Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joslin Manufacturing, Inc. has a manufacturing machine that needs attention. i (Click the icon to view additional information.) Joslin expects the following net cash inflows

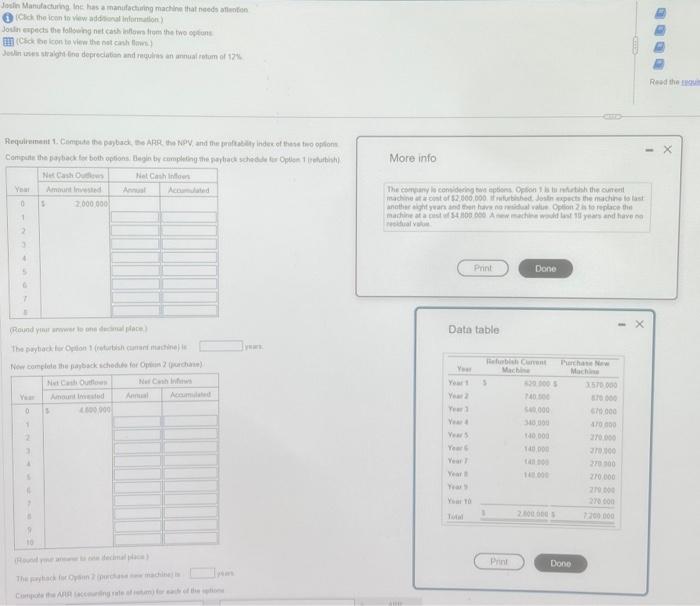

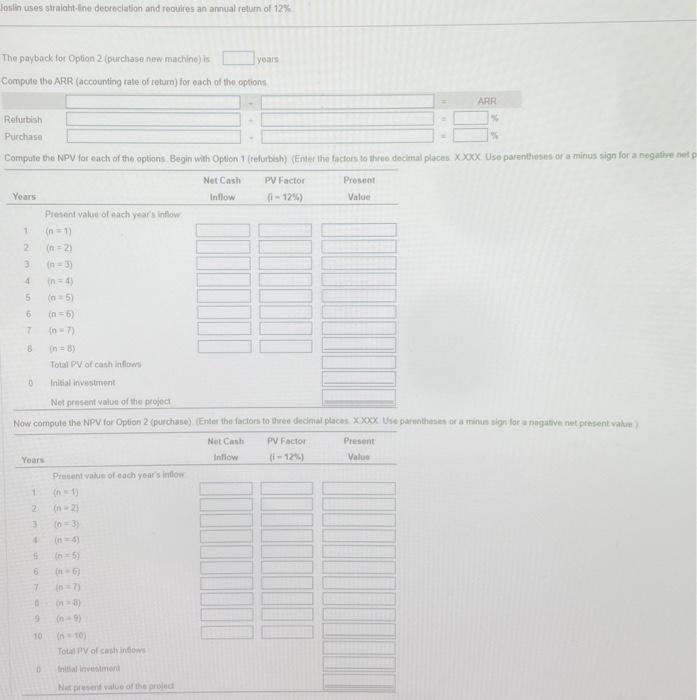

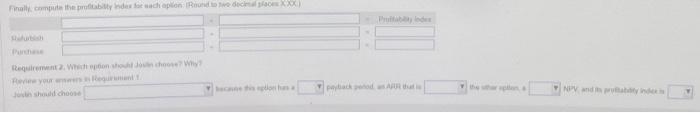

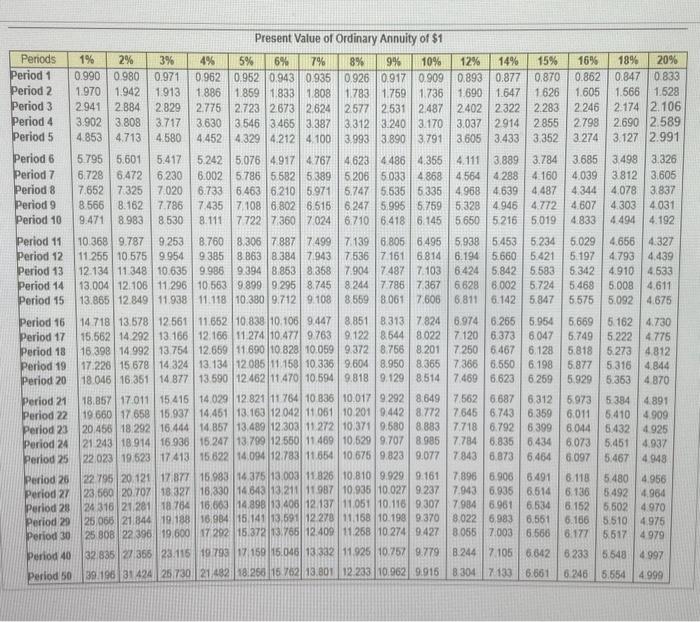

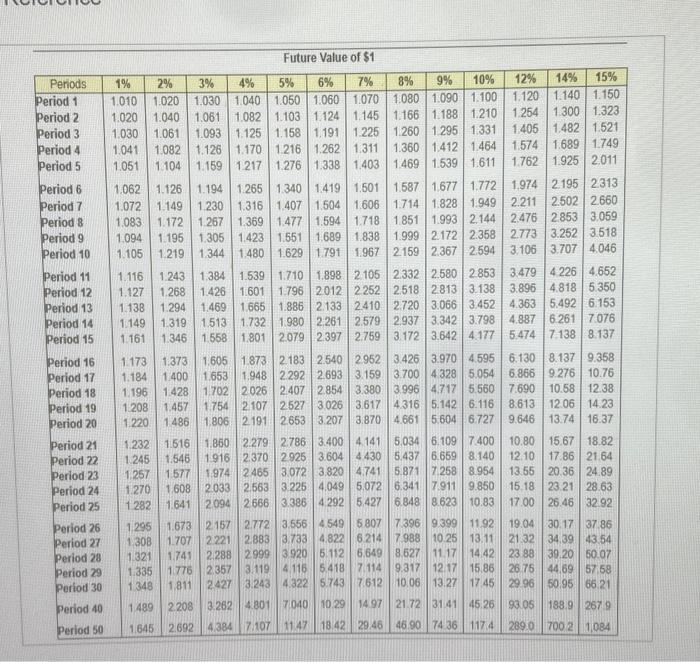

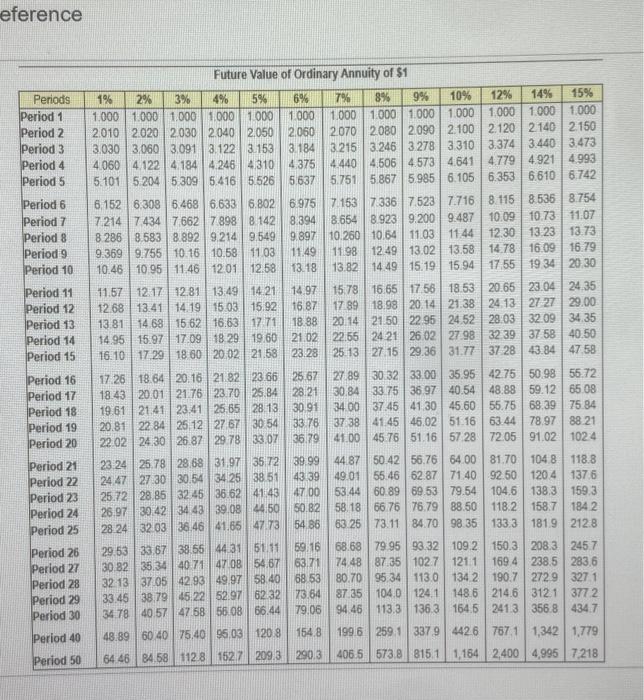

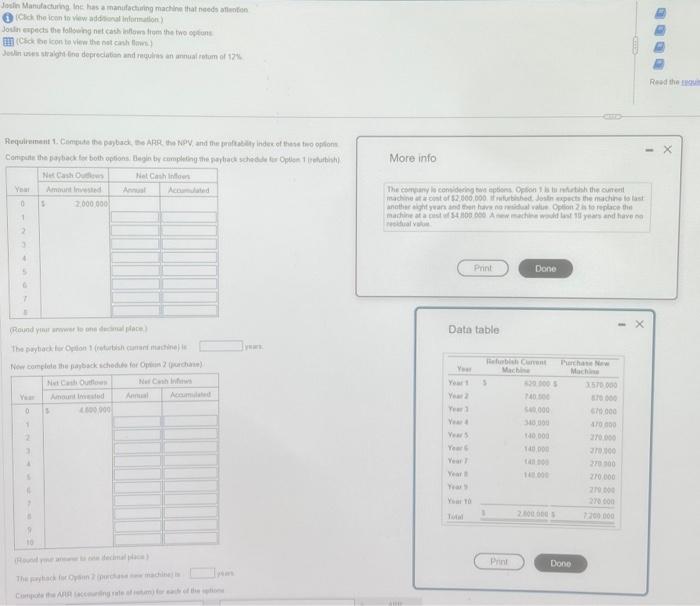

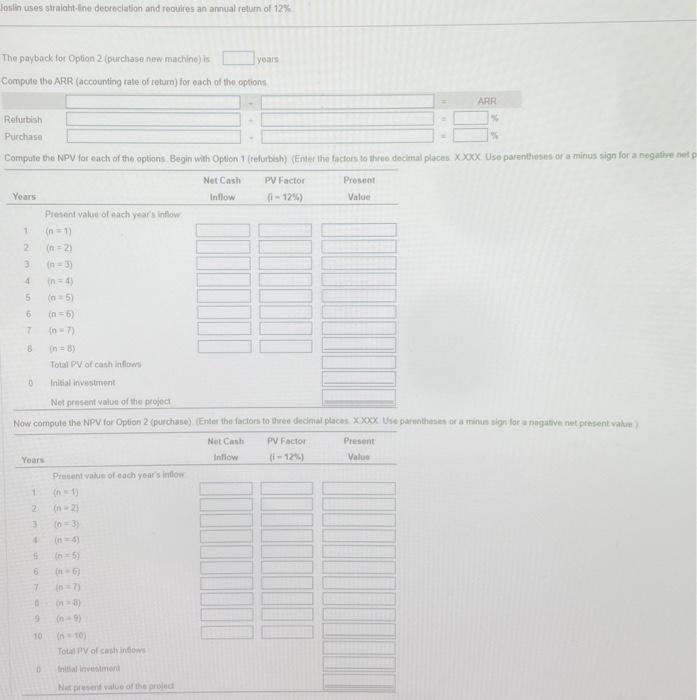

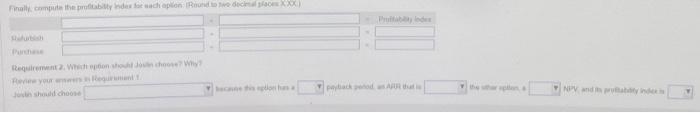

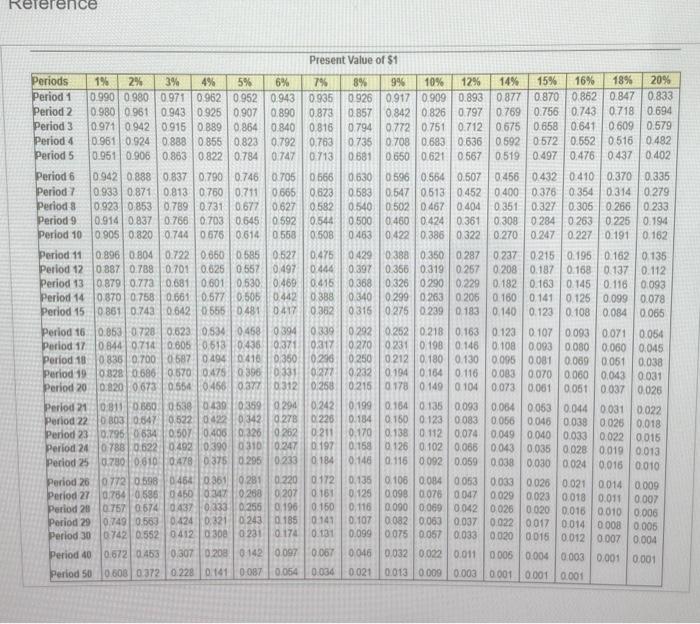

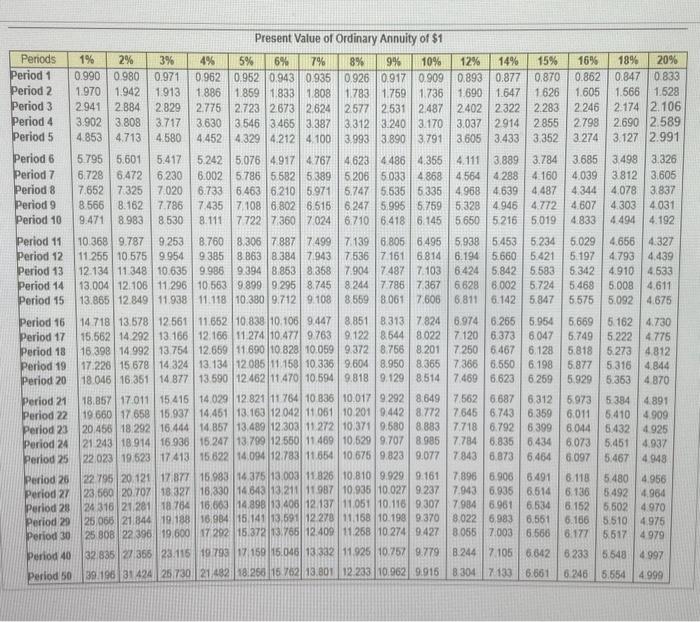

Joslin Manufacturing, Inc. has a manufacturing machine that needs attention. i (Click the icon to view additional information.) Joslin expects the following net cash inflows from the two options: (Click the icon to view the net cash flows.) Joslin uses straight-line depreciation and requires an annual return of 12%. Requirement 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options. Comp the payback for both options. Begin by completing the payback schedule for Option 1 (refurbish). Net Cash Inflows Year 0 1 2 3 4 5 6 7 8 Year 0 Net Cash Outflows Amount Invested- 2,000,000 1 2 3 4 5 6 7 8 9 10 $ (Round your answer to one decimal place.) The payback for Option 1 (refurbish current machine) is Now complete the payback schedule for Option 2 (purchase). Net Cash Inflows Net Cash Outflows Amount Invested 4,800,000 Annual $ Accumulated Annual Accumulated (Round your answer to one decimal place.) The payback for Option 2 (purchase new machine) is Compute the ARR (accounting rate of return) for each of the options. years years. More info The company is considering two options. Option 1 is to refurbish the current machine at a cost of $2,000,000. If refurbished, Joslin expects the machine to last another eight years and then have no residual value Option 2 is to replace the machine at a cost of $4,800,000 A new machine would last 10 years and have no residual value. ARR Data table Year Print Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Total $ $ Refurbish Current Machine Done Print 620,000 $ 740,000 540,000 340,000 140,000 140,000 140,000 140,000 2,800,000 $ Purchase New Machine Done

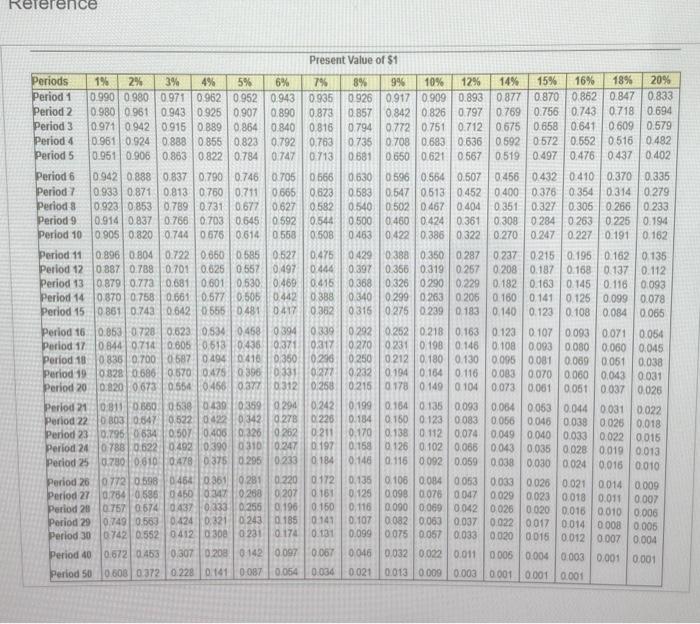

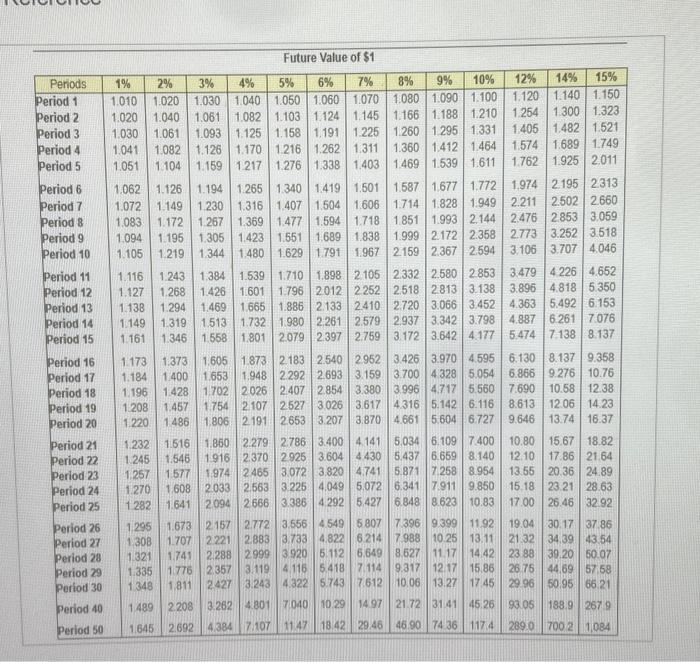

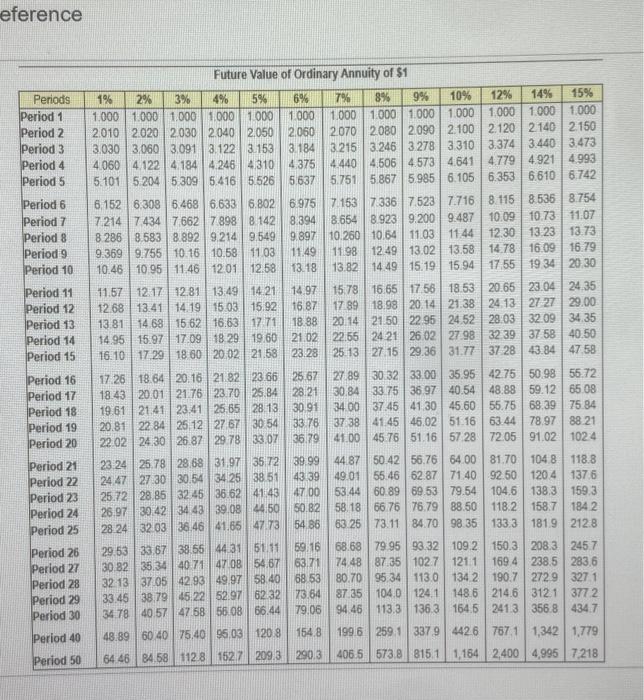

Jesfin Manulacturng lac has a manifschiring machine that needs afteoten Josin erpects the lollowing net cash infleres ligm the twe ogftunt (Ciok be kcon te vien the pot conh llain) Jeoder ioves strakgit line depreciation and regulins an annual rotum of 12% Requirement 1. Combide the pogbad tes ARP the NoY, and the preftaldiy indec of these tho options More info another aighif yean and then have na weidual valie Gptiont 2 a to fonlace the resitual yotue Data table Lotilin uses straiaht-line deoreclation and reouires an annual return of 12% The payback for Option 2 (purchase new machine) is years Compute the ARR (accounting rate of cetum) for oach of the oplions Phareman doven shoudichoose Reterence Present Value of Ordinary Annuity of $1 Future Value of $1 Eustura Valina nf nertinaru Annutity of A Jesfin Manulacturng lac has a manifschiring machine that needs afteoten Josin erpects the lollowing net cash infleres ligm the twe ogftunt (Ciok be kcon te vien the pot conh llain) Jeoder ioves strakgit line depreciation and regulins an annual rotum of 12% Requirement 1. Combide the pogbad tes ARP the NoY, and the preftaldiy indec of these tho options More info another aighif yean and then have na weidual valie Gptiont 2 a to fonlace the resitual yotue Data table Lotilin uses straiaht-line deoreclation and reouires an annual return of 12% The payback for Option 2 (purchase new machine) is years Compute the ARR (accounting rate of cetum) for oach of the oplions Phareman doven shoudichoose Reterence Present Value of Ordinary Annuity of $1 Future Value of $1 Eustura Valina nf nertinaru Annutity of A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started