Answered step by step

Verified Expert Solution

Question

1 Approved Answer

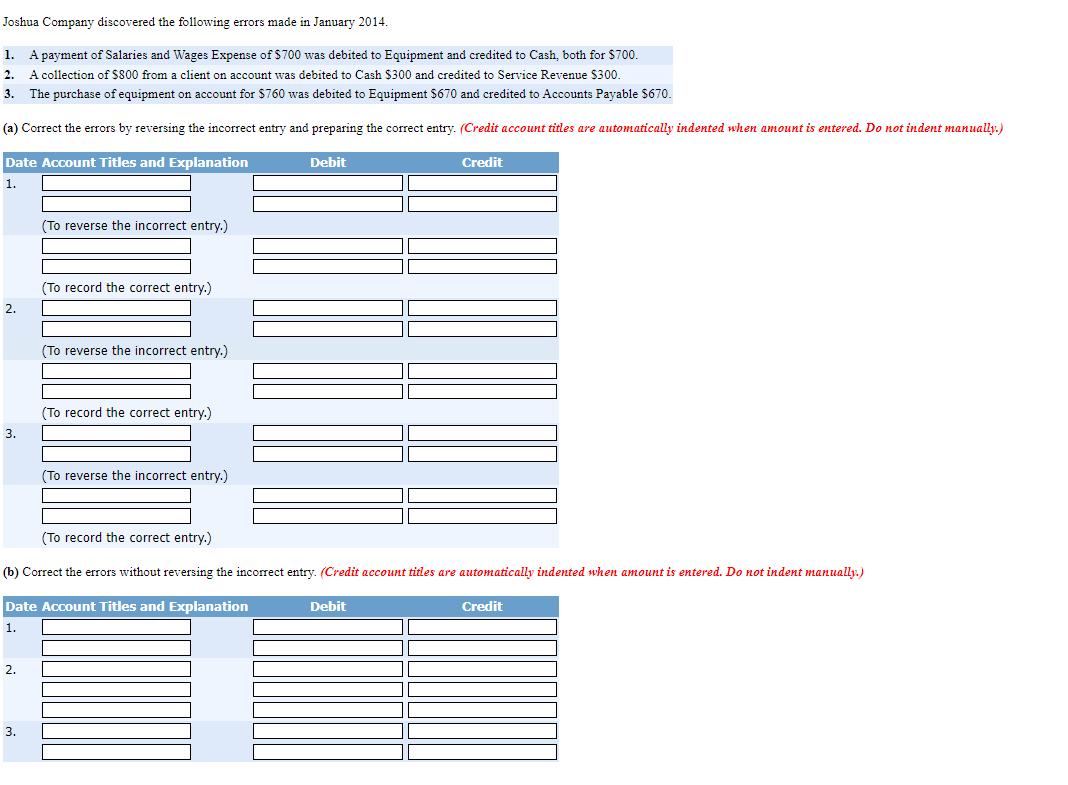

Joshua Company discovered the following errors made in January 2014. A payment of Salaries and Wages Expense of $700 was debited to Equipment and

Joshua Company discovered the following errors made in January 2014. A payment of Salaries and Wages Expense of $700 was debited to Equipment and credited to Cash, both for $700. A collection of $800 from a client on account was debited to Cash $300 and credited to Service Revenue $300. 1. 2. 3. The purchase of equipment on account for $760 was debited to Equipment $670 and credited to Accounts Payable $670. (a) Correct the errors by reversing the incorrect entry and preparing the correct entry. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation 1. 2. 3. 2. (To reverse the incorrect entry.) 3. (To record the correct entry.) (To reverse the incorrect entry.) (To record the correct entry.) (To reverse the incorrect entry.) Debit (To record the correct entry.) (b) Correct the errors without reversing the incorrect entry. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation 1. Credit Debit Credit

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

B DATE Correct the errors by reversing the incorrect e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started