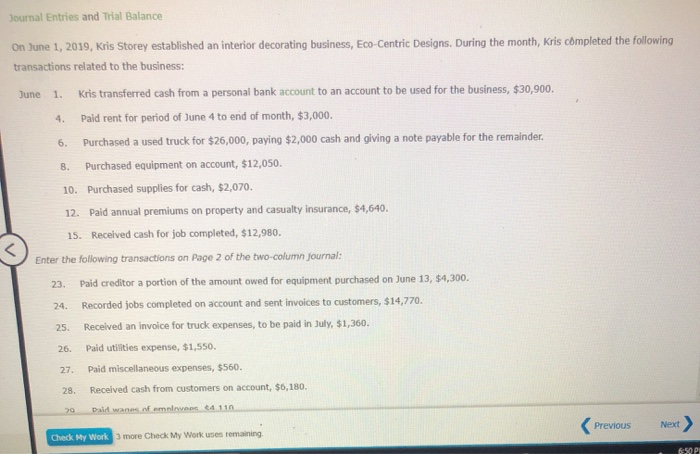

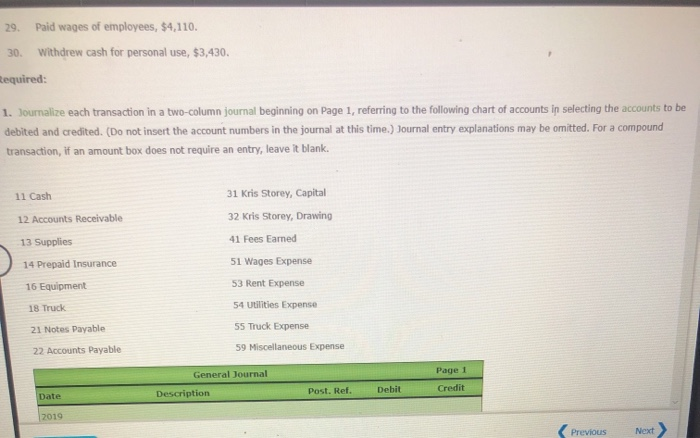

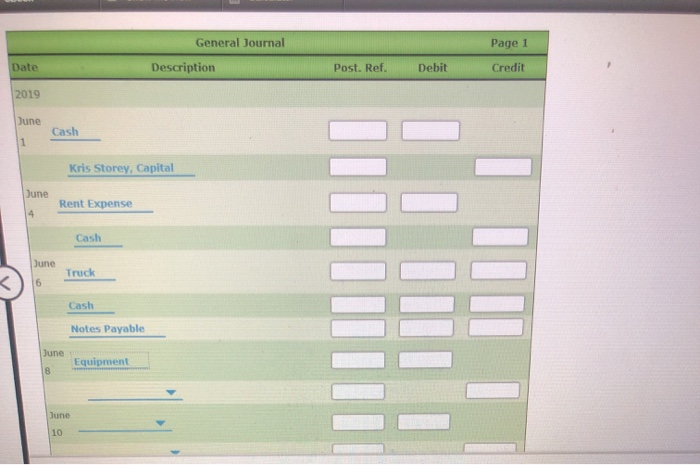

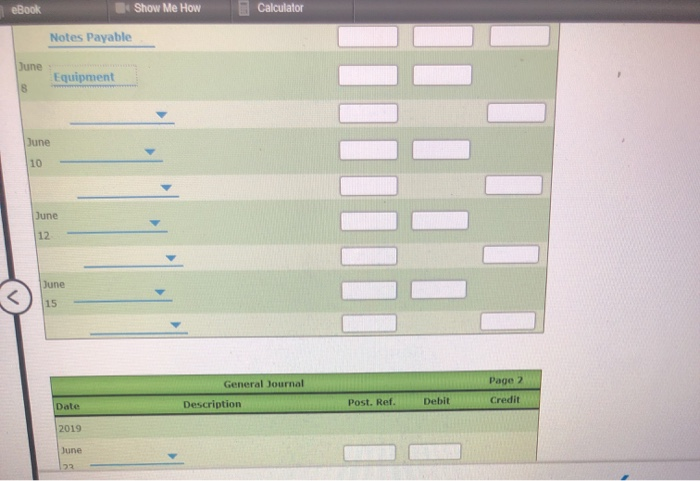

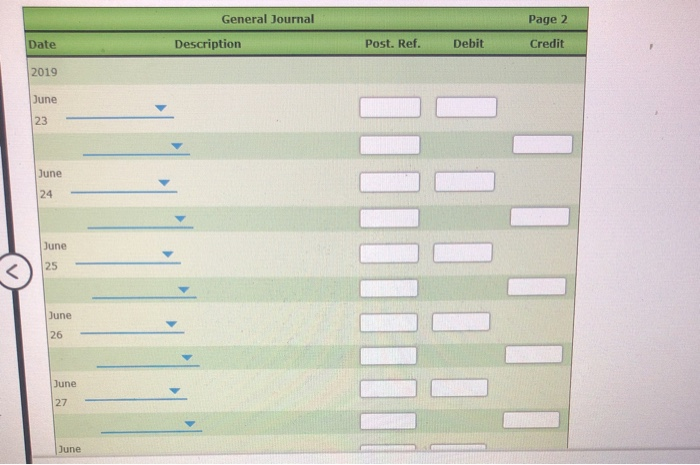

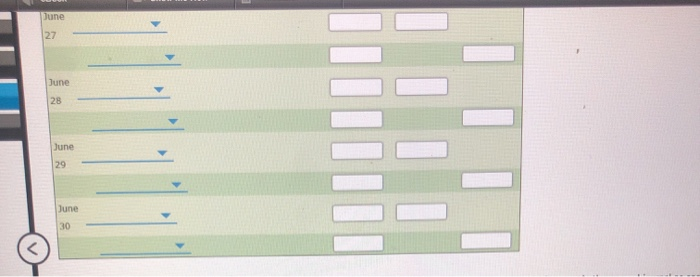

Journal Entries and Trial Balance On June 1, 2019, Kris Storey established an interior decorating business, Eco-Centric Designs. During the month, Kris completed the following transactions related to the business: June 1. Kris transferred cash from a personal bank account to an account to be used for the business, $30,900. 4. Paid rent for period of June 4 to end of month, $3,000. 6. Purchased a used truck for $26,000, paying $2,000 cash and giving a note payable for the remainder. 8. Purchased equipment on account, $12,050. 10. Purchased supplies for cash, $2,070. 12. Paid annual premiums on property and casualty insurance, $4,640. 15. Received cash for job completed, $12,980. Enter the following transactions on Page 2 of the two-column Journal: 23. Paid creditor a portion of the amount owed for equipment purchased on June 13, $4,300. 24. Recorded jobs completed on account and sent invoices to customers, $14,770. 25. Received an invoice for truck expenses, to be paid in July, $1,360. 26. 27. Paid utilities expense, $1,550. Paid miscellaneous expenses, $560. 28. Received cash from customers on account, $6,180. 29 Dat wanns of emne 4 110 Check My Work 3 more Check My Work uses remaining 6SOPI 29. Paid wages of employees, $4,110. 30. Withdrew cash for personal use, $3,430. tequired: 1. Joumalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. For a compound transaction, if an amount box does not require an entry, leave it blank. 11 Cash 31 Kris Storey, Capital 32 Kris Storey, Drawing 12 Accounts Receivable 13 Supplies 41 Fees Eamed 14 Prepaid Insurance 51 Wages Expense 16 Equipment 53 Rent Expense 18 Truck 54 Utilities Expense 21 Notes Payable SS Truck Expense 22 Accounts Payable 59 Miscellaneous Expense Page 1 General Journal Description Post. Ref. Debit Credit Date 2019 General Journal Page 1 Date Description Post. Ref. Debit Credit 2019 June Cash Kris Storey, Capital June Rent Expense Cash June 1 HITO Truck Cash Notes Payable June Equipment June Show Me How Calculator Notes Payable June Equipment June June 12 June 15 General Journal Description Page 2 Credit Date Post. Ref. Debit 2019 June General Journal Description Page 2 Credit Date Post. Ref. Debit 2019 June June June IIIII June June June June 27 June 29 June