but still wondered if perhaps he should pursue more traditional financing, such as a bank loan. In order to secure traditional financing, however, he and his partners would likely be forced to identify and pursue a target business now. A CPC would give them the time and flexibility to find an ideal candidate. A bank loan would also require regular interest and principle payments to be made: this could put any newly-acquired business, depending on its financial state at the time, under financial strain. Vigneault also wondered what risks he should consider: Would the market be receptive to another CPC offering? Would his significant experience, and that of his partners, be enough to attract investments? The group had worked together for many years and established a successful business track record, but this was the first time they were turning to the public market for capital. If the CPC failed in its IPO, the group would have wasted a significant amount of time and money. He also wondered if they would be able to identify an acceptable target for the qualifying transaction. If he did decide to go the CPC route, how would he explain the CPC program to his partners? They might be hesitant to pursue such an entrepreneurial option, and he was unsure if they would accept a management position that did not pay a salary, even though there was the potential for capital gains. He would have to explain to them the effect that a qualifying transaction and additional financing would have on their share ownership and what type of return they could expect if successful. Vigneault was due to meet with his partners the following day and needed to make a decision. By continually learning each individual's desires and AL PLATFORM $ O w 1) 100% GA Mon 6:52 PM Q Preview File Edit View Go Tools Window Help AutoSave OFF AA SUF Q CPC assignment CPC Company Case.pdf (page 5 of 8) G. n Q Search BOOKMARKS Exhibit 1 THE CPC PROCESS? Anatomy of a Qualifying Transaction Step 1 The Capital Pool Company Seed financing of the company (min. $100,000) + Prospectus offering to create a corporate vehicle with public distribution (max. $1.9 million) CPC Private Company Qualifying Transaction Coinciding Private Placement 0 Step 2 The Qualifying Transaction An operating company is identified, disclosed, additionally financed (if appropriate) and acquired New TSX Venture Company Exhibit 2 A CPC SUCCESS STORY Corporate Profile - BioExx Specialty Proteins Ltd. 8 AI PLATFORM By continually learning each individual's desires and $1 O w )) 100% GA Mon 6:52 PM Q Preview File Edit View Go Tools Window Help AutoSave OFF AA SUF CPC assignment CPC Company Case.pdf (page 6 of 8) @ G. Q Search BOOKMARKS Exhibit 3 QUEBEC-BASED REAL ESTATE COMPANY Founders' Round - Seed Shares Price Shares Proceeds % Ownership Management Member 1 Management Member 2 Management Member 3 Other Board Members Total 500,000 500,000 500,000 2,500,000 4,000,000 $50,000 $50,000 $50,000 $250,000 $400,000 12.5% 12.5% 12.5% 62.5% 100.0% $0.10 As per TSX Venture rules, the price of the shares at the IPO of the CPC is automatically double the price of the seeds shares. Eight million shares were sold in the IPO at a price of $0.20, for $1,600,000 in proceeds. The dilution of ownership is shown below: 9 The following is what the associate at the boutique bank sent to Vigneault. It assumes that the seed shareholders do not By continually learning each individual's desires and AI PLATFORM $ O W > 100% GA Mon 6:52 PM Q Preview File Edit View Go Tools Window Window Help AutoSave OFF AASUS = CPC assignment CPC Company Case.pdf (page 7 of 8) @ G. Q Search BOOKMARKS Exhibit 3 (continued) IPO of CPC Shares Proceeds % Ownership Price 0 $0 Management Member 1 Management Member 2 Management Member 3 Other Board Members Total 0 0 0 0 8,000,000 $0 $0 $0 $1,600,000 4.2% 4.2% 4.2% 20.8% 33.4% $0.20 Prior to the private placement round concurrent with the qualifying transaction, the shares of the company were consolidated 5:1; hence, the number of shares outstanding prior to the private placement is: Seed Shares: CPC IPO Round: Total (Pre-Consolidation): Share Exchange: Shares Outstanding: 4,000,000 8,000,000 12,000,000 5 2,400,000 In order to close the qualifying transaction, the company raised capital via a private placement. The company raised $25,000,000 by issuing 11,627,907 shares at $2.15 per share. This further diluted management's ownership stake: By continually learning each individual's desires and AL PLATFORM $ O w 1500 > 100% GA Mon 6:52 PM Q Preview File Edit View Go Tools Window Help AutoSave OFF AA SUF CPC assignment CPC Company Case.pdf (page 7 of 8) @ G. Q Search S BOOKMARKS management ownersmp stake. Price Shares* Proceeds % Ownership 0 Management Member 1 Management Member 2 Management Member 3 Other Board Members Total 0 0 $0 $0 $0 $0 $25,000,000 0.9% 0.9% 0.9% 4.3% 7.0% 0 11,627,907 $2.15 * Note: 14,027,907 shares outstanding (2,400,000 + 11,627,907) By continually learning each individual's desires and AL PLATFORM $ O w > % 100% GA Mon 6:52 PM Q = Preview File Edit View Go Tools Window Help AutoSave OFF AA SUF CPC assignment CPC Company Case.pdf (page 8 of 8) @ G. n Q Search BOOKMARKS Exhibit 3 (continued) In total, after the completion of the IPO, the qualifying transaction and the concurrent private placement, the corporation had 14,027,907 shares outstanding. The resulting ownership structure is shown below: Post-Private Placement Shares Proceeds % Ownership Price Management Member 1 Management Member 2 Management Member 3 Other Board Members Total 0 0 0 0 0 14,027,907 $0 $0 $0 $0 $30,160,000 0.7% 0.7% 0.7% 3.6% 5.7% $2.15 Exhibit 4 FINANCIAL RETURN FOR SEED HOLDERS Original price Effective price* S Lift % Lift By continually learning each individual's desires and AL PLATFORM $ O W w X )) 100% GA Mon 6:52 PM Q Preview File Edit View Go Tools Window Help AutoSave OFF AA SUF CPC assignment CPC Company Case.pdf (page 8 of 8) @ G. Q Search BOOKMARKS Exhibit 4 FINANCIAL RETURN FOR SEED HOLDERS Original price Effective price* S Lift % Lift $1.65 $1.15 330% 115% Founders' shares $0.10 $0.50 CPC IPO round $0.20 $1.00 Private placement $2.15 $2.15 * Effective price takes into account the share consolidation. By continually learning each individual's desires and AL PLATFORM $ O w Help 1) 100% GA Mon 6:51 PM Q Preview File Edit View Go Tools Window AutoSave OFF AA SUF CPC assignment CPC Company Case.pdf (page 3 of 8) @ G. Q Search BOOKMARKS A CPC could also help in building a track record that could be used to graduate to a senior stock exchange such as the TSX or NASDAQ. Since the inception of the CPC program in 1987, more than 2,050 CPCs were created and more than 1,600 companies had completed their qualifying transactions. More than 300 CPCs have graduated to senior stock exchanges. Some notable graduates include Cardiome Pharma Corp., which grew into a $500 million company listed on both the TSX and NASDAQ,* and BioExx Specialty Proteins Ltd., which was formed as a CPC in September 2006 and was later listed on the TSX with a market cap of $340 million (see Exhibit 2). One disadvantage of a CPC was that the management team of a CPC did not get paid a salary: the only compensation that the management team received was in the form of share appreciation. When a qualifying transaction was completed and the CPC began trading as a normal TSX-V stock, the managers had the opportunity to take some capital off the table and realize capital gains on their seed shares. The potential for capital gains was quite high due to the method in which the CPC issued shares to the founders. The founders received shares in exchange for their seed capital at a minimum price between the greater of $0.05 and 50 per cent of the price at which subsequent shares were to be sold via prospectus; for example, if the founders of a company purchased one million shares at $0.10 ($100,000), then the shares sold in the IPO would have to be priced at $0.20. This benefited the founders, as they doubled their investment soon after their original investment. Further share appreciation was usually seen following the qualifying transaction and share consolidation. VIGNEAULT CONSIDERS A CPC To further his understanding of CPCs before consulting with his partners, Vigneault called the boutique investment bank in Toronto to talk to someone about previous transactions. He spoke with an associate at the bank who had previously worked with a CPC when it had pursued a real estate transaction. The CPC had been founded by a group of entrepreneurs with $400,000 in capital, and the CPC shell company had By continually learning each individual's desires and AI PLATFORM $1 W UO O w SA > % 100% GA Mon 6:51 PM Q Preview File Edit View Go Tools Window Help AutoSave OFF AA SUF CPC assignment CPC Company Case.pdf (page 3 of 8) @ G. Q Search BOOKMARKS VIGNEAULT CONSIDERS A CPC To further his understanding of CPCs before consulting with his partners, Vigneault called the boutique investment bank in Toronto to talk to someone about previous transactions. He spoke with an associate at the bank who had previously worked with a CPC when it had pursued a real estate transaction. The CPC had been founded by a group of entrepreneurs with $400,000 in capital, and the CPC shell company had been listed on the TSX-V. Its IPO had raised a further $1,600,000 for a total of $2,000,000 in capital. The CPC had then identified a real estate asset that they were interested in purchasing, and completed their qualifying transaction the following year. The CPC went on to become a real estate investment trust (REIT) listed on the TSX-V and had built up an impressive real estate portfolio. The associate was happy to share with Vigneault his experiences working with the CPC on the transaction, and offered to explain the resulting share structure of the company after it completed its qualifying transaction, a private placement and a share consolidation (see Exhibit 3). The associate also provided high-level financial returns for the seed shareholders (see Exhibit 4). THE DEAL Based on what he now understood about CPCs, Vigneault decided that he should complete a thorough analysis of the process and estimate how much dilution he and his partners would experience after completing a hypothetical qualifying transaction. Under the rules of the CPC Program, Vigneault and his partners would be required to invest a minimum aggregate of $100,000 in seed money into the CPC shell company. Vigneault assumed that this $100,000 would be split as follows: Vigneault would invest 3 Presentation to MBA Class by employees of the TMX Group, "TSX and TSXV - Entrepreneurial Finance Overview." Presentation took place April 21, 2010 at Richard Ivey School of Business, London, Ontario. * TMX Group; available at http://tmx.quote media.com/quote.php?qm_symbol=COM&locale=EN, accessed on April 25, 2014 By continually learning each individual's desires and AL PLATFORM $ VISA LW LOFOP Q @ Preview File Edit View Go Tools Window Help ))) 100% G2 % Mon 6:51 PM AutoSave OFF AA SUF CPC assignment CPC Company Case.pdf (page 4 of 8) G. Q Search $50,000, with his two partners investing $35,000 and $15,000, respectively. For the purpose of his analysis, he assumed that the seed shares would be priced at $0.05. Vigneault would receive 1,000,000 shares, while his first partner would receive 700,000 and his second partner 300,000. As the seed shares were issued at a price of $0.05, the IPO price of the CPC's shares would automatically be doubled (i.e. $0.10). Vigneault and his partners had set a target of capitalizing the CPC with $500,000 in cash, and would therefore aim to raise $400,000 in the IPO ($500,000 - $100,000 in seed money). BOOKMARKS The CPC's qualifying transaction would be the acquisition of an existing business, and Vigneault believed that the purchase would be in the $4,000,000 to $5,000,000 range. He decided to complete his dilution analysis based on an acquisition of $4,500,000. In order to close the qualifying transaction, the CPC would be required to raise additional capital, likely via a private placement. For the purpose of his analysis he estimated that a private placement could be done at a price of $1.25 per share, after a five for one share consolidation. The increase in share price from $0.25 to $1.25 (adjusted for the share consolidation) would reflect the increased earning potential and outlook for the company going forward post-qualifying transaction. Vigneault also recognized that the completion of a qualifying transaction would increase the amount of capital required to fund the business, and he therefore decided that an additional $1,000,000 should be raised in the private placement, for a total of $5,500,000 million. With all of his assumptions established, Vigneault set out to calculate the share structure of the CPC post-qualifying transaction and calculate the potential returns for himself and his partners. CONSIDERING HIS OPTIONS Vigneault wondered whether pursuing the CPC option made sense: he saw many benefits that the CPC Program provided, but still wondered if perhaps he should pursue more traditional financing, such as a bank loan. In order to secure traditional financing, however, he and his partners would likely be forced to identify and pursue a target business now. A CPC would give them the time and flexibility to find an ide: By continually learning each individual's desires and AI PLATFORM $ Her O W > % 100% GA Mon 6:51 PM Q Preview File Edit View Go Tools Window Help AutoSave OFF AA SUF CPC assignment CPC Company Case.pdf (page 4 of 8) @ G. Q Search BOOKMARKS CONSIDERING HIS OPTIONS Vigneault wondered whether pursuing the CPC option made sense: he saw many benefits that the CPC Program provided, but still wondered if perhaps he should pursue more traditional financing, such as a bank loan. In order to secure traditional financing, however, he and his partners would likely be forced to identify and pursue a target business now. A CPC would give them the time and flexibility to find an ideal candidate. A bank loan would also require regular interest and principle payments to be made: this could put any newly-acquired business, depending on its financial state at the time, under financial strain. Vigneault also wondered what risks he should consider: Would the market be receptive to another CPC offering? Would his significant experience, and that of his partners, be enough to attract investments? The group had worked together for many years and established a successful business track record, but this was the first time they were turning to the public market for capital. If the CPC failed in its IPO, the group would have wasted a significant amount of time and money. He also wondered if they would be able to identify an acceptable target for the qualifying transaction. If he did decide to go the CPC route, how would he explain the CPC program to his partners? They might be hesitant to pursue such an entrepreneurial option, and he was unsure if they would accept a management position that did not pay a salary, even though there was the potential for capital gains. He would have to explain to them the effect that a qualifying transaction and additional financing would have on their share ownership and what type of return they could expect if successful. Vigneault was due to meet with his partners the following day and needed to make a decision. By continually learning each individual's desires and AL PLATFORM $ O w 1) 100% GA Mon 6:52 PM Q Preview File Edit View Go Tools Window Help AutoSave OFF AA SUF Q CPC assignment CPC Company Case.pdf (page 5 of 8) G. n Q Search BOOKMARKS Exhibit 1 THE CPC PROCESS? Anatomy of a Qualifying Transaction Step 1 The Capital Pool Company Seed financing of the company (min. $100,000) + Prospectus offering to create a corporate vehicle with public distribution (max. $1.9 million) CPC Private Company Qualifying Transaction Coinciding Private Placement 0 Step 2 The Qualifying Transaction An operating company is identified, disclosed, additionally financed (if appropriate) and acquired New TSX Venture Company Exhibit 2 A CPC SUCCESS STORY Corporate Profile - BioExx Specialty Proteins Ltd. 8 AI PLATFORM By continually learning each individual's desires and $1 O w )) 100% GA Mon 6:52 PM Q Preview File Edit View Go Tools Window Help AutoSave OFF AA SUF CPC assignment CPC Company Case.pdf (page 6 of 8) @ G. Q Search BOOKMARKS Exhibit 3 QUEBEC-BASED REAL ESTATE COMPANY Founders' Round - Seed Shares Price Shares Proceeds % Ownership Management Member 1 Management Member 2 Management Member 3 Other Board Members Total 500,000 500,000 500,000 2,500,000 4,000,000 $50,000 $50,000 $50,000 $250,000 $400,000 12.5% 12.5% 12.5% 62.5% 100.0% $0.10 As per TSX Venture rules, the price of the shares at the IPO of the CPC is automatically double the price of the seeds shares. Eight million shares were sold in the IPO at a price of $0.20, for $1,600,000 in proceeds. The dilution of ownership is shown below: 9 The following is what the associate at the boutique bank sent to Vigneault. It assumes that the seed shareholders do not By continually learning each individual's desires and AI PLATFORM $ O W > 100% GA Mon 6:52 PM Q Preview File Edit View Go Tools Window Window Help AutoSave OFF AASUS = CPC assignment CPC Company Case.pdf (page 7 of 8) @ G. Q Search BOOKMARKS Exhibit 3 (continued) IPO of CPC Shares Proceeds % Ownership Price 0 $0 Management Member 1 Management Member 2 Management Member 3 Other Board Members Total 0 0 0 0 8,000,000 $0 $0 $0 $1,600,000 4.2% 4.2% 4.2% 20.8% 33.4% $0.20 Prior to the private placement round concurrent with the qualifying transaction, the shares of the company were consolidated 5:1; hence, the number of shares outstanding prior to the private placement is: Seed Shares: CPC IPO Round: Total (Pre-Consolidation): Share Exchange: Shares Outstanding: 4,000,000 8,000,000 12,000,000 5 2,400,000 In order to close the qualifying transaction, the company raised capital via a private placement. The company raised $25,000,000 by issuing 11,627,907 shares at $2.15 per share. This further diluted management's ownership stake: By continually learning each individual's desires and AL PLATFORM $ O w 1500 > 100% GA Mon 6:52 PM Q Preview File Edit View Go Tools Window Help AutoSave OFF AA SUF CPC assignment CPC Company Case.pdf (page 7 of 8) @ G. Q Search S BOOKMARKS management ownersmp stake. Price Shares* Proceeds % Ownership 0 Management Member 1 Management Member 2 Management Member 3 Other Board Members Total 0 0 $0 $0 $0 $0 $25,000,000 0.9% 0.9% 0.9% 4.3% 7.0% 0 11,627,907 $2.15 * Note: 14,027,907 shares outstanding (2,400,000 + 11,627,907) By continually learning each individual's desires and AL PLATFORM $ O w > % 100% GA Mon 6:52 PM Q = Preview File Edit View Go Tools Window Help AutoSave OFF AA SUF CPC assignment CPC Company Case.pdf (page 8 of 8) @ G. n Q Search BOOKMARKS Exhibit 3 (continued) In total, after the completion of the IPO, the qualifying transaction and the concurrent private placement, the corporation had 14,027,907 shares outstanding. The resulting ownership structure is shown below: Post-Private Placement Shares Proceeds % Ownership Price Management Member 1 Management Member 2 Management Member 3 Other Board Members Total 0 0 0 0 0 14,027,907 $0 $0 $0 $0 $30,160,000 0.7% 0.7% 0.7% 3.6% 5.7% $2.15 Exhibit 4 FINANCIAL RETURN FOR SEED HOLDERS Original price Effective price* S Lift % Lift By continually learning each individual's desires and AL PLATFORM $ O W w X )) 100% GA Mon 6:52 PM Q Preview File Edit View Go Tools Window Help AutoSave OFF AA SUF CPC assignment CPC Company Case.pdf (page 8 of 8) @ G. Q Search BOOKMARKS Exhibit 4 FINANCIAL RETURN FOR SEED HOLDERS Original price Effective price* S Lift % Lift $1.65 $1.15 330% 115% Founders' shares $0.10 $0.50 CPC IPO round $0.20 $1.00 Private placement $2.15 $2.15 * Effective price takes into account the share consolidation. By continually learning each individual's desires and AL PLATFORM $ O w