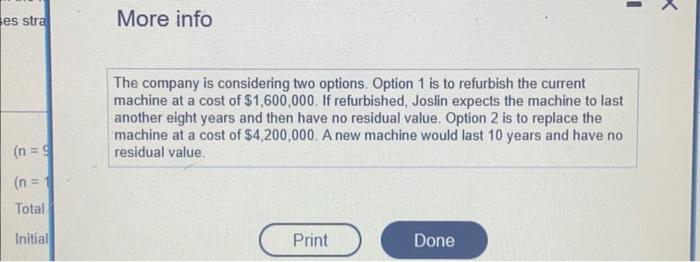

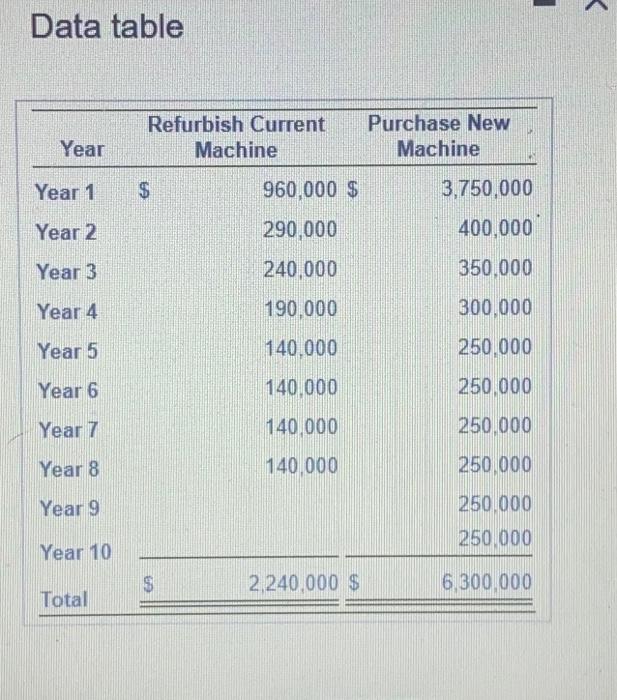

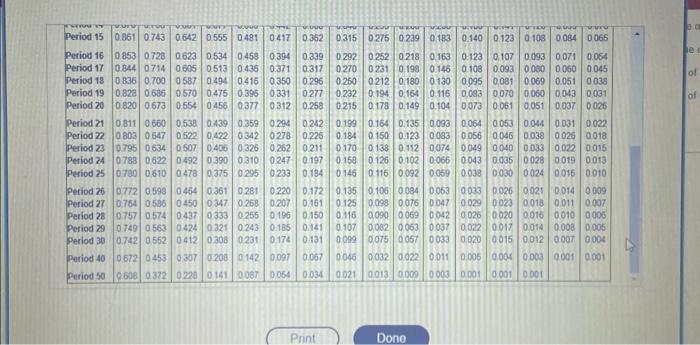

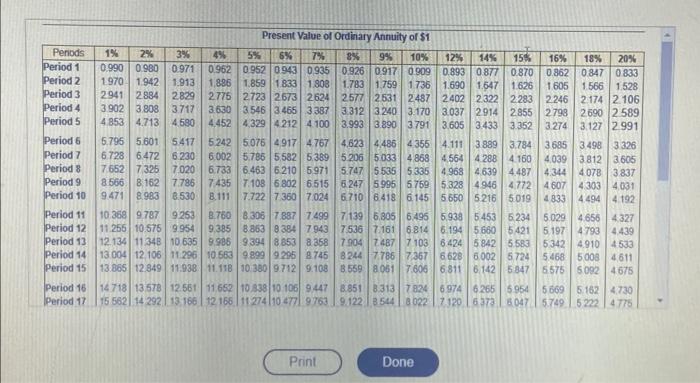

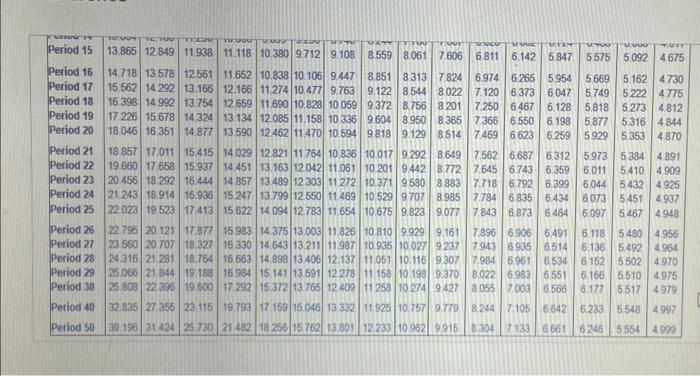

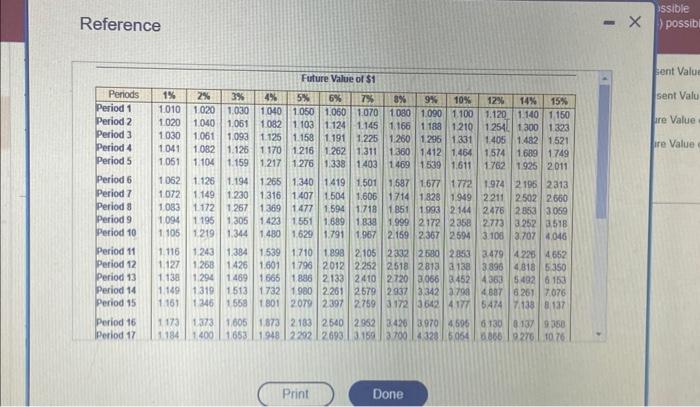

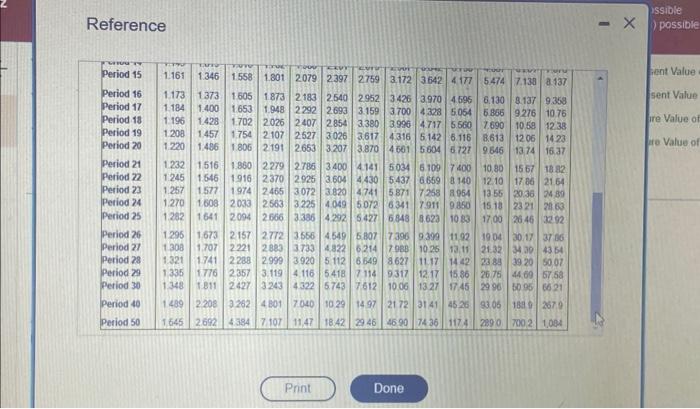

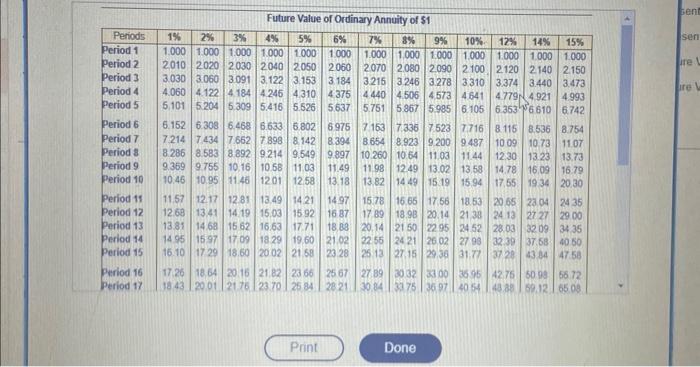

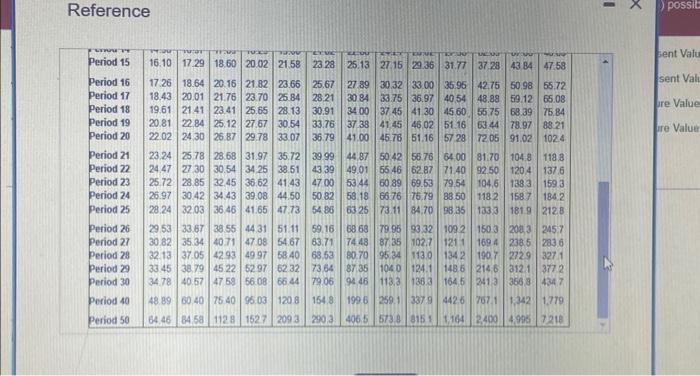

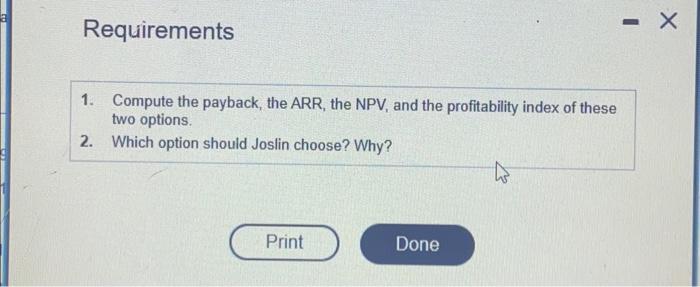

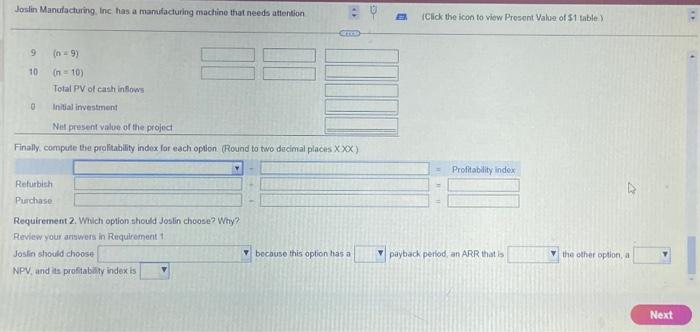

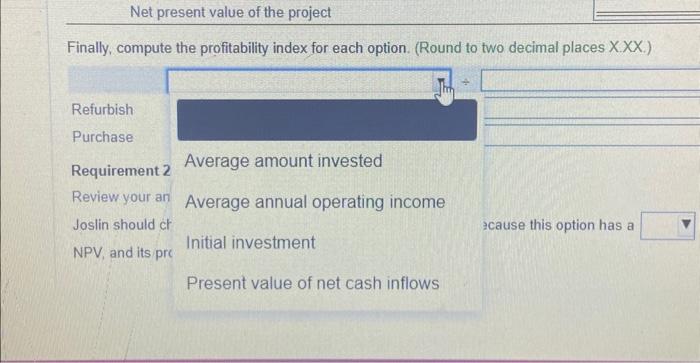

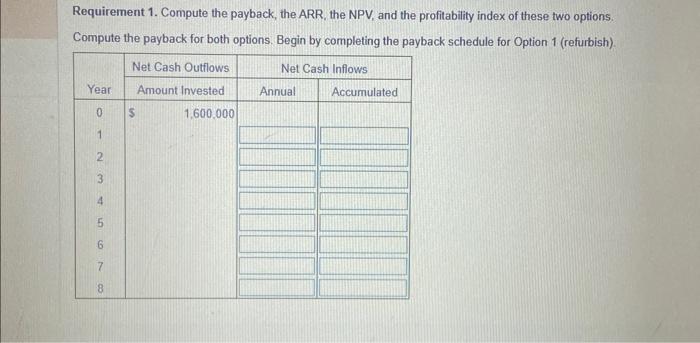

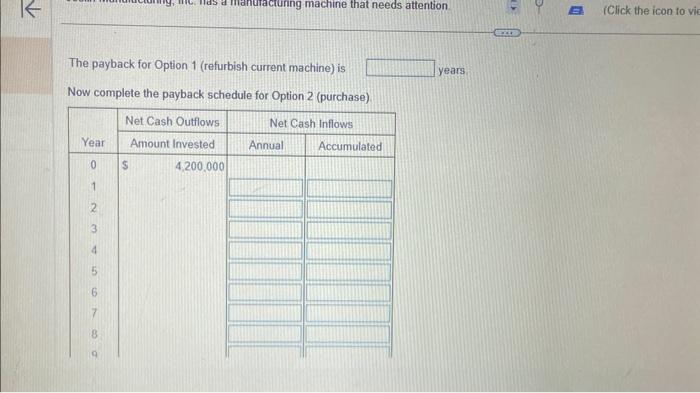

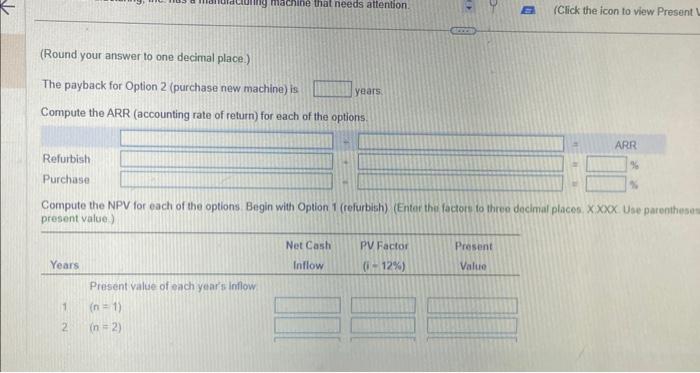

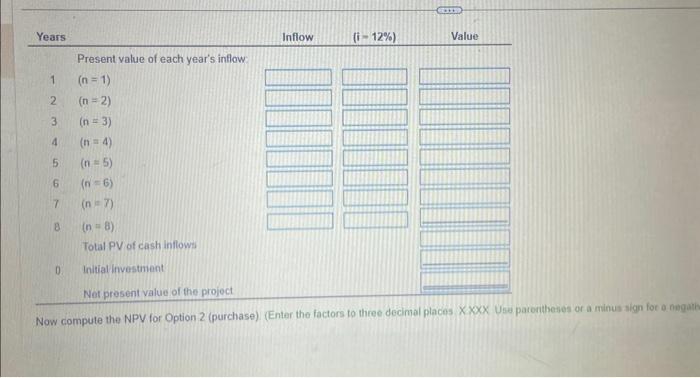

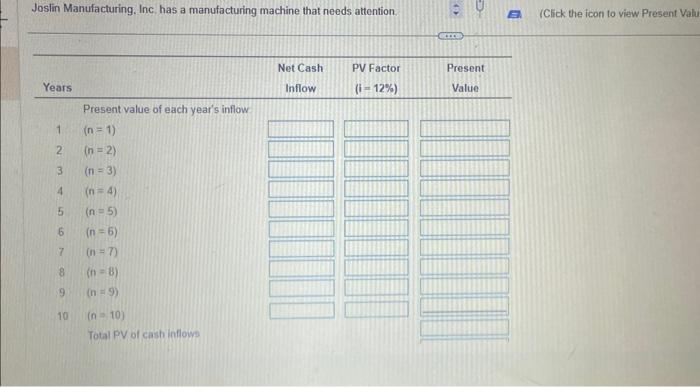

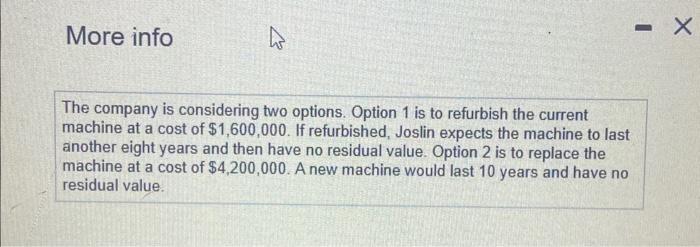

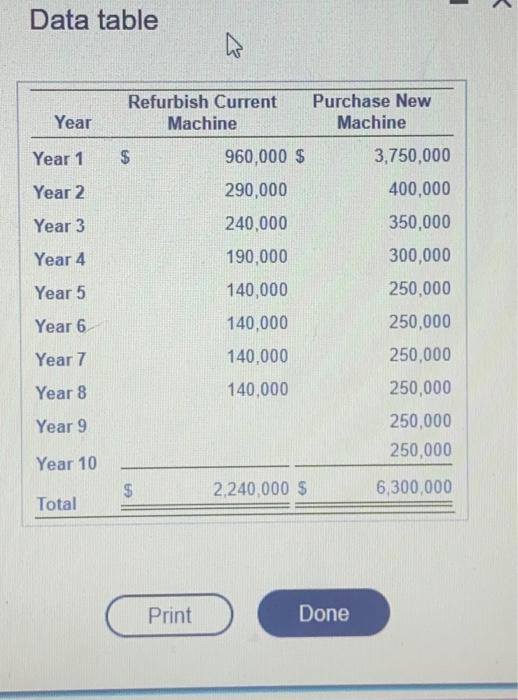

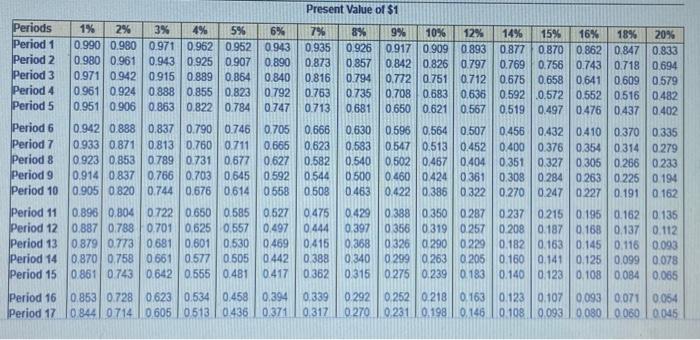

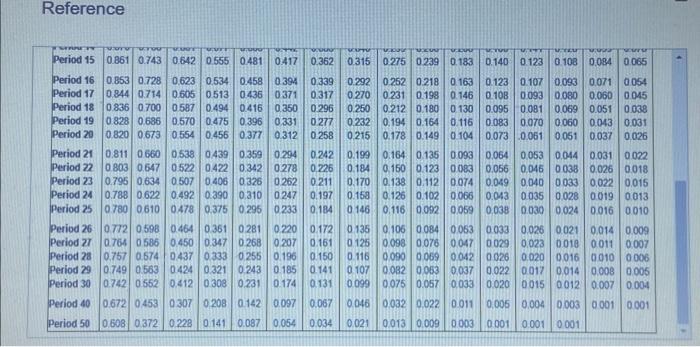

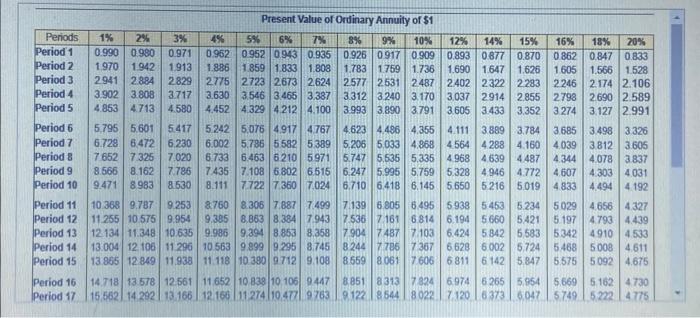

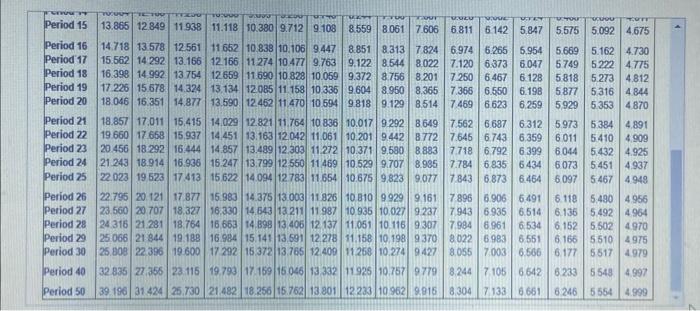

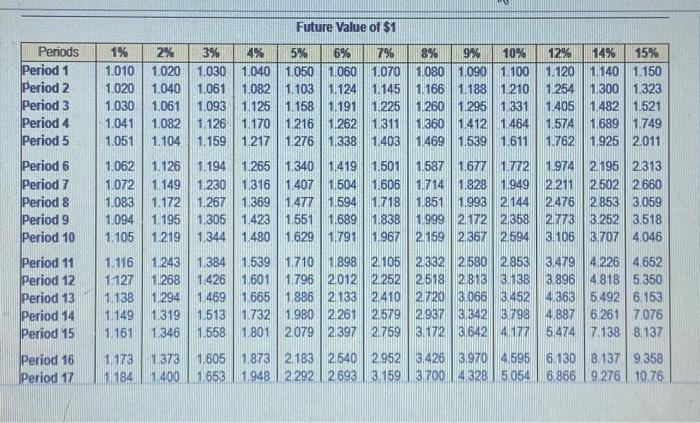

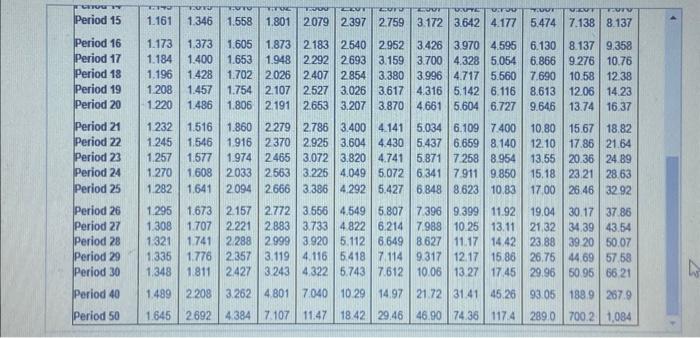

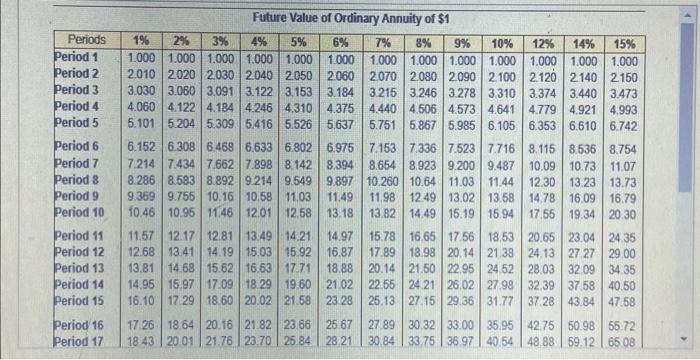

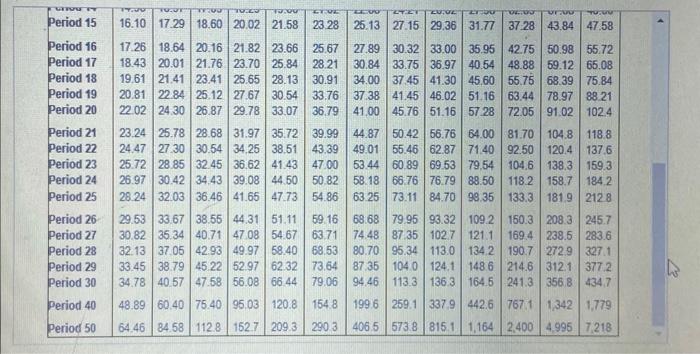

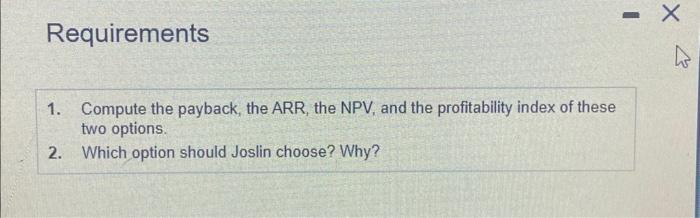

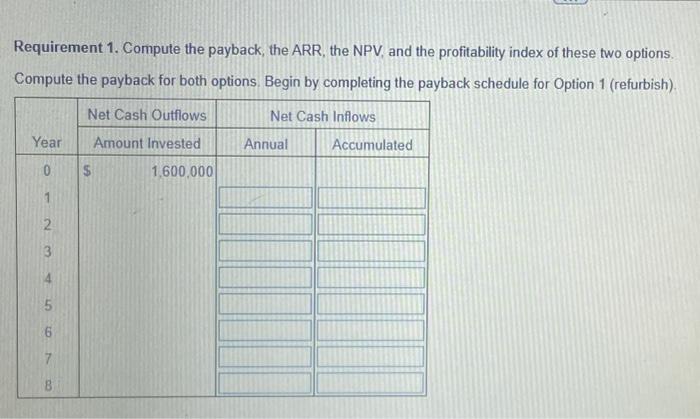

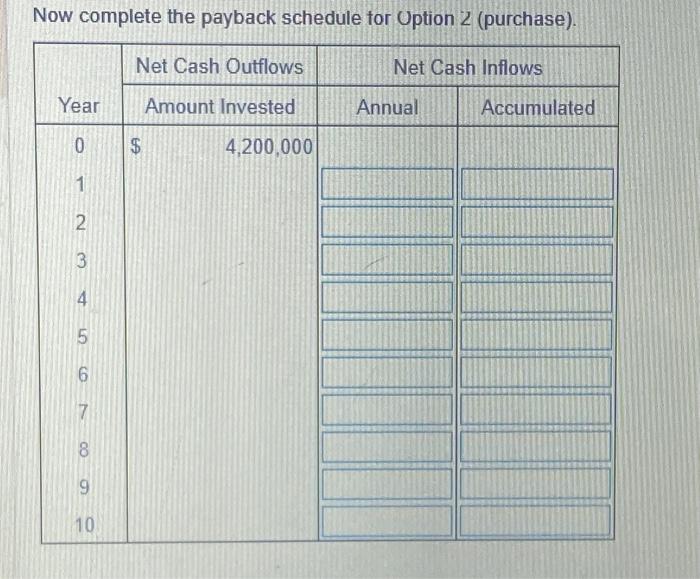

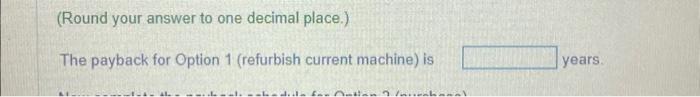

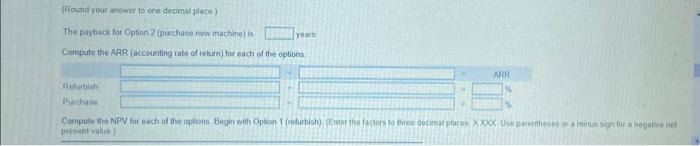

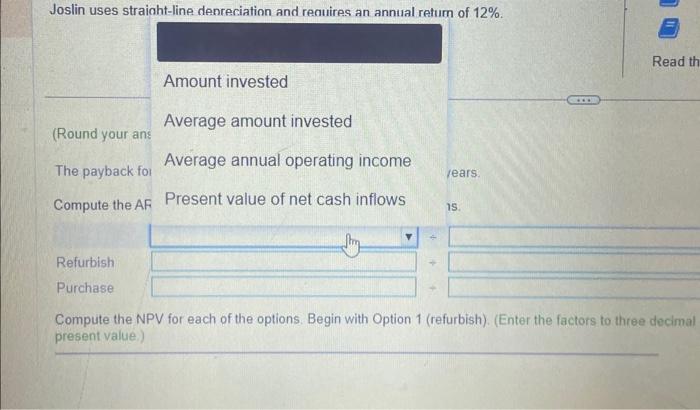

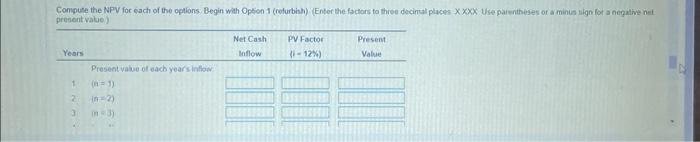

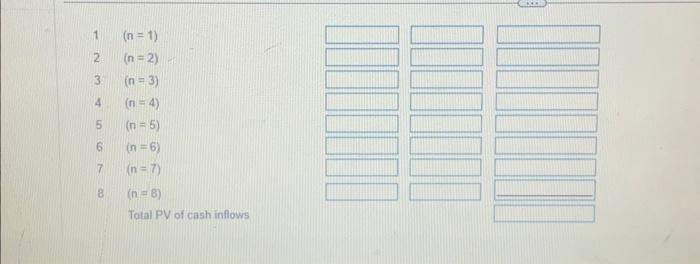

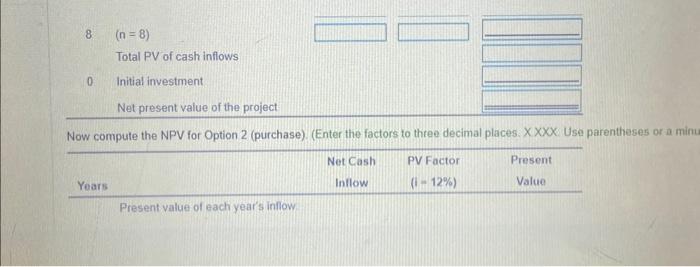

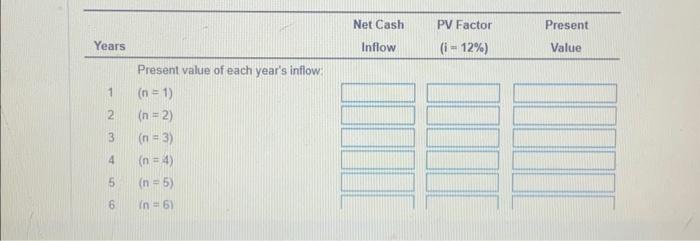

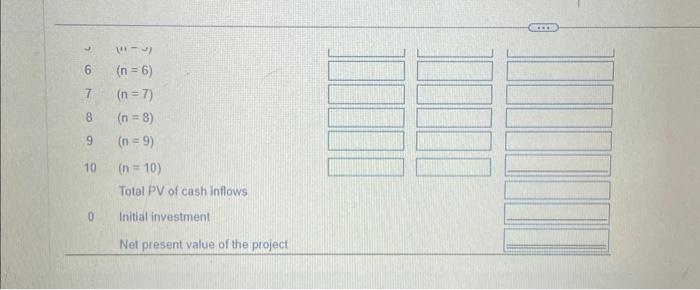

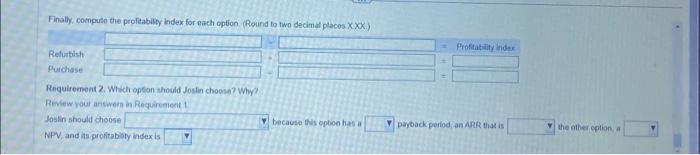

Jostin Manufachuring, Inc. has a manufacturing machine that needs attention (Click the icon to view Present Value of \$1 table ) (1) (Cick the icon to view additional information') (Click the icon to view Present Value of Ordinary Annuify of 51 Joskin expects the following net cash inflows from the two options (Click the icon to view the net cash llows) (Cilick the icon to view Future Value of S1 table) Josfin uses straight-line depreciation and tequlres an annual tetum of 12% (CSck the icon to view Futare Value of Ordinary Annuly of 51 Read the teguirements Fircally, compute the profiability index for eoch opton (Round to two decimal places XXX ) Proritatility index More info The company is considering two options. Option 1 is to refurbish the current machine at a cost of $1,600,000. If refurbished, Joslin expects the machine to last another eight years and then have no residual value. Option 2 is to replace the machine at a cost of $4,200,000. A new machine would last 10 years and have no residual value. Data table Done Present Value of Ordinary Annuity of $1 Print Done Reference Reference Future Value of Ordinary Annuity of $1 Print Done Reference Requirements 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options. 2. Which option should Joslin choose? Why? Jostin Manutacturing, inc has a manufacturing machine that needs attention : % (Cick the icon to viow Prosont Value of 51 labte) Finally compuite the profitablily indox for each option. (Rounid to two decimal places ) Requirement 2. Which option should Joslin choose? Why? Review your ariwhers in Requirement 1 Joslin should choost payback period; an ARR that is the other option, a NPV, and is prostabilly index is Finally, compute the profitability index for each option. (Round to two decimal places XX.) Refurbish Purchase Requirement 2 Review your an Joslin should ch zcause this option has a Requirement 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options. Compute the payback for both options. Begin by completing the payback schedule for Option 1 (refurbish). The payback for Option 1 (refurbish current machine) is years Now complete the payback schedule for Option 2 (purchase) (Round your answer to one decimal place.) The payback for Option 2 (purchase new machine) is years Compute the ARR (accounting rate of return) for each of the options. Compute the NPV for each of the options Begin with Option 1 (refurbish) (Enter thi factor to three decimal places. X XOCX. Use parenthese present value.) Now compute the NPV for Option 2 (purchase) (Enter the factors to three decimal places X XXX Usu parentheies or a minus sign foc o nagar Joslin Manufacturing. Inc. has a manufacturing machine that needs attention Joslin Manufacturing, Inc. has a manufacturing machine that needs attention. (Click the icon to view additional information.) Joslin expects the following net cash inflows from the two options: (Click the icon to view the net cash flows.) Joslin uses straight-line depreciation and requires an annual return of 12%. The company is considering two options. Option 1 is to refurbish the current machine at a cost of $1,600,000. If refurbished, Joslin expects the machine to last another eight years and then have no residual value. Option 2 is to replace the machine at a cost of $4,200,000. A new machine would last 10 years and have no residual value. Data table Present Value of $1 Reference Present Value of Ordinary Annuity of \$1 Future Value of $1 \begin{tabular}{|l|l|l|l|l|l|l|l|l|l|l|l|l|l|l|} \hline Period 15 & 1.161 & 1.346 & 1.558 & 1.801 & 2.079 & 2397 & 2.759 & 3.172 & 3.642 & 4.177 & 5.474 & 7.138 & 8.137 \\ Period 16 & 1.173 & 1.373 & 1.605 & 1.873 & 2.183 & 2.540 & 2.952 & 3.426 & 3.970 & 4.595 & 6.130 & 8.137 & 9.358 \\ Period 17 & 1.184 & 1.400 & 1.653 & 1.948 & 2.292 & 2.693 & 3.159 & 3.700 & 4.328 & 5.054 & 6.866 & 9.276 & 10.76 \\ Period 18 & 1.196 & 1.428 & 1.702 & 2.026 & 2.407 & 2.854 & 3.380 & 3.996 & 4.717 & 5.560 & 7.690 & 10.58 & 12.38 \\ Period 19 & 1.208 & 1.457 & 1.754 & 2.107 & 2.527 & 3.026 & 3.617 & 4.316 & 5.142 & 6.116 & 8.613 & 12.06 & 14.23 \\ Period 20 & 1.220 & 1.486 & 1.806 & 2.191 & 2.653 & 3.207 & 3.870 & 4.661 & 5.604 & 6.727 & 9.646 & 13.74 & 16.37 \\ Period 21 & 1.232 & 1.516 & 1.860 & 2.279 & 2.786 & 3.400 & 4.141 & 5.034 & 6.109 & 7.400 & 10.80 & 15.67 & 18.82 \\ Period 22 & 1.245 & 1.546 & 1.916 & 2370 & 2.925 & 3.604 & 4.430 & 5.437 & 6.659 & 8.140 & 12.10 & 17.86 & 21.64 \\ Period 23 & 1.257 & 1.577 & 1.974 & 2465 & 3.072 & 3.820 & 4.741 & 5.871 & 7.258 & 8.954 & 13.55 & 20.36 & 24.89 \\ Period 24 & 1.270 & 1.608 & 2.033 & 2.663 & 3.225 & 4.049 & 5.072 & 6.341 & 7.911 & 9.850 & 15.18 & 23.21 & 28.63 \\ Period 25 & 1.282 & 1.641 & 2.094 & 2.666 & 3.386 & 4.292 & 5.427 & 6.848 & 8.623 & 10.83 & 17.00 & 26.46 & 32.92 \\ Period 26 & 1.295 & 1.673 & 2.157 & 2.772 & 3.556 & 4.549 & 5.807 & 7.396 & 9.399 & 11.92 & 19.04 & 30.17 & 37.86 \\ Period 27 & 1.308 & 1.707 & 2.221 & 2.883 & 3.733 & 4.822 & 6.214 & 7.983 & 10.25 & 13.11 & 21.32 & 34.39 & 43.54 \\ Period 28 & 1.321 & 1.741 & 2.288 & 2.999 & 3920 & 5.112 & 6.649 & 8.627 & 11.17 & 14.42 & 23.88 & 39.20 & 50.07 \\ Period 29 & 1.335 & 1.776 & 2.357 & 3.119 & 4.116 & 5.418 & 7.114 & 9.317 & 12.17 & 15.86 & 26.75 & 44.69 & 57.58 \\ Period 30 & 1.348 & 1.811 & 2.427 & 3.243 & 4.322 & 5.743 & 7.612 & 10.06 & 13.27 & 17.45 & 29.96 & 50.95 & 66.21 \\ Period 40 & 1.489 & 2.208 & 3.262 & 4.801 & 7.040 & 10.29 & 14.97 & 21.72 & 31.41 & 45.26 & 93.05 & 188.9 & 267.9 \\ Period 50 & 1.645 & 2.692 & 4.384 & 7.107 & 11.47 & 18.42 & 29.46 & 46.90 & 74.36 & 117.4 & 289.0 & 700.2. & 1.084 \\ \hline \end{tabular} Future Value of Ordinarv Annuify of \$1 Requirements 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options. 2. Which option should Joslin choose? Why? Requirement 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options Compute the payback for both options. Begin by completing the payback schedule for Option 1 (refurbish). Now complete the Davback schedule tor Untion (nurchase) (Round your answer to one decimal place.) The payback for Option 1 (refurbish current machine) is years. (Round your anewer to one docmal place) The paybsck for Cption 2 (puachase new machine) is roats Compute the ARR (accounting rate of return) for each of the options Joslin uses straioht-line denreciation and reauires an annual retum of 12%. Amount invested Average amount invested (Round your ans The payback for Average annual operating income lears. Compute the AF Present value of net cash inflows 15. Refurbish Purchase Compute the NPV for each of the options. Begin with Option 1 (refurbish). (Enter the factors to three decimal present value.) Compuse the NPV for each of the options. Begin wath Option 1 (roturbihh) (Enter the foctors to three decintal places Xxx Use parentheses of a minis sign for a negative net present vatue) 12345678(n=1)(n=2)(n=3)(n=4)(n=5)(n=6)(n=7)(n=8) Total PV of cash inflows 8(n=8) Total PV of cash inflows 0. Initial investment Net present value of the project Now compute the NPV for Option 2 (purchase). (Enter the factors to three decimal places, X XXX Use parentheses or a minu \begin{tabular}{cccc} & Net Cash & PVFactor & Present \\ Years & Inllow & (112%) & Value \\ \hline \end{tabular} Present value of each year's inflow \begin{tabular}{lll|} & (n2) \\ 6 & (n=6) & \\ 7 & (n=7) \\ 8 & (n=8) \\ 9 & (n=9) \\ 10 & (n=10) & \end{tabular} Total PV of cash inflows 0 Initial investment Net present value of the project Finally, compute the profitabilty idex for each option (Round to two decimal placos .) Refurtish Purchase Requirement 2. Which option should Josin choosa? Why? Review your ariswers in Requareneet 1 Hoshin should choose because this option has a payback period an ARR that is the ather cotion a NPV, and its proftabily index is Finally, compute the profitability index for each option. (Round to two decimal places XXX.) Refurbish Purchase Requirement 2 Reviewyour an Joslin should cl 7cause this option has a payback period, an A: Finally, compute the profitability index for each option. (Round to two decimal places XXX.) Refurbish Purchase Requirement 2. Whic Review your answers Joslin should choose because this option has a payback period, an A NPV, and its profitability index is