Answered step by step

Verified Expert Solution

Question

1 Approved Answer

journal entries ACCT 2.Assign#2.OCT.22. - Protected View - Saved to this PC- O Search Manpreet ki esign Layout References Mailings Review View Help the Internet

journal entries

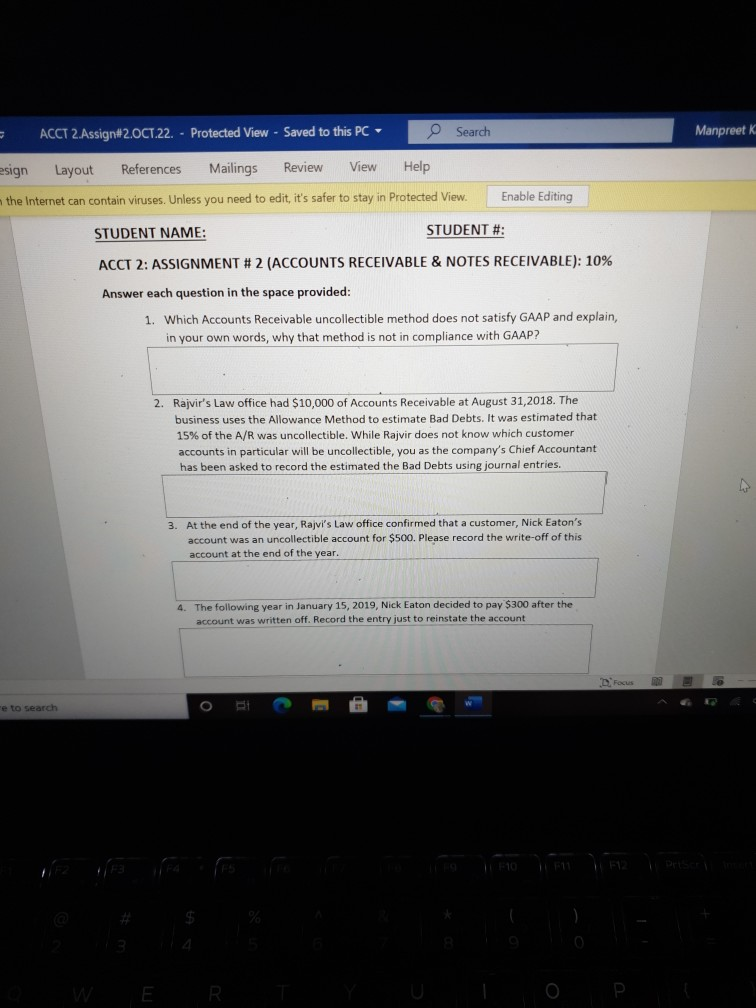

ACCT 2.Assign#2.OCT.22. - Protected View - Saved to this PC- O Search Manpreet ki esign Layout References Mailings Review View Help the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View Enable Editing STUDENT NAME: STUDENT #: ACCT 2: ASSIGNMENT # 2 (ACCOUNTS RECEIVABLE & NOTES RECEIVABLE): 10% Answer each question in the space provided: 1. Which Accounts Receivable uncollectible method does not satisfy GAAP and explain, in your own words, why that method is not in compliance with GAAP? 2. Rajvir's Law office had $10,000 of Accounts Receivable at August 31,2018. The business uses the Allowance Method to estimate Bad Debts. It was estimated that 15% of the A/R was uncollectible. While Rajvir does not know which customer accounts in particular will be uncollectible, you as the company's Chief Accountant has been asked to record the estimated the Bad Debts using journal entries. 3 At the end of the year, Rajvi's Law office confirmed that a customer, Nick Eaton's account was an uncollectible account for $500. Please record the write-off of this account at the end of the year. 4. The following year in January 15, 2019, Nick Eaton decided to pay $300 after the account was written off. Record the entry just to reinstate the account Fess e to search DStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started