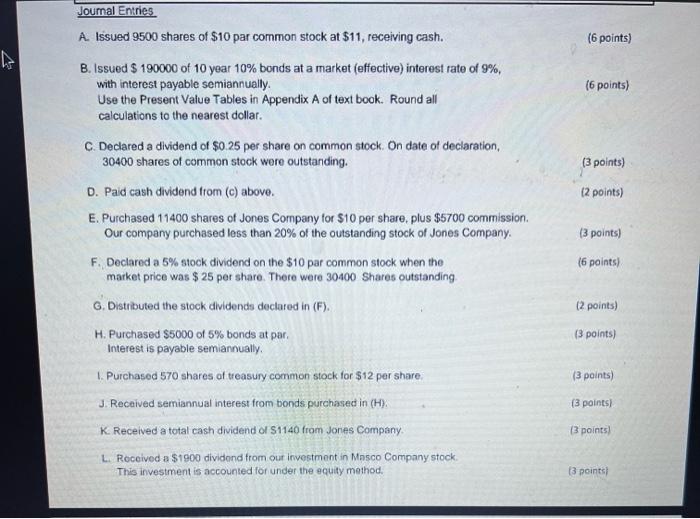

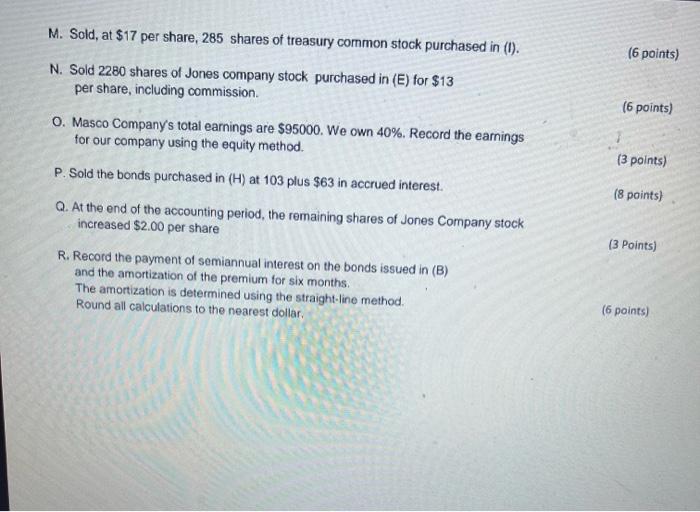

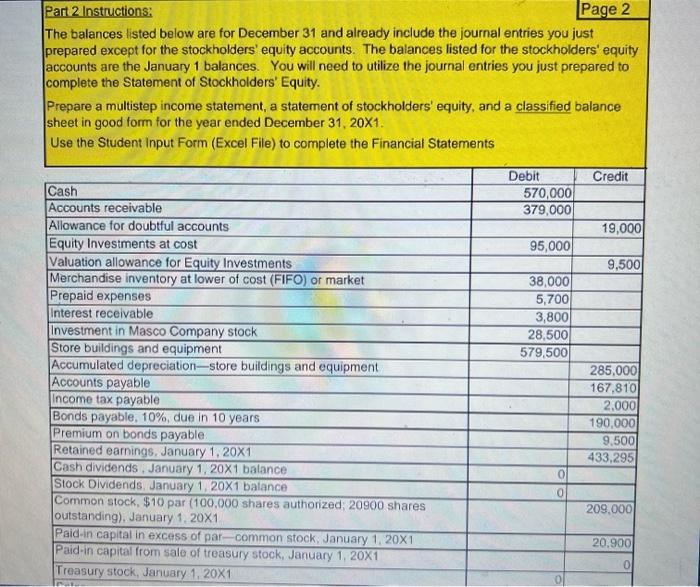

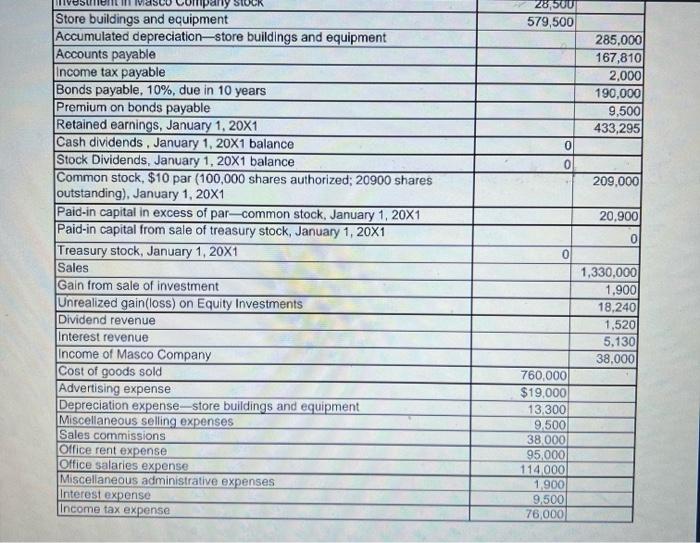

Joumal Entries A. Issued 9500 shares of $10 par common stock at $11, receiving cash. (6 points) B. Issued $190000 of 10 year 10% bonds at a market (effective) interest rate of 9%, with interest payable semiannually. Use the Present Value Tables in Appendix A of text book. Round all (6 points) calculations to the nearest dollar. C. Declared a dividend of $0.25 per share on common stock. On date of declaration, 30400 shares of common stock were outstanding. (3 points) D. Paid cash dividend from (c) above. (2 points) E. Purchased 11400 shares of Jones Company for $10 per share, plus $5700 commission. Our company purchased less than 20% of the outstanding stock of Jones Company. (3 points) F. Declared a 5% stock dividend on the $10 par common stock when the (6 points) market price was $25 per share. There were 30400 Shares outstanding G. Distributed the stock dividends declared in (F). (2 points) H. Purchased $5000 of 5% bonds at par, (3 points) Interest is payable semiannually. 1. Purchased 570 shares of treasury common stock for $12 per share. (3 points) J. Recaived semiannual interest from bonds purchased in (H). (3 points) K. Received a total cash dividend ol S1140 from Jones Company. (3 points) L. Roceived a $1900 dividand from out investment in Mnsco Company stock. This investment is accounted for under the equity method. (3 peints) M. Sold, at $17 per share, 285 shares of treasury common stock purchased in (I). N. Sold 2280 shares of Jones company stock purchased in (E) for $13 (6 points) per share, including commission. 0. Masco Company's total earnings are $95000. We own 40%. Record the earnings (6 points) for our company using the equity method. P. Sold the bonds purchased in (H) at 103 plus $63 in accrued interest. (3 points) Q. At the end of the accounting period, the remaining shares of Jones Company stock ( 8 points) increased $2.00 per share R. Record the payment of semiannual interest on the bonds issued in (B) and the amortization of the premium for six months. The amortization is determined using the straight-line method. Round all calculations to the nearest dollar. (3 Points) Part 2 Instructions: The balances listed below are for December 31 and already include the journal entries you just prepared except for the stockholders' equity accounts. The balances listed for the stockholders' equity accounts are the January 1 balances. You will need to utilize the journal entries you just prepared to complete the Statement of Stockholders' Equity. Prepare a multistep income statement, a statement of stockholders' equity, and a classified balance sheet in good form for the year ended December 31, 20X1. Use the Student Input Form (Excel File) to complete the Financial Statements Journal Entries 28 points each ( 75 points) \begin{tabular}{|l|l|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} ABC Corporation, Inc. Page 5 Income Statement For the Year Ended December 31, 20X1 (27 points) ABC Corporation, Inc. Page 6 Statement of Stockholders' Equity For the Year Ended December 31, 20X1 ABC Corporation, Inc. Balance Sheet December 31,201 Joumal Entries A. Issued 9500 shares of $10 par common stock at $11, receiving cash. (6 points) B. Issued $190000 of 10 year 10% bonds at a market (effective) interest rate of 9%, with interest payable semiannually. Use the Present Value Tables in Appendix A of text book. Round all (6 points) calculations to the nearest dollar. C. Declared a dividend of $0.25 per share on common stock. On date of declaration, 30400 shares of common stock were outstanding. (3 points) D. Paid cash dividend from (c) above. (2 points) E. Purchased 11400 shares of Jones Company for $10 per share, plus $5700 commission. Our company purchased less than 20% of the outstanding stock of Jones Company. (3 points) F. Declared a 5% stock dividend on the $10 par common stock when the (6 points) market price was $25 per share. There were 30400 Shares outstanding G. Distributed the stock dividends declared in (F). (2 points) H. Purchased $5000 of 5% bonds at par, (3 points) Interest is payable semiannually. 1. Purchased 570 shares of treasury common stock for $12 per share. (3 points) J. Recaived semiannual interest from bonds purchased in (H). (3 points) K. Received a total cash dividend ol S1140 from Jones Company. (3 points) L. Roceived a $1900 dividand from out investment in Mnsco Company stock. This investment is accounted for under the equity method. (3 peints) M. Sold, at $17 per share, 285 shares of treasury common stock purchased in (I). N. Sold 2280 shares of Jones company stock purchased in (E) for $13 (6 points) per share, including commission. 0. Masco Company's total earnings are $95000. We own 40%. Record the earnings (6 points) for our company using the equity method. P. Sold the bonds purchased in (H) at 103 plus $63 in accrued interest. (3 points) Q. At the end of the accounting period, the remaining shares of Jones Company stock ( 8 points) increased $2.00 per share R. Record the payment of semiannual interest on the bonds issued in (B) and the amortization of the premium for six months. The amortization is determined using the straight-line method. Round all calculations to the nearest dollar. (3 Points) Part 2 Instructions: The balances listed below are for December 31 and already include the journal entries you just prepared except for the stockholders' equity accounts. The balances listed for the stockholders' equity accounts are the January 1 balances. You will need to utilize the journal entries you just prepared to complete the Statement of Stockholders' Equity. Prepare a multistep income statement, a statement of stockholders' equity, and a classified balance sheet in good form for the year ended December 31, 20X1. Use the Student Input Form (Excel File) to complete the Financial Statements Journal Entries 28 points each ( 75 points) \begin{tabular}{|l|l|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} ABC Corporation, Inc. Page 5 Income Statement For the Year Ended December 31, 20X1 (27 points) ABC Corporation, Inc. Page 6 Statement of Stockholders' Equity For the Year Ended December 31, 20X1 ABC Corporation, Inc. Balance Sheet December 31,201