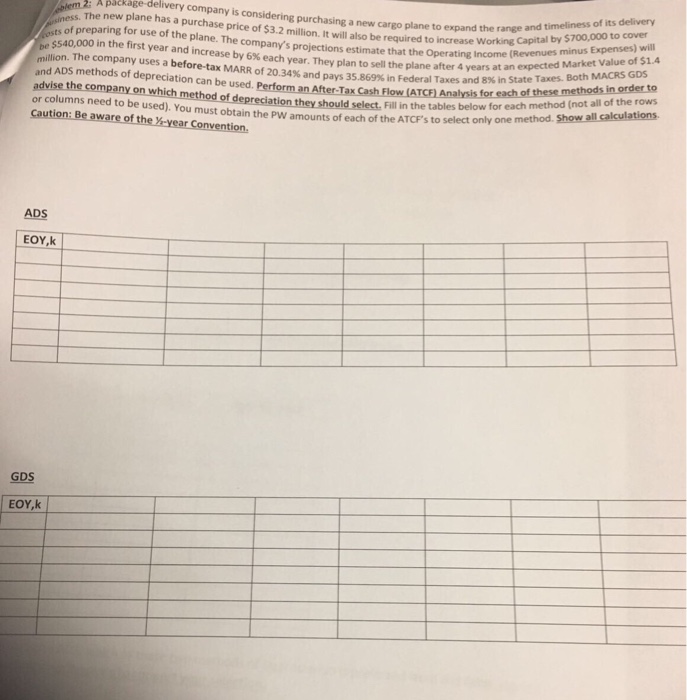

A package-delivery company is considering purchasing a new cargo plane to expand the range and timeliness of its delivery business. The new plane has a purchase price of $3.2 million. It will also be required to increase Working Capital by $700,000 to cover costs of preparing for use of the plane. The company's projection estimate that the Operating Income (Revenues minus Expenses) will be $540,000 in the first year and increase by 6% each year. They plan to sell the plane after 4 years at an expected Market Value of $1.4 million. The company uses a before-tax MARR of 20.34% and pays 35.869% in Federal Taxes and 8% in State Taxes. Both MACRS GDS and ADS methods of depreciation can be used. Perform an After-Tax Cash Flow (ATCF) Analysis for each of these methods in order to advise the company on which method of depreciation they should select. Fill in the tables below for each method (not all of the rows or columns need to be used). You must obtain the PW amounts of each of the ATCF's to select only one method. Show all calculations. Caution: Be aware of the 1/2-year Convention. A package-delivery company is considering purchasing a new cargo plane to expand the range and timeliness of its delivery business. The new plane has a purchase price of $3.2 million. It will also be required to increase Working Capital by $700,000 to cover costs of preparing for use of the plane. The company's projection estimate that the Operating Income (Revenues minus Expenses) will be $540,000 in the first year and increase by 6% each year. They plan to sell the plane after 4 years at an expected Market Value of $1.4 million. The company uses a before-tax MARR of 20.34% and pays 35.869% in Federal Taxes and 8% in State Taxes. Both MACRS GDS and ADS methods of depreciation can be used. Perform an After-Tax Cash Flow (ATCF) Analysis for each of these methods in order to advise the company on which method of depreciation they should select. Fill in the tables below for each method (not all of the rows or columns need to be used). You must obtain the PW amounts of each of the ATCF's to select only one method. Show all calculations. Caution: Be aware of the 1/2-year Convention