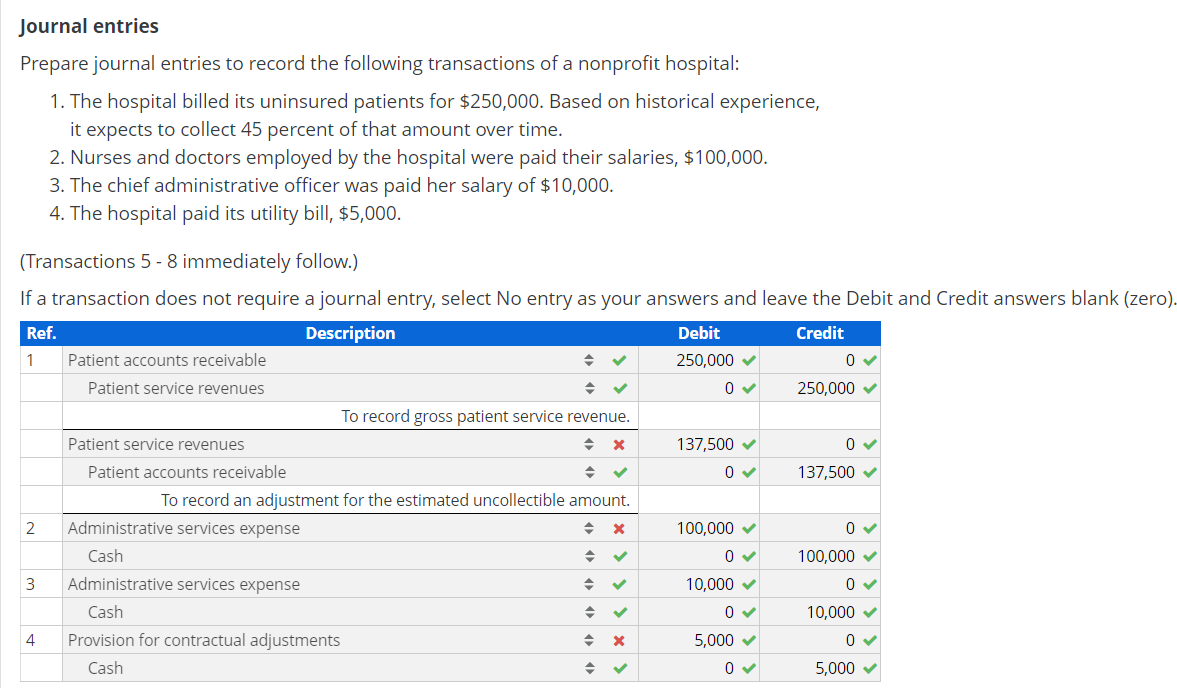

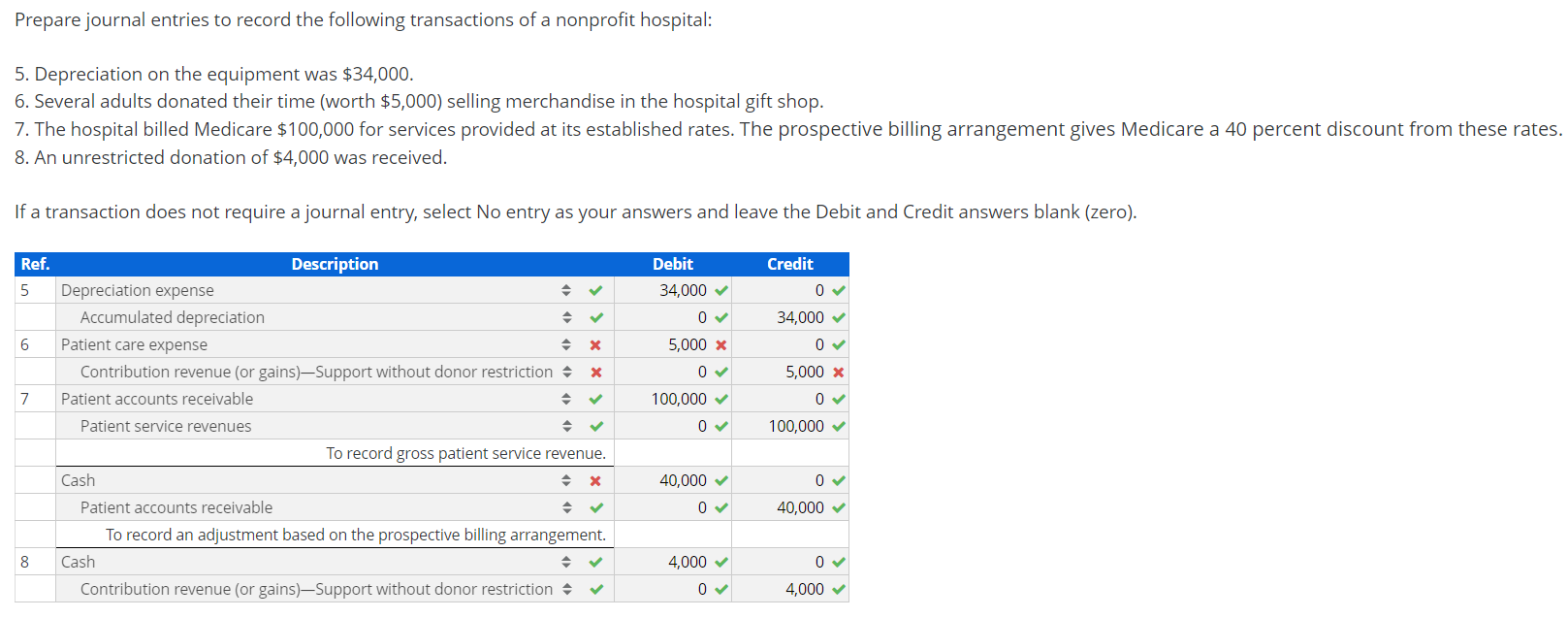

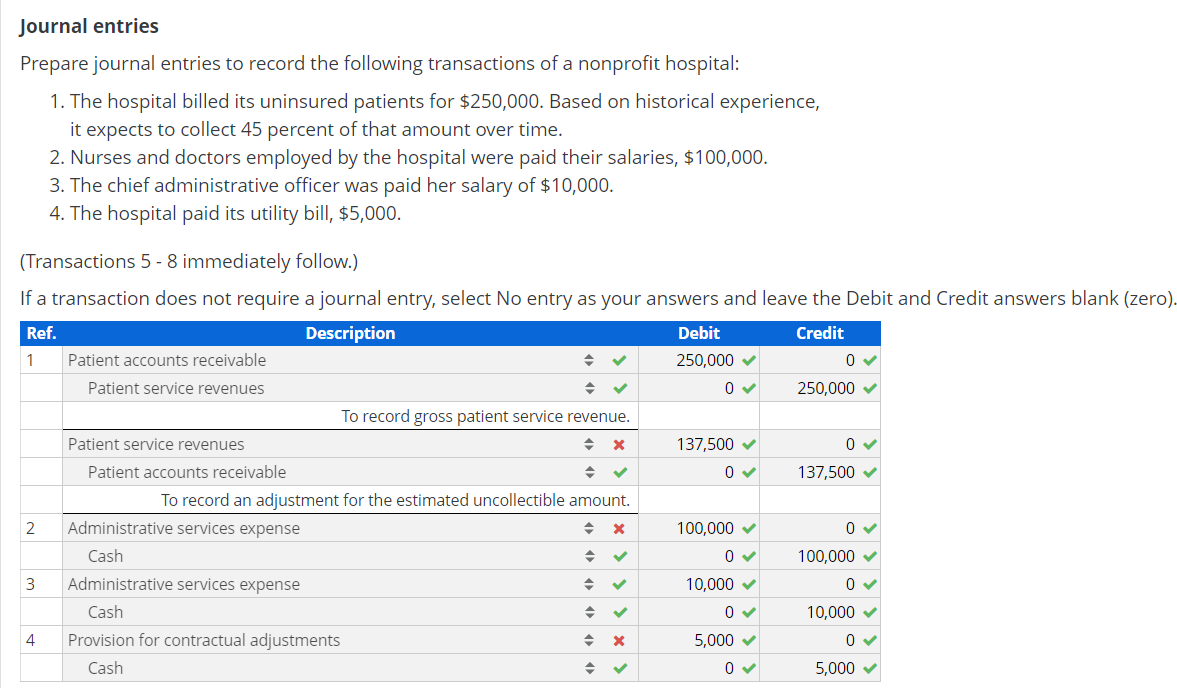

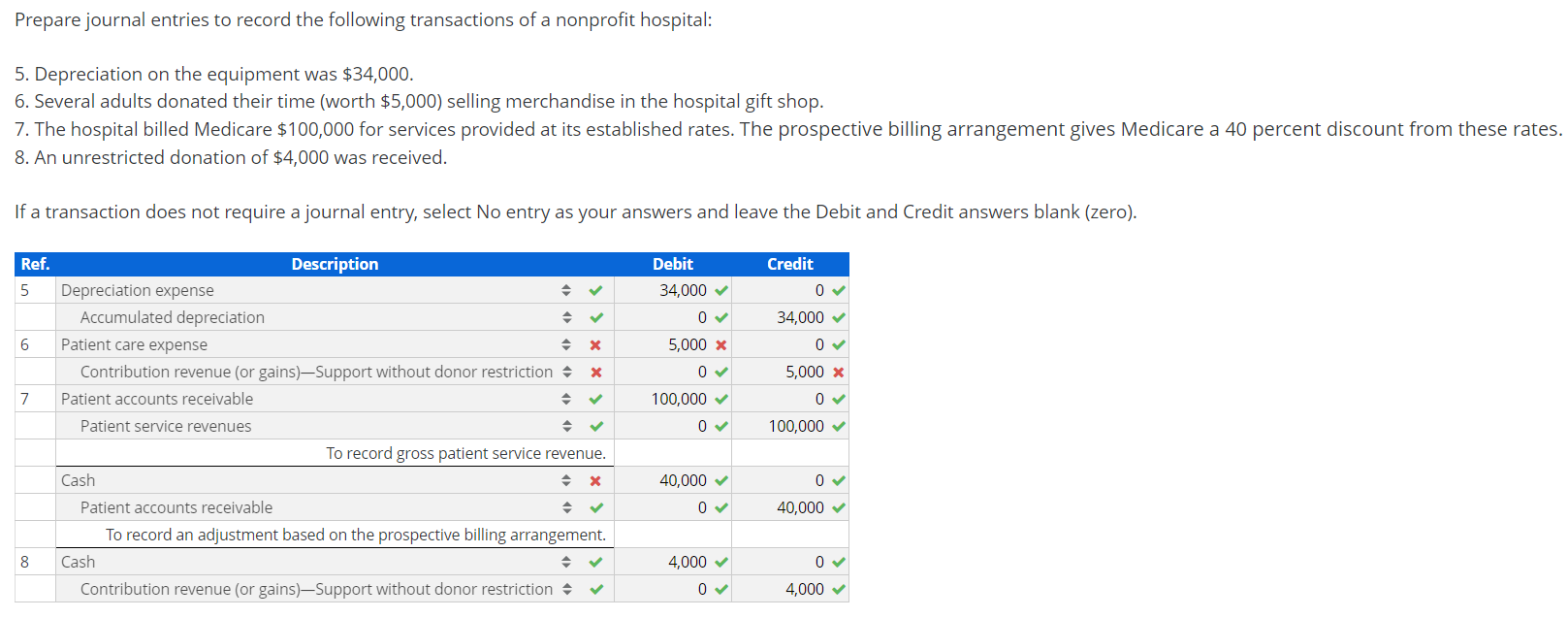

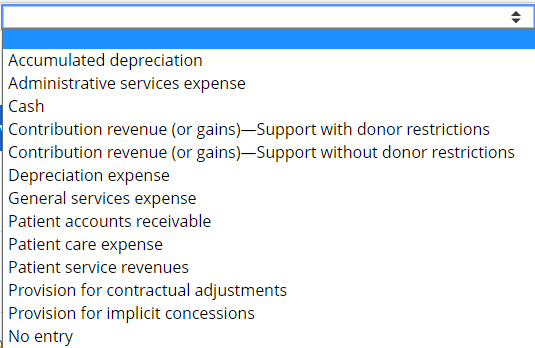

Journal entries Prepare journal entries to record the following transactions of a nonprofit hospital: 1. The hospital billed its uninsured patients for $250,000. Based on historical experience, it expects to collect 45 percent of that amount over time. 2. Nurses and doctors employed by the hospital were paid their salaries, $100,000. 3. The chief administrative officer was paid her salary of $10,000. 4. The hospital paid its utility bill, $5,000. . x (Transactions 5 - 8 immediately follow.) If a transaction does not require a journal entry, select No entry as your answers and leave the Debit and Credit answers blank (zero). Ref. Description Debit Credit 1 Patient accounts receivable 250,000 0 Patient service revenues 0 250,000 To record gross patient service revenue. Patient service revenues 137,500 0 Patient accounts receivable 137,500 To record an adjustment for the estimated uncollectible amount. 2 Administrative services expense 100,000 Cash 0 100,000 3 Administrative services expense 10,000 0 Cash 0 10,000 Provision for contractual adjustments 5,000 0 Cash 0 5,000 0 X 0 4 X Prepare journal entries to record the following transactions of a nonprofit hospital: 5. Depreciation on the equipment was $34,000. 6. Several adults donated their time (worth $5,000) selling merchandise in the hospital gift shop. 7. The hospital billed Medicare $100,000 for services provided at its established rates. The prospective billing arrangement gives Medicare a 40 percent discount from these rates. 8. An unrestricted donation of $4,000 was received. If a transaction does not require a journal entry, select No entry as your answers and leave the Debit and Credit answers blank (zero). Ref. Credit Debit 34,000 5 0 0 34,000 Description Depreciation expense Accumulated depreciation Patient care expense Contribution revenue (or gains)-Support without donor restriction Patient accounts receivable 6 5,000 x 0 x 0 5,000 x 7 0 100,000 0 Patient service revenues 100,000 To record gross patient service revenue. Cash X 0 40,000 0 40,000 Patient accounts receivable To record an adjustment based on the prospective billing arrangement. Cash 8 4,000 0 Contribution revenue (or gains)Support without donor restriction 0 4,000 . Accumulated depreciation Administrative services expense Cash Contribution revenue (or gains)-Support with donor restrictions Contribution revenue (or gains)Support without donor restrictions Depreciation expense General services expense Patient accounts receivable Patient care expense Patient service revenues Provision for contractual adjustments Provision for implicit concessions No entry